Survey of Accounting (Accounting I)

8th Edition

ISBN: 9781305961883

Author: Carl Warren

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Question

thumb_up100%

General accounting question

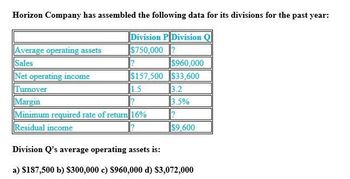

Transcribed Image Text:Horizon Company has assembled the following data for its divisions for the past year:

Division P Division Q

Average operating assets

$750,000 2

Sales

?

$960,000

Net operating income

$157,500

$33,600

Turnover

1.5

3.2

Margin

?

3.5%

Minimum required rate of return 16%

Residual income

$9,600

Division Q's average operating assets is:

a) $187,500 b) $300,000 c) $960,000 d) $3,072,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Residual income The Commercial Division of Galena Company has operating income of 12,680,000 and assets of 74,500,000. The minimum acceptable return on assets is 12%. What is the residual income for the division?arrow_forwardSelected sales and operating data for three divisions of different structural engineering firms are given as follows: Division A Division B Division C Sales $ 6,100,000 $ 10,100,000 $ 9,200,000 Average operating assets $ 1,525,000 $ 5,050,000 $ 2,300,000 Net operating income $ 317,200 $ 929,200 $ 225,400 Minimum required rate of return 15.00 % 18.40 % 12.00 % Required: 1. Compute the return on investment (ROI) for each division using the formula stated in terms of margin and turnover. 2. Compute the residual income (loss) for each division. 3. Assume that each division is presented with an investment opportunity that would yield a 17% rate of return. a. If performance is being measured by ROI, which division or divisions will probably accept or reject the opportunity? b. If performance is being measured by residual income, which division or divisions will probably accept or reject the opportunity?arrow_forwardSelected sales and operating data for three divisions of different structural engineering firms are given as follows: Division A Division B Division C Sales $ 15,400,000 $ 28,320,000 $ 25,400,000 Average operating assets $ 3,080,000 $ 7,080,000 $ 5,080,000 Net operating income $ 693,000 $ 396,480 $ 736,600 Minimum required rate of return 7.00 % 7.50 % 14.50 % Required: 1. Compute the margin, turnover, and return on investment (ROI) for each division. 2. Compute the residual income (loss) for each division. 3. Assume that each division is presented with an investment opportunity that would yield a 8% rate of return. a. If performance is being measured by ROI, which division or divisions will probably accept the opportunity? b. If performance is being measured by residual income, which division or divisions will probably accept the opportunity?arrow_forward

- Selected sales and operating data for three divisions of different structural engineering firms are glven as follows: Division A $ 16, 200,000 $ 3,240,000 24 Division B Division C $ 26, 200,000 $ 5,240,000 Sales $ 28,960,000 Average operating assets Net operating income Minimum required rate of return 24 24 7,240,000 761,400 463,360 24 655,000 12.5e% 7.00% 7.5e% Required: 1. Compute the margin, turnover, and return on Investment (ROI) for each division. 2. Compute the residual Income (loss) for each division. 3. Assume that each division is presented with an Investment opportunity that would yleld a 8% rate of return. a. If performance is being measured by ROI, which division or divisions will probably accept the opportunity? b. If performance Is belng measured by residual Income, which division or divislons will probably accept the opportunity?arrow_forwardThe sales, operating income, and invested assets for each division of Salem Company are as follows: Sales OperatingIncome InvestedAssets Division C $4,000,000 $410,000 $3,500,000 Division D 3,500,000 600,000 4,000,000 Division E 2,250,000 780,000 7,000,000 Management has established a minimum rate of return for invested assets of 11%. a. Determine the residual income for each division. Residual Income Division C $fill in the blank 1 Division D $fill in the blank 2 Division E $fill in the blank 3 b. Based on residual income, which division is the most profitable?arrow_forwardKyle Corporation provides the following information for the Product Division and Service Division for the year. Product Division Service Division 420,000 $ 650,000 195,000 245,000 640,000 610,000 14.0% 14.0% Net sales Operating income Average total assets Target rate of return $ Requirement 1. Calculate the return on investment for each division. (Enter answers as a percent rounded to the nearest hundredth percent, X.XX%) The return on investment for the Product Division is The return on investment for the Service Division is Requirement 2. Which division has the highest ROI? % % Requirement 3. Calculate the residual income for each division. (Round answers to the nearest whole dollar.) The residual income for the Product Division is The residual income for the Service Division is Requirement 4. Which division has the highest residual income?arrow_forward

- Selected sales and operating data for three divisions of different structural engineering firms are given as follows: Division C $8,100, 000 $ 1,620, 000 $ Division A Division B Sales Average operating assets Net operating income Minimum required rate of return $ 5,000, 000 $ 1,000, 000 $ $ 9,000, 000 $4,500, 000 729,000 16.20% 205,000 109, 350 16.00% 13.00% Required: 1. Compute the return on investment (ROI) for each division using the formula stated in terms of margin and turnover. 2. Compute the residual income (loss) for each division. 3. Assume that each division is presented with an investment opportunity that would yield a 16% rate of return. a. If performance is being measured by ROI, which division or divisions will probably accept or reject the opportunity? b. If performance is being measured by residual income, which division or divisions will probably accept or reject the opportunity? Complete this question by entering your answers in the tabs below. Req 1 Req 2 Req 3A Req…arrow_forwardSelected sales and operating data for three divisions of different structural engineering firms are given as follows: Division A $ 5,000,000 $ 1,000,000 24 Division C $ 8,100, 000 $ 1,620, 000 $4 Division B $ 9,000, 000 $ 4,500,000 $4 Sales Average operating assets Net operating income Minimum required rate of return 205,000 729, 000 109, 350 16.00% 16.20% 13.00% Required: 1. Compute the return on investment (ROI) for each division using the formula stated in terms of margin and turnover. 2. Compute the residual income (loss) for each division. 3. Assume that each division is presented with an investment opportunity that would yield a 16% rate of return. a. If performance is being measured by ROI, which division or divisions will probably accept or reject the opportunity? b. If performance is being measured by residual income, which division or divisions will probably accept or reject the opportunity? Complete this question by entering your answers in the tabs below. Req 1 Req 2 Req 3A…arrow_forwardThe sales, income from operations, and invested assets for each division of Wren Company are as follows: Division c Division D Division E Sales $5,000,000 6,800,000 3,750,000 Income from Operations $630,000 760,000 750,000 Invested Assets $4,000,000 3,900,000 7,500,000 Management has established a minimum rate of return for invested assets of 8%. a. Determine the residual income for each division. Division C: Division D: Division E: b. Based on residual income, which of the divisions is the most profitable?arrow_forward

- The sales, income from operations, and invested assets for each division of Wren Company are as follows: Sales Income from Operations Invested Assets Division C $5,000,000 $630,000 $4,000,000 Division D 6,800,000 760,000 3,900,000 Division E 3,750,000 750,000 7,500,000 Management has established a minimum rate of return for invested assets of 10%. What is the Residual Income for Division C? What is the Residual Income for Division D? What is the Residual Income for Division E? Based on Residual Income, Division __?__ is the most profitable.arrow_forwardSelected sales and operating data for three divisions of different structural engineering firms are given as follows: Division A Division B Division C $ 5,000, 000 $ 1,000,000 %$4 Sales Average operating assets Net operating income Minimum required rate of return $ 9,000,000 $ 4,500,000 2$ $ 8, 100, 000 $ 1,620, 000 109, 350 13.00% 205,000 $4 729,000 16.20% 16.00% Required: 1. Compute the return on investment (ROI) for each division using the formula stated in terms of margin and turnover. 2. Compute the residual income (loss) for each division. 3. Assume that each division is presented with an investment opportunity that would yield a 16% rate of return. a. If performance is being measured by ROI, which division or divisions will probably accept or reject the opportunity? b. If performance is being measured by residual income, which division or divisions will probably accept or reject the opportunity? es Complete this question by entering your answers in the tabs below. Req 1 Req Req…arrow_forwardI need answer of this question general accountingarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Survey of Accounting (Accounting I)AccountingISBN:9781305961883Author:Carl WarrenPublisher:Cengage Learning

Survey of Accounting (Accounting I)AccountingISBN:9781305961883Author:Carl WarrenPublisher:Cengage Learning Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Survey of Accounting (Accounting I)

Accounting

ISBN:9781305961883

Author:Carl Warren

Publisher:Cengage Learning

Managerial Accounting

Accounting

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:South-Western College Pub