FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

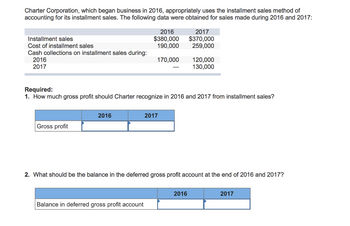

Transcribed Image Text:Charter Corporation, which began business in 2016, appropriately uses the installment sales method of

accounting for its installment sales. The following data were obtained for sales made during 2016 and 2017:

Installment sales

Cost of installment sales

Cash collections on installment sales during:

2016

2017

Gross profit

2016

2016

$380,000

190,000

170,000

Required:

1. How much gross profit should Charter recognize in 2016 and 2017 from installment sales?

Balance in deferred gross profit account

2017

2017

$370,000

259,000

120,000

130,000

2. What should be the balance in the deferred gross profit account at the end of 2016 and 2017?

2016

2017

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 4 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Galubhaiarrow_forwardCarter & Evans reported the following rounded amounts (in millions): 2019 $ 5,435 (305) $ 5,130 $ 40,500 2018 $ 5,140 (310) $ 4,830 $ 39,000 Accounts Receivable Allowance for Doubtful Accounts Accounts Receivable, Net of Allowance Net Sales (assume all on credit) Required: 1. Determine the receivables turnover ratio and days to collect for 2019. 2. Do the measures calculated in requirement 1 represent an improvement (or deterioration) in receivables turnover, compared to 2018, when the turnover was 9.5?arrow_forwardThe balance sheet at the end of 2018 reported Accounts Receivable of $785,500 and Allowance for Doubtful Accounts of $11,783 (credit balance). The company’s total sales during 2019 were $8,350,200. Of these, $1,252,530 were cash sales the rest were credit sales. By the end of the year, the company had collected $6,291,700 of accounts receivable. It also wrote off an account for $10,380. Question 1 of 8 What follows is a fill in the blank question with 16 blanks. Prepare the journal entry for sales. Account Names DR CR Blank 1. Fill in the blank, read surrounding text. Blank 2. Fill in the blank, read surrounding text. Blank 3. Fill in the blank, read surrounding text. Blank 4. Fill in the blank, read surrounding text. Blank 5. Fill in the blank, read surrounding text. Blank 6. Fill in the blank, read surrounding text. Blank 7. Fill in the blank, read surrounding text. Blank 8. Fill in the blank, read surrounding text. Blank 9. Fill in the blank, read…arrow_forward

- The balance sheet at the end of 2018 reported Accounts Receivable of $785,500 and Allowance for Doubtful Accounts of $11,783 (credit balance). The company’s total sales during 2019 were $8,350,200. Of these, $1,252,530 were cash sales the rest were credit sales. By the end of the year, the company had collected $6,291,700 of accounts receivable. It also wrote off an account for $10,380. Prepare the journal entry for collections. Account Names DR CR Blank 1. Fill in the blank, read surrounding text. Blank 2. Fill in the blank, read surrounding text. Blank 3. Fill in the blank, read surrounding text. Blank 4. Fill in the blank, read surrounding text. Blank 5. Fill in the blank, read surrounding text. Blank 6. Fill in the blank, read surrounding text. Blank 7. Fill in the blank, read surrounding text. Blank 8. Fill in the blank, read surrounding text. Blank 9. Fill in the blank, read surrounding text. Blank 10. Fill in the blank, read surrounding text. Blank 11.…arrow_forwardFrom the following information, you are required to prepare Profit and Loss Account of Zee Bank Ltd., for the year ending 31st March, 2016 : $ 2$ Interest and Discount Other Income Income on Investments 44,00,000 Interest Expended 1,25,000 Operating Expenses 5,000 Interest on Balance with RBI 13,60,000 13,31,000 25,000 Additional information : (a) Rebate on bills discounted to be provided for $ 15,000 (b) Classification of advances : $ 25,00,000 5,60,000 2,55,000 Standard Assets Sub-standard Assets (fully secured) Doubtful Assets not covered by Security Doubtful Assets covered by Security : For 1 year For 2 years For 3 years For 4 years Loss Assets 25,000 50,000 1,00,000 75,000 1,00,000 (c) Make tax provision @ 35% (d) Profit and Loss A/c (Cr.) $40,000.arrow_forwardUse the following information to answer this question. Windswept, Inc.2017 Income Statement($ in millions) Net sales $ 9,000 Cost of goods sold 7,350 Depreciation 360 Earnings before interest and taxes $ 1,290 Interest paid 87 Taxable income $ 1,203 Taxes 421 Net income $ 782 Windswept, Inc.2016 and 2017 Balance Sheets($ in millions) 2016 2017 2016 2017 Cash $ 160 $ 190 Accounts payable $ 1,150 $ 1,332 Accounts rec. 840 740 Long-term debt 1,000 1,233 Inventory 1,570 1,565 Common stock 3,190 2,910 Total $ 2,570 $ 2,495 Retained earnings 470 720 Net fixed assets 3,240 3,700 Total assets $ 5,810 $ 6,195 Total liab. & equity $ 5,810 $ 6,195 What is the equity multiplier for 2017?arrow_forward

- Al-Taweel Corporation, which began business in 201Z appropriately uses the installment sales method following data were obtained foe sales during 2017 and 2018 : 2017 2018 Installment sales OR 140,000 OR130, 000 Cost of installment sales 84,000 91,000 Cash collections on installment sales during 2017 55,000 37,000 2018 45,000 Required: Prepare journal entries for 2017 and 2018 to account for the installment sales and cash collections.arrow_forwardHogenson Company estimates bad debt expense at 0.60% of credit sales. The company reported accounts receivable and allowance for uncollectible accounts of $481,000 and $1,480 respectively on December 31, 2018. During 2019, Hogenson Company's credit sales and collections were $325,000 and $316,000, respectively, and $1,870 in accounts receivable were written off. Determine the company’s net realizable value of accounts receivable on December 31, 2019. A. $488,440.B. $484,700.C. $486,570. D. $469,020.arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education