Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

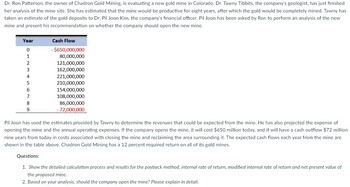

Transcribed Image Text:Dr. Ron Patterson, the owner of Chadron Gold Mining, is evaluating a new gold mine in Colorado. Dr. Tawny Tibbits, the company's geologist, has just finished

her analysis of the mine site. She has estimated that the mine would be productive for eight years, after which the gold would be completely mined. Tawny has

taken an estimate of the gold deposits to Dr. Pil Joon Kim, the company's financial officer. Pil Joon has been asked by Ron to perform an analysis of the new

mine and present his recommendation on whether the company should open the new mine.

Year

Cash Flow

0

1

2

-$650,000,000

80,000,000

121,000,000

3

162,000,000

4

221,000,000

5

210,000,000

6

154,000,000

7

108,000,000

8

9

86,000,000

-72,000,000

Pil Joon has used the estimates provided by Tawny to determine the revenues that could be expected from the mine. He has also projected the expense of

opening the mine and the annual operating expenses. If the company opens the mine, it will cost $650 million today, and it will have a cash outflow $72 million

nine years from today in costs associated with closing the mine and reclaiming the area surrounding it. The expected cash flows each year from the mine are

shown in the table above. Chadron Gold Mining has a 12 percent required return on all of its gold mines.

Questions:

1. Show the detailed calculation process and results for the payback method, internal rate of return, modified internal rate of return and net present value of

the proposed mine.

2. Based on your analysis, should the company open the mine? Please explain in detail.

SAVE

AI-Generated Solution

info

AI-generated content may present inaccurate or offensive content that does not represent bartleby’s views.

Unlock instant AI solutions

Tap the button

to generate a solution

to generate a solution

Click the button to generate

a solution

a solution

Knowledge Booster

Similar questions

- Vijayarrow_forwardYou own a coal mining company and are considering opening a new mine. The mine will cost $119.5 million to open. If this money is spent immediately, the mine will generate $21.5 million for the next 10 years. After that, the coal will run out and the site must be cleaned and maintained at environmental standards. The cleaning and maintenance are expected to cost $1.6 million per year in perpetuity. What does the IRR rule say about whether you should accept this opportunity? If the cost of capital is 7.6%, what does the NPV rule say? NPV ($ mil पात 10 15 et Discount Rate (%) What does the IRR rule say about whether you should accept this opportunity? (Select the best choice below.) A. Accept the opportunity because the IRR is greater than the cost of capital. B. There are two IRRS, so you cannot use the IRR as a criterion for accepting the opportunity. O C. Reject the opportunity because the IRR is lower than the 7.6% cost of capital. D. The IRR is r= 11.46%, so accept the opportunity.…arrow_forwardSuppose you have been hired as a financial consultant to Defense Electronics, Incorporated (DEI), a large, publicly traded firm that is the market share leader in radar detection systems (RDSS). The company is looking at setting up a manufacturing plant overseas to produce a new line of RDSS. This will be a five-year project. The company bought some land three years ago for $7.2 million in anticipation of using it as a toxic dump site for waste chemicals, but it built a piping system to safely discard the chemicals instead. If the land were sold today, the net proceeds would be $7.66 million after taxes. In five years, the land will be worth $7.96 million after taxes. The company wants to build its new manufacturing plant on this land; the plant will cost $13.24 million to build. The following market data on DEI's securities are current: Debt: Common stock: Preferred stock: Market: 91,200 6.9 percent coupon bonds outstanding, 23 years to maturity, selling for 94.4 percent of par; the…arrow_forward

- I need this in Excel Worksheet to show formulas and calculations please. Seth Bullock, the owner of Bullock Gold Mining, is evaluating a new gold mine in South Dakota. Dan Dority, the company’s geologist, has just finished his analysis of the mine site. He has estimated that the mine would be productive for eight years, after which the gold would be completely mined. Dan has taken an estimate of the gold deposits to Alma Garrett, the company’s financial officer. Alma has been asked by Seth to perform an analysis of the new mine and present her recommendation on whether the company should open the new mine. Year Cash Flow0 −$625,000,0001 70,000,0002 129,000,0003 183,000,0004 235,000,0005 210,000,0006 164,000,0007 108,000,0008 86,000,0009 − 90,000,000 Alma has used the estimates provided by Dan to determine the revenues that could be expected from the mine. She also has projected the expense of opening the mine…arrow_forwardBullock Gold Mining Seth Bullock, the owner of Bullock Gold Mining, is evaluating a new gold mine in South Dakota. Dan Dority, the company’s geologist, has just finished his analysis of the mine site. He has estimated that the mine would be productive for eight years, after which the gold would be completely mined. Dan has taken an estimate of the gold deposits to Alma Garrett, the company’s financial officer. Alma has been asked by Seth to perform an analysis of the new mine and present her recommendation on whether the company should open the new mine. Alma has used the estimates provided by Dan to determine the revenues that could be expected from the mine. She has also projected the expense of opening the mine and the annual operating expenses. If the company opens the mine, it will cost $745 million today, and it will have a cash outflow of $55 million nine years from today in costs associated with closing the mine and reclaiming the area surrounding it. The expected cash flows…arrow_forwardMike Mulligan wants to expand his heavy equipment business into excavation. He plans to buy a used excavator for $300,000. The excavator requires an inventory of spare parts worth $ 10,000. These investments will occur immediately. Mulligan will operate the excavation business for two years and expects EBITDA of $200,000 at the end of each year. He will close his business at the end of the second year, sell the equipment for $100,000 and liquidate the inventory of spare parts. Mulligan pays a tax rate of 25%. Using this information, compute the appropriate values for operating cash flow, investments in net working capital, CAPEX and free cash flow for each year of the project.arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education