FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

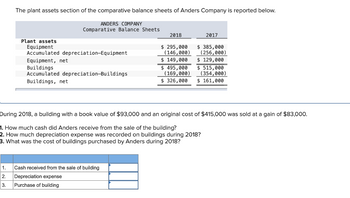

Transcribed Image Text:The plant assets section of the comparative balance sheets of Anders Company is reported below.

1.

2.

3.

ANDERS COMPANY

Comparative Balance Sheets

Plant assets

Equipment

Accumulated depreciation-Equipment

Equipment, net

Buildings

Accumulated depreciation-Buildings

Buildings, net

2018

Cash received from the sale of building

Depreciation expense

Purchase of building

$ 295,000

(146,000)

$ 149,000

$ 495,000

2017

$ 385,000

(256,000)

$ 129,000

$ 515,000

(354,000)

(169,000)

$ 326,000 $ 161,000

During 2018, a building with a book value of $93,000 and an original cost of $415,000 was sold at a gain of $83,000.

1. How much cash did Anders receive from the sale of the building?

2. How much depreciation expense was recorded on buildings during 2018?

3. What was the cost of buildings purchased by Anders during 2018?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 5 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- On May 1st, 2015, Nancy Silva paid $870,000 for a commercial building. She later sold the building on August 27th, 2021, for $1,850,000. Find the depreciation amount in 2015 using the appropriate MACRS GDS method.arrow_forwardA. ACQUISITION COSTS Mr. Ardi acquired land at a cost of Rp4.200.000.000 on April 1, 2019. In addition to this cost, he had to pay the following expenses: a. Commission fee, 2% from the land price, Rp84,000,000 b. Land acquisition tax Rp12,000,000 c. Removal cost of old (unused) building Rp20.500.000. Mr. Ardi received Rp17.000.000 from the sales of salvage materials. d. Rpl10.000.000 to build a fence e. Rp215.000.000 to build a parking lot Instructions: Prepare the journal entries for the above transaction! (4%)arrow_forwardCalculate total accumulated depreciation of each asset until the sold date .arrow_forward

- Arrangement of the Income Statement Powers Wrecking Service demolishes old buildings and other structures and sells the salvaged materials. During 2019, Powers had $425,000 of revenue from demolition services and $137,000 of revenue from salvage sales. Powers also had $1,575 of interest income from investments. Powers incurred $243,200 of wages expense, $24,150 of depreciation expense, $48,575 of supplies expense, $84,000 of rent expense, $17,300 of miscellaneous expense, and $43,900 of income taxes expense.arrow_forwardIn its first year of business, Coronado purchased land, a building, and equipment on March 5, 2023, for $636,000 in total. The land was valued at $269,400, the building at $336,750, and the equipment at $67,350. Additional information on the depreciable assets follows: Asset Building Equipment (a) Land Residual Value Building Your answer is correct. $ $25,200 $ 4,000 Equipment $ Useful Life in Years Allocate the purchase cost of the land, building, and equipment to each of the assets. 60 8 254400 318000 Depreciation Method 63600 Straight-line Double diminishing-balancearrow_forwardAn asset which costs $25,000 and has accumulated depreciation of $6,000 is sold for $11,000. What amount of gain or loss will be recognized when the asset is sold? a. A gain of $14,000 b. A loss of $14,000 c. A gain of $8,000 d. A loss of $8,000arrow_forward

- (a) What is the weighted average of accumulated expenditures? (b) What is the avoidable interest for the building in 2018?arrow_forwardAt December 31, 2025, Blue Corporation reported the following plant assets. Land Buildings Less: Accumulated depreciation-buildings Equipment Less: Accumulated depreciation-equipment Total plant assets During 2026, the following selected cash transactions occurred. Apr. May June Date 1 Purchased land for $3,335,200. 1 Sold equipment that cost $909,600 when purchased on January 1, 2019. The equipment was sold for $257,720. 1 Sold land for $2,425,600. The land cost $1,516,000. July 1 Purchased equipment for $1,667,600. Dec. 31 Retired equipment that cost $1,061,200 when purchased on December 31, 2016. No salvage value was received. April 1 $26,520,000 11,934,000 60,640,000 7,580,000 May 1 Journalize the transactions. (Hint: You may wish to set up T-accounts, post beginning balances, and then post 2026 transactions.) Blue uses straight-line depreciation for buildings and equipment. The buildings are estimated to have a 40-year useful life and no salvage value; the equipment is estimated…arrow_forwardLopez acquired a building on June 1, 2017, for $9,644,500. Compute the depreciation deduction assuming the building is classified as (a) residential and (b) non residential. Click here to access the depreciation table to use for this problem. If required, round your answers to the nearest dollar. a. Calculate Lopez's cost recovery deduction for 2022 if the building is classified as residential rental real estate. b. Calculate Lopez's cost recovery deduction for 2022 if the building is classified as nonresidential real estate.arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education