Practical Management Science

6th Edition

ISBN: 9781337406659

Author: WINSTON, Wayne L.

Publisher: Cengage,

expand_more

expand_more

format_list_bulleted

Question

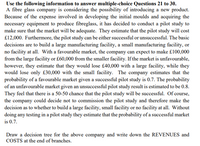

Transcribed Image Text:Use the following information to answer multiple-choice Questions 21 to 30.

A fibre glass company is considering the possibility of introducing a new product.

Because of the expense involved in developing the initial moulds and acquiring the

necessary equipment to produce fibreglass, it has decided to conduct a pilot study to

make sure that the market will be adequate. They estimate that the pilot study will cost

£12,000. Furthermore, the pilot study can be either successful or unsuccessful. The basic

decisions are to build a large manufacturing facility, a small manufacturing facility, or

no facility at all. With a favourable market, the company can expect to make £100,000

from the large facility or £60,000 from the smaller facility. If the market is unfavourable,

however, they estimate that they would lose £40,000 with a large facility, while they

would lose only £30,000 with the small facility. The company estimates that the

probability of a favourable market given a successful pilot study is 0.7. The probability

of an unfavourable market given an unsuccessful pilot study result is estimated to be 0.8.

They feel that there is a 50-50 chance that the pilot study will be successful. Of course,

the company could decide not to commission the pilot study and therefore make the

decision as to whether to build a large facility, small facility or no facility at all. Without

doing any testing in a pilot study they estimate that the probability of a successful market

is 0.7.

Draw a decision tree for the above company and write down the REVENUES and

COSTS at the end of branches.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, operations-management and related others by exploring similar questions and additional content below.Similar questions

- what are the fears, needs and wants of a customer when selecting a 3 PL company?arrow_forwardDiscuss in detail a minimum of 10 recommendations for the company Nike, that are viable for antheir continued long-term growth and success.arrow_forwardThe make-versus-buy decision is important every time a new application is requested of the IS group. In today’s internet-enables, cloud-computing-rich environment, identify at least two scenario/use-cases, that would justify in-house IS development as opposed to external-sourcing (buy-decision) for key IS solutions. Provide a concise but informative justification for each of your two scenarios/use-cases.arrow_forward

- Read the case and answer the below questions 1)Summarize the key points of the case. 2) Describe the present purchase structure of the firm. 3)Evaluate Make Vs Buy model for the firm. 4)If you were at Alice's place, what would you opt and why? Case 5–3 Alicia Wong Alicia Wong, Corporate Supply Manager, Thain Foods Limited, wanted to prepare a proposal to manufacture mustardi in-house Mustard, an important ingredient in many of the company’s products, was currently purchased from an outside supplier. She hoped a comprehensive proposal could be prepared in on month’s time for the CEO’s approval.GENERAL COMPANY BACKGROUND ThainFoods Limited (TFL) had been in business for more than30 years. Its products included a wide range of syrups, fudges cone dips, sauces, mayonnaise, and salad dressings. Its customers were major food chains, hotels, and restaurantsin North America and Europe. TFLbelieved in continuous improvement to its operations Over the last two years, it invested more than $2…arrow_forwardList three current news story/events about TripAdvisor and briefly discuss how it affects or could affect the stock value and company.arrow_forwardBegin by selecting two functional strategies from the list below: Marketing Strategy Financial Strategy In your initial post, explain the overall goals of each of the strategies that you selected, generally speaking. Then, expand on your choices by describing how each functional strategy may work together to potentially achieve economies of scope. Further develop your response by describing how the functional strategies that you selected operate either at your place or work, a place where you have worked in the past, or in a hypothetical “best” corporation scenario. Alternatively, you may research an actual corporation to further develop your response on your chosen functional strategies. Be sure to post at least 2 referencesarrow_forward

- Three-line summaries of your brief observations on the following topics should be included: (what/why/advantage(s)/disadvantage(s)) The Manchester Methodarrow_forwardSports Marketing At CSU Stanislaus is considering adding a Sports Marketing program on campus. Discuss the possible types of target markets to whom CSU Stanislaus could direct the program, using multiple segmentation, targeting and positioning approaches. Discuss different types of research that CSU Stanislaus should undertake to support their decision. Besides potential students, what other stakeholders should CSU Stanislaus gather data about/from in order to support the decisions that need to be made? Is there a means by which CSU Stanislaus could test market the program?arrow_forwardDEF Corporation is an online shopping platform based in Australia. What factor would be least appropriate to consider in a merger and acquisition?a. The service provided by a target firm involved in IT solutionsb. The size and profitability of the target firm when it plans close the latter and decrease competition.c. The synergies obtained from a target firm that provides a somewhat related product or serviced. The geography and region of the target firm when it plans to expand to a more global marketarrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Practical Management ScienceOperations ManagementISBN:9781337406659Author:WINSTON, Wayne L.Publisher:Cengage,

Practical Management ScienceOperations ManagementISBN:9781337406659Author:WINSTON, Wayne L.Publisher:Cengage, Operations ManagementOperations ManagementISBN:9781259667473Author:William J StevensonPublisher:McGraw-Hill Education

Operations ManagementOperations ManagementISBN:9781259667473Author:William J StevensonPublisher:McGraw-Hill Education Operations and Supply Chain Management (Mcgraw-hi...Operations ManagementISBN:9781259666100Author:F. Robert Jacobs, Richard B ChasePublisher:McGraw-Hill Education

Operations and Supply Chain Management (Mcgraw-hi...Operations ManagementISBN:9781259666100Author:F. Robert Jacobs, Richard B ChasePublisher:McGraw-Hill Education

Purchasing and Supply Chain ManagementOperations ManagementISBN:9781285869681Author:Robert M. Monczka, Robert B. Handfield, Larry C. Giunipero, James L. PattersonPublisher:Cengage Learning

Purchasing and Supply Chain ManagementOperations ManagementISBN:9781285869681Author:Robert M. Monczka, Robert B. Handfield, Larry C. Giunipero, James L. PattersonPublisher:Cengage Learning Production and Operations Analysis, Seventh Editi...Operations ManagementISBN:9781478623069Author:Steven Nahmias, Tava Lennon OlsenPublisher:Waveland Press, Inc.

Production and Operations Analysis, Seventh Editi...Operations ManagementISBN:9781478623069Author:Steven Nahmias, Tava Lennon OlsenPublisher:Waveland Press, Inc.

Practical Management Science

Operations Management

ISBN:9781337406659

Author:WINSTON, Wayne L.

Publisher:Cengage,

Operations Management

Operations Management

ISBN:9781259667473

Author:William J Stevenson

Publisher:McGraw-Hill Education

Operations and Supply Chain Management (Mcgraw-hi...

Operations Management

ISBN:9781259666100

Author:F. Robert Jacobs, Richard B Chase

Publisher:McGraw-Hill Education

Purchasing and Supply Chain Management

Operations Management

ISBN:9781285869681

Author:Robert M. Monczka, Robert B. Handfield, Larry C. Giunipero, James L. Patterson

Publisher:Cengage Learning

Production and Operations Analysis, Seventh Editi...

Operations Management

ISBN:9781478623069

Author:Steven Nahmias, Tava Lennon Olsen

Publisher:Waveland Press, Inc.