FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

Transcribed Image Text:K

During 2021, Ming's Book Store paid $486,000 for land and built a store in Naperville, Illinois. Prior to construction, the city of Naperville charged Ming's $1,000 for a building permit,

which Ming's paid. Ming's also paid $15,000 for architect's fees. The construction cost of $670,000 was financed by a long-term note payable, with interest costs of $28,020 paid at the

completion of the project. The building was completed June 30, 2021. Ming's depreciates the building using the straight-line method over 35 years, with estimated residual value of

$330,000.

Read the requirements.

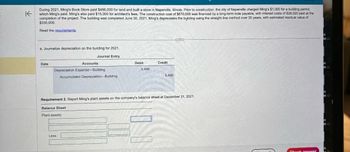

c. Joumalize depreciation on the building for 2021.

Journal Entry

Date

Accounts

Depreciation Expense-Building

Accumulated Depreciation Building

Balance Sheet

Plant assets:

Debit

Less:

5,486

Credit

5,486

Requirement 2. Report Ming's plant assets on the company's balance sheet at December 31, 2021.

***

Check answer

ot

MO

ot

MO

ot

MO

ot

MO

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 4 steps with 4 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Skysong Co. is building a new hockey arena at a cost of $2,310,000. It received a downpayment of $490,000 from local businesses to support the project, and now needs to borrow $1,820,000 to complete the project. It therefore decides to issue $1,820,000 of 12%, 10-year bonds. These bonds were issued on January 1, 2019, and pay interest annually on each January 1. The bonds yield 11%. Assume that on July 1, 2022, Skysong Co. redeems half of the bonds at a cost of $1,001,900 plus accrued interest. Prepare the journal entry to record this redemption. (to record Interest and to record reacquisition)arrow_forwardIn 2020, Murphy Manufacturing Inc. acquired and placed in service a piece of machinery to manufacture interactive toys for dogs. The following costs were associated with the machinery: Purchase price from vendor$2,130,000 Tax on purchase price $150,000 Shipping/Delivery$20,000 Insurance for Shipping$5,000 Installation/Calibration$15,000 On-going support contract$10,000/year Routine annual cleaning$2,000/year Montgomery Manufacturing placed a piece of equipment (7 year property) in service on April 1, 2020. It’s cost was $2,550,000. It was the only asset placed in service in 2020. How much 179 expense deduction can they take and What is the remaining depreciable basis after the 179 elections?arrow_forwardDuring 2021, Tao's Book Store paid $490,000 for land and built a store in Cleveland, Ohio. Prior to construction, the city of Cleveland charged Tao's $1,000 for a building permit, which Tao's paid. Tao's also paid $15,000 for architect's fees. The construction cost of $670,000 was financed by a long-term note payable, with interest costs of $28,020 paid at the completion of the project. The building was completed June 30, 2021. Tao's depreciates the building using the straight-line method over 35 years, with estimated residual value of $330,000. Read the requirements. ... Rec Question Viewer rnalize transactions for the following (explanations are not required): a. Purchase of the land, b. All the costs chargeable to the building in a single entry, and c. Depreciation on the building for 2021. (Record debits first, then credits. Exclude explanations from any journal entries.) a. Journalize the purchase of the land. Date Journal Entry Accounts Debit Creditarrow_forward

- Aukey Smith contributed $1,000,000 to the local homeless shelter on November 1, 2025, stipulating that the contribution be used to purchase a building to provide additional beds for the homeless. The building was purchased at à cost of $1,200,000 on March 31, 2026, with $200,000 coming from surpluses in the general fund. The building has an estimated useful life of 15 years, with no residual value. The shelter capitalizes its capital assets and uses the straight line method to amortize its capital assets, pro-rating for the number of months owned in the years of acquisition and disposal. The shelter has a December 31 year end and uses the deferral method. What journal entry correctly accounts for the building and contribution revenue in the financial statements for the year ending December 31, 2026? 50,000 O Dr. Deferred contribution liability Cr. Contribution revenue Dr. Amortization expense Cr. Capital asset-accumulated amortization Dr. Deferred revenue Dr. Amortization expense Cr.…arrow_forwardIn 2021, Bratten Fitness Company made the following cash purchases: The exclusive right to manufacture and sell the X-Core workout equipment from Symmetry Corporation for $216,000. Symmetry created the unique design for the equipment. Bratten also paid an additional $10,500 in legal and filing fees to attorneys to complete the transaction. An initial fee of $325,000 for a three-year agreement with Silver’s Gym to use its name for a new facility in the local area. Silver’s Gym has locations throughout the country. Bratten is required to pay an additional fee of $6,600 for each month it operates under the Silver’s Gym name, with payments beginning in March 2021. Bratten also purchased $416,000 of exercise equipment to be placed in the new facility. The exclusive right to sell Healthy Choice, a book authored by Kent Patterson, for $35,000. The book includes healthy recipes, recommendations for dietary supplements, and natural remedies. Bratten plans to display the book at the check-in…arrow_forwardMetlock Inc. began work on a $11,300,000 non-cancellable contract in 2020 to construct an office building. During 2020, Metlock Inc. incurred costs of $1,092,000, billed its customers for $1,200,000 (non-refundable), and collected $990,000. At December 31, 2020, the estimated future costs to complete the project totalled $3,108,000.Prepare Metlock’s 2020 journal entries using the percentage-of-completion method. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter 0 for the amounts.) Account Titles and Explanation Debit Credit enter an account title to record cost of construction No Entry / Contract Asset/Liability / Materials, Cash, Payables / Revenue from Long-Term Contracts / Accounts Receivable / Construction Expenses enter a debit amount enter a credit amount enter an account…arrow_forward

- Please read and answer the question carefully.arrow_forwardDamian Company operates a construction company. On January 1, 2021, Damian Company negotiates a new contract with Horton Hockey Association and agrees to construct a large complex for the hockey association in four phases over a 12-month period at a total cost of $1,600,000. The complex will not be usable until all construction is complete. On January 1, 2021, Horton pays Damian a refundable deposit of $100,000 and agrees to four installment payments of $375,000. The installment payments are due on March 31, 2021, June 30, 2021, September 30, 2021, and December 31, 2021. Under the contract terms, Horton has the option of ending the contract if the association is dissatisfied with the construction. To terminate the contract, the hockey association must notify Damian Company before June 30, 2021. If the hockey association decides to terminate the contract, the association will receive the January 1, 2021, refundable deposit of $100,000. If the hockey association provides a timely notice…arrow_forwardPrincess Town Insurance Inc., located in a country which has a capital gains tax, purchased a building in February 2018 for $26,000,000. In March 2019, they spent $1, 800,000 to install solar panels for electricity in the building. The building was sold for $39,000,000 in 2020. The annual maintenance cost was $500,000. The cost of advertising the sale of the building and the legal fees amounted to $1,950,000. Capital losses were as follows:2017 - $200,0002018 - $250,000 Required:Calculate the capital gains tax in 2020, assuming a capital gains tax of 20%arrow_forward

- Arlington Town uses an Internal Service Fund to account for its motor poolactivities. You have the following information:Automobiles: The Motor Pool uses two 6-passenger vans, each costing $90,000and each estimated to have a 5-year life when they were acquired in 2020.Driver salaries: The Motor Pool has a driver-administrator, who earns $90,000a year, and a driver, who earns $70,000.The town uses a rate of 33 percent (to cover benefits, including pensions)for planning purposes.Insurance: In 2020, the town purchased a 3-year automobile accident policyat a cost of $12,000.Fuel and maintenance costs: Based on experience, the driver-administratorestimates that total fuel and maintenance costs for the year will be $16,000.Billing units: To simplify its record keeping, the Motor Pool charges a fixed priceper trip. Arlington’s budget office estimates it will provide 1,600 trips to thetown’s departments in 2021.Arlington Town had the following transactions and events during January 2021:1.…arrow_forwardResidents of the town of Sunny View, Arizona authorized a $5,000,000 renovation to theirhistoric town hall on November 15, 2022. Financing for the project consists of $2,500,000 froma 5 percent serial bond issue, $1,500,000 from a state grant, and $1,000,000 from the GeneralFund. Debt service for the serial bonds will be provided by a one-quarter-cent city sales taximposed on every dollar of sales in the city. Required: Complete the necessary journal entries to record the related transactions in the town's capitalprojects fund, debt service fund, and governmental activities at the government-wide level. Youmay ignore entries in the General Fund. The town has a calendar year-end. n. The sales tax collections for debt service amounted to $250,000. o. Central Paving and Construction gave a final billing to the town for $2,000,000. Upon last inspection by the Public Works Department, a leak was discovered in the roof.p. Public works employees installed a new sidewalk and landscaping at a…arrow_forwardSunland Company self-insures its property for fire and storm damage. If the company were to obtain insurance on the property, it would cost them $1970000 per year. The company estimates that on average it will incur losses of $1610000 per year. During 2021, $705000 worth of losses were sustained. How much total expense and/or loss should be recognized by Sunland Company for 2021?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education