FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

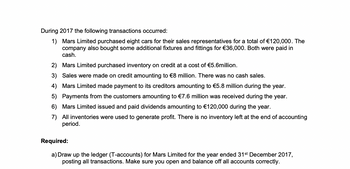

Transcribed Image Text:During 2017 the following transactions occurred:

1)

Mars Limited purchased eight cars for their sales representatives for a total of €120,000. The

company also bought some additional fixtures and fittings for €36,000. Both were paid in

cash.

2)

Mars Limited purchased inventory on credit at a cost of €5.6million.

3) Sales were made on credit amounting to €8 million. There was no cash sales.

4)

Mars Limited made payment to its creditors amounting to €5.8 million during the year.

5) Payments from the customers amounting to €7.6 million was received during the year.

6) Mars Limited issued and paid dividends amounting to €120,000 during the year.

7) All inventories were used to generate profit. There is no inventory left at the end of accounting

period.

Required:

a) Draw up the ledger (T-accounts) for Mars Limited for the year ended 31st December 2017,

posting all transactions. Make sure you open and balance off all accounts correctly.

Transcribed Image Text:Tutorial Question 1

Mars limited

Mars Limited's Statement of Financial Position as at 1st January 2017 is as follows:

Mars Limited Statement of Financial Position as at 1st January 2017

ASSETS

Non-current assets

Premises

Fixtures and ngs

Vehicle

Distribution costs

Employee costs

Occupancy costs

Total non-current assets

Current assets

Inventories

Trade receivables

Cash and cash equivalents

Total current assets

Total assets

EQUITY AND LIABILITIES

Share capital

Retained earnings

Total equity

Current liabilities

Trade payables

Total current liabilities

Total equity and liabilities

NBV

€'000

Repairs and maintenance expenses

Utility expenses

Other administrative expenses

1,280

144

40

1,464

80

360

820

1,260

2,724

1,280

1,044

2,324

There are the following payments listed in the bank statement that took place during 2017:

400

400

2,724

€'000

240

720

16

8

96

24

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps with 4 images

Follow-up Questions

Read through expert solutions to related follow-up questions below.

Follow-up Question

Draw out a

Thank you .

Solution

by Bartleby Expert

Follow-up Question

what is the purporse of opening the cost of sales A/C yet a double entry had been made upon their purchase in the inventory A/C and cash and cash eqivalents A/C ?

Thank you .

Solution

by Bartleby Expert

Follow-up Questions

Read through expert solutions to related follow-up questions below.

Follow-up Question

Draw out a

Thank you .

Solution

by Bartleby Expert

Follow-up Question

what is the purporse of opening the cost of sales A/C yet a double entry had been made upon their purchase in the inventory A/C and cash and cash eqivalents A/C ?

Thank you .

Solution

by Bartleby Expert

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Create a ledger of Account Receivable and ledger of AFDD to find the bad debt by using this information; Alpha Company's accounts receivable and allowance for doubtful accounts balances were RM100000 and RM14000 (credit) respectively, at the beginning of 2012. During 2012, a customer defaults on a RM12000 balance related to goods purchased during 2011. By the end of the year, the company had mad credit sales of RM2400000 and collected RM2200000 on account. Estimates 1 percent of its credit sales will default.arrow_forwardThe Miller Company earned $190,000 of revenue on account during Year 1. There was no beginning balance in the accounts receivable and allowance accounts. During Year 1, Miller collected $136,000 of cash from its receivables accounts. The company estimates that it will be unable to collect 3% of its sales on account. What is the amount of uncollectible accounts expense that will be recognized on the Year 1 income statement? Multiple Choice О $5,700 $1,320 О $4,080arrow_forwardJayco Inc. started its operations in 2022. Its sales during 2022, all on account, totalled $700,000. The company collected $500,000 in cash from customers during the year and wrote off $8,000 in uncollectible accounts. The company set up an allowance for doubtful accounts at December 31, 2022, its fiscal year-end, and determined the account balance to be $14,000. The unadjusted balances of selected accounts at December 31, 2023 are as follows: Accounts receivable $ 300,000 Allowance for doubtful accounts (debit) 10,000 Sales revenue (including 80 percent in sales on account) 800,000 Aging of the accounts receivable on December 31, 2023, resulted in an estimate of $11,000 in potentially uncollectible accounts. Required: 2. Prepare the journal entries to record all the transactions during 2023 and post them to appropriate T-accounts. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field.)…arrow_forward

- Kerr Co.'s accounts payable balance at December 31, 2010 was $1,500,000 before considering the following transactions: • Goods were in transit from a vendor to Kerr on December 31, 2010. The invoice price was $70,000, and the goods were shipped f.o.b. shipping point on December 29, 2010. The goods were received on January 4, 2011. • Goods shipped to Kerr, f.o.b. shipping point on December 20, 2010, from a vendor were lost in transit. The invoice price was $50,000. On January 5, 2011, Kerr filed a $50,000 claim against the common carrier. In its December 31, 2010 balance sheet, Kerr should report accounts payable of O$1.620,000. $1,570,000. $1,550,000. O $1.500,000.arrow_forwardOn March 1, 2016, ASG Co. assigned its P1,900,000 accounts receivable to DXB Bank in exchange for a 2-month, 12% loan equal to 75% of the assigned receivables. ASG Co. received the loan proceeds after a 1.5% deduction for service fee based on the assigned notes. During March, P500,000 were collected from the receivables. Sales returns and discounts amounted to P150,000. How much net cash is received from the assignment transaction on March 1, 2016?arrow_forwardDirect Materials Variances The following data relate to the direct materials cost for the production of 1,900 automobile tires: Actual: 54,400 lb. at $1.70 Standard: 53,300 Ib. at $1.65 a. Determine the direct materials price variance, direct materials quantity variance, and total direct materials cost variance. Enter a favorable variance as a negative number using a minus sign and an unfavorable variance as a positive number. Price variance Unfavorable Quantity variance Unfavorable Total direct materials cost variance Unfavorable b. The direct materials price variance should normally be reported to the Purchasing Department - V. If lower amounts of direct materials had been used because of production efficiencies, the variance would be reported to the Production Supervisor V. If the favorable use of raw materials had been caused by the purchase of higher- quality raw materials, the variance should be reported to the Purchasing Departmentarrow_forward

- During 2014, a company wrote off $6,000 in uncollectible accounts receivable. At the end of the year, they estimated bad debt expense using a percent of gross sales. In 2015, the company recovered a $1,000 account that was written off in 2014. The recording of this recovery would include a a. Debit to retained earnings b. Credit to accounts receivable c. Debit to allowance for doubtful accounts d. Credit to prior period adjustmentsarrow_forwardAt January 1, 2015, Windy Mountain Flagpoles had accounts receivable of $30,000 and allowance for bad debts had a credit balance of $3,000. During the year, Windy Mountain Flagpoles recorded the following: Sales of $178,000 ($158,000 on account; $20,000 for cash) Collections on account, $124,000 Write-offs of uncollectible receivables, $2,800 Accounting for uncollectible accounts using the allowance method (percent-of-sales) and reporting receivables on the balance sheet Question 1 Requirements Journalize Windy's transaction that occurred during 2015. The company uses the allowance method. Post Windy's transaction to the account receivable and allowance for bad debts T-accounts Journalize Windy's adjustment to record bad debts expense assuming Windy estimate bad debts as 4% of credit sales. Post the adjustment to the appropriate T-accounts. Show how Windy Mountain Flagpoles will report net accounts receivable on its December 31, 2015 balance sheet. Question 2 Requirements Journalize…arrow_forwardRosewood corporation began 2018 with a balance in accounts receivable of $575,000. Service revenue, all on account, for the year totaled $2,000,000. The company ended the year with a balance in accounts receivable of $800,000. Rosewoods bad debt write offs are nonexistent. How much cash did the comapny collect from customers in 2018? a.$1,775,000 b.$2,225,000 c.$2,800,000 d.$2,000,000arrow_forward

- On December 31, 2016, Rusell estimated that 2% of its net sales of RM360,000 will become uncollectible. The company recorded this amount as an additional of Allowance for doubtful accounts. On May, 11, 2017, Rusell determined that Vetter account was uncollectible and wrote of RM1,100. On June 12, 2017, Vetter paid the amount previously written off. Required: Prepare the journal entries on December 31, 2016, May 11, 2017 and June 12, 2017.arrow_forward8. JOY Corporation provides an allowance for its doubtful accounts receivable. allowance account had a credit balance of P8,000. Each month JOY accrues bad debts expense in an amount equal to 2% of credit sales. Total credit sales during 2016 amounted to P2,000,000. During 2016 uncollectible accounts receivable totaling P22,000 were written off against the allowance account. An aging of accounts receivable at December 31, 2016 indicates that an allowance of P42,000 should be provided for doubtful accounts as of the date. Accordingly, bad debts expense previously accrued during 2016 should be increased by At December 31, 2015, thearrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education