Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

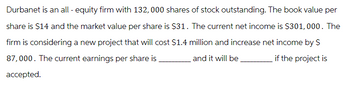

Transcribed Image Text:Durbanet is an all-equity firm with 132,000 shares of stock outstanding. The book value per

share is $14 and the market value per share is $31. The current net income is $301,000. The

firm is considering a new project that will cost $1.4 million and increase net income by S

87,000. The current earnings per share is

if the project is

and it will be

accepted.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- ETA is an all-equity firm with 50 million shares outstanding. It has $200 million in cash and expects future free cash flows of $80 million per year (with the next cash flow occurring in exactly one year's time). The Board of ETA can either use all excess cash to repurchase shares or for expansion. Suppose that ETA is able to invest the $200 million excess cash into a project that will increase the future free cash flows by 30% in year 1 (and cash flows stay constant at that level after year 1). This investment will not alter the risk of the business. ETA's cost of capital is 10% and assume that capital markets are perfect. If you were advising the board, what course of action would you recommend? Should ETA use the $200 million to expand or repurchase shares? Required: (a) Firm value with expansion is $ million. Note: Please provide your answer as an integer in million in the format of xxxx (for example, if the answer is $1,234.5 million, type in 1235). (b) If the board decides to…arrow_forwardJL Enterprises has 90,000 shares of stock outstanding with a book value of $1,343,000 and a market value of $1,560,000. The firm is considering a project that requires the purchase of $189,000 of fixed assets and has a net present value of $7,500. The project would be all-equity financed through the sale of shares. What will the new book value per share be after the project is implemented?arrow_forwardStart-Up Industries is a new firm that has raised $360 million by selling shares of stock.Management plans to earn a 20% rate of return on equity, which is more than the 15% rate of return available on comparable-risk investments. Half of all earnings will be reinvested in the firm. What will be Start-Up’s ratio of market value to book value? What will be Start-Up’s ratio of market value to book value if the firm can earn only a rate of return of 5% on its investments?arrow_forward

- Suppose you have just become the president of J&J and the first decision you face is whether Co go ahead with a plan to renovate the company's Al systems. The plan will cost the company $60 million, and it is expected to save $15 million per year after taxes over the next five years. The firm sources of funds and corresponding required rates of return are as follow: $5 million common stock at 16%, $800,000 preferred stock at 12%, $6 million debt at 7%. All amounts are listed at market values and the firm's tax rate is 30%. You are the financial manager and supposed to calculate the NPV. What's the NPV? Do you recommend taking the project? ง = O NPV $5.167 Millions; I'll recommend the owners to take the project. O NPV=-$1.720 Millions; I'll tell the owners not to take the project. NPV = $4.562 Millions; I'll tell the owners not to take the project. O NPV=-$8.098 Millions; I'll tell the owners not to take the project.arrow_forwardThe Hartley Hotel Corporation is planning a major expansion. Hartley is financed 100 percent with equity and intends to maintain this capital structure after the expansion. Hartley’s beta is 1. The expected market return is 18 percent, and the risk-free rate is 9 percent. If the expansion is expected to produce an internal rate of return of 17 percent, should Hartley make the investment? Round your answer to one decimal places. Based on the cost of capital of %, Hartley invest.arrow_forwardThe Hartley Hotel Corporation is planning a major expansion. Hartley is financed 100 percent with equity and intends to maintain this capital structure after the expansion. Hartley’s beta is 0.8. The expected market return is 15 percent, and the risk-free rate is 8 percent. If the expansion is expected to produce an internal rate of return of 14 percent, should Hartley make the investment? Round your answer to one decimal places. Based on the cost of capital of ________ %, Hartley should invest ____ or not invest ______arrow_forward

- A firm is currently an all equity firm that has 510,000 shares of stock outstanding with a market price of $53.60 a share. The current cost of equity is 10.5 percent and the tax rate is 25 percent. The firm is considering adding $7.10million of debt with a coupon rate of 6 percent to its capital structure. The debt will be sold at par value. What is the levered value of the equity ?arrow_forwardGoogle has 15 million shares outstanding with a current market price of $2 per share. Google announces an investment in a project where the initial investment in year 0 is $5 million and the cash inflow for the next five years will be $3 million, after which the investment will generate no cash flows. Google’s discount rate for this project is 8%. What is the dollar increase in Google’s share price due to the undertaking this investment?arrow_forwardMokoko Ltd. is considering a number projects and thus need to estimate its cost of capital in order to estimate their NPV. The company’s current dividend is $2.25 per share, which has grown steadily at 6% each year for over a decade and is expected to continue doing so. Its stock currently trades at $26 and there are 2 million shares outstanding. The company’s 100,000 preferred shares trade at $22 and pay annual dividends of $3. Cash and marketable securities on the company’s balance sheet total $30.5 million and the firm pays a tax rate of 30%. Their existing long-term debt (face value of $100 million, semi-annual payments) pays a 9.5% coupon and has 12 years remaining before maturity. Due to current conditions, the required rate of return (yield to maturity) on this debt is 11% and any new debt issuance would be required to offer the same yield to investors (there is no term premium for 1 year vs 12 year debt). What is Mokoko Ltd's Debt/Equity ratio? Assuming the firm wants to…arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education