FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

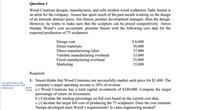

Transcribed Image Text:Question 1

Wood Creations designs, manufactures, and sells modern wood sculptures. Sally Jensen is

an artist for the company. Jensen has spent much of the past month working on the design

of an intricate abstract piece. Jim Smoot, product development manager, likes the design.

However, he wants to make sure that the sculpture can be priced competitively. Alexis

Nampa, Wood's cost accountant, presents Smoot with the following cost data for the

expected production of 75 sculptures:

$ 8,000

30,000

37,000

33,000

25,000

15,000

Design cost

Direct materials

Direct manufacturing labor

Variable manufacturing overhead

Fixed manufacturing overhead

Marketing

Required:

1. Smoot thinks that Wood Creations can successfully market each piece for $2,400. The

1)(a) ignore above info,

suppose aim to earn 20%

market price

company's target operating income is 20% of revenue.

$2,400

75units a.) Wood Creations has a total capital investment of $240,000. Compute the target

percentage of return on investment.

b.) Calculate the markup percentage on full cost based on the current cost data.

c.) Calculate the target full cost of producing the 75 sculptures. Does the cost estimate

Nampa developed meet Wood's requirements? Is value engineering needed?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Compute conversion costs given the following data: direct materials, $351,300; direct labor, $207,800; factory overhead, $189,700 and selling expenses, $46,300. a. $748,800 b. $143,400 c. $541,000 d. $397,500arrow_forward⦁ Use ABC to compute overhead cost assigned to an order.KCC Production Corporation uses an activity-based costing system and provided the following budget data: The distribution of resource consumption across activities is as follows: During the year, KCC completed one order from a new customer for 1,000 units, and the related data are as follows: direct labor hours= 0.5 /unit direct materials= $2.00/unit direct labor= $5.00/hour machine hour =1 machine hour per unit Requirements1. Compute the activity rates for each of the activity cost pools.2. Compute the overhead cost assigned to the order from the new customer.arrow_forwardA manufacturer uses activity-based costing to assign overhead cost to products. Budgeted cost information for its activities follows. Budgeted Cost $ 210,600 Activity Cost Driver Purchase orders Square feet Budgeted Activity Usage 5,400 purchase orders 5,900 square feet 50 Setups Factory services 104,250 Setup 67,750 Setups Compute an activity rate for each activity. (Round your answers to 2 decimal places.) Activity Purchasing Activity Purchasing Factory services Setup Budgeted Cost 210,600 104,250 67,750 $ $ $ Budgeted Activity Usage Activity Ratearrow_forward

- Z Company uses activity based costing and gives you the following data regarding cost pools and estimated overhead cost for each pool. Machine related RO 80,000 Material handling RO 130,000 Purchase related RO 340,000 General factory RO 320,000 The amount of total estimated overhead is: a. RO 660,000 b. RO 550,000 c. RO 790,000 d. RO 870,000 fast just choosearrow_forwardThe following information was collected for the first year of manufacturing for Appliance Apps: Direct Materials per Unit $2.50 Direct Labor per Unit $1.50 Variable Manufacturing Overhead per Unit $0.25 Variable Selling and Administration Expenses $1.75 Units Produced 39,000 Units Sold 35,000 Sales Price $12 Fixed Manufacturing Expenses $117,000 Fixed Selling and Administration Expenses $20,000 Question Content Area Prepare an income statement under variable costing method. Appliance AppsIncome Statement $- Select - - Select - $- Select - - Select - $- Select - - Select - - Select - $- Select - Question Content Area Prepare a reconciliation to the income under the absorption method. Appliance AppsReconciliation $- Select - - Select - $- Select -arrow_forwardEstimated Estimated Cost Drivers Activity Cost Overhead Street Mountain Pools Costs Tires Tires Machine set ups $ 90,000 150 350 Assembling $500,000 25,000 15,000 Inspection $400,000 180 320 Question Using the activity-based costing approach, determine the applied overhead rates for Darter Company.arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education