Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

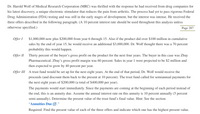

Transcribed Image Text:Dr. Harold Wolf of Medical Research Corporation (MRC) was thrilled with the response he had received from drug companies for

his latest discovery, a unique electronic stimulator that reduces the pain from arthritis. The process had yet to pass rigorous Federal

Drug Administration (FDA) testing and was still in the early stages of development, but the interest was intense. He received the

three offers described in the following paragraph. (A 10 percent interest rate should be used throughout this analysis unless

otherwise specified.)

Page 287

Offer I

$1,000,000 now plus $200,000 from year 6 through 15. Also if the product did over $100 million in cumulative

sales by the end of year 15, he would receive an additional $3,000,000. Dr. Wolf thought there was a 70 percent

probability this would happen.

Thirty percent of the buyer's gross profit on the product for the next four years. The buyer in this case was Zbay

Pharmaceutical. Zbay's gross profit margin was 60 percent. Sales in year 1 were projected to be $2 million and

Offer II

then expected to grow by 40 percent per year.

Offer III

A trust fund would be set up for the next eight years. At the end of that period, Dr. Wolf would receive the

proceeds (and discount them back to the present at 10 percent). The trust fund called for semiannual payments for

the next eight years of $200,000 (a total of $400,000 per year).

The payments would start immediately. Since the payments are coming at the beginning of each period instead of

the end, this is an annuity due. Assume the annual interest rate on this annuity is 10 percent annually (5 percent

semi-annually). Determine the present value of the trust fund's final value. Hint: See the section

"Annuities Due ."

Required: Find the present value of each of the three offers and indicate which one has the highest present value.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 2 images

Knowledge Booster

Similar questions

- You work for a pharmaceutical company that has developed a new drug. The patent on the drug will last 17 years. You expect that the drug's profits will be $1 million in its first year and that this amount will grow at a rate of 2% per year for the next 17 years. Once the patent expires, other pharmaceutical companies will be able to produce the same drug and competition will likely drive profits to zero, What is the present value of the new drug if the interest rate is 8% per year? The present value of the new drug is 5 million (Round to three decimal places.)arrow_forwardA new antitheft system incorporating MEMS technology is being separately evaluated economically by three engineers at Dragon Technologies. The first cost of the equipment will be $85,000, and the life is estimated at 6 years with a salvage value of $9000. The engineers made different estimates of the net savings that the equipment might generate. Jacob made an estimate of $12,000 per year. Susan states that this is too low and estimates $13,000, while Tyler estimates $23,000 per year before tax. If the MARR is 8% per year, use PW to determine if these different estimates will change the decision to purchase the equipment. The present worth of the pessimistic estimate is $[ The present worth of the most likely estimate is $ The present worth of the optimistic estimate is $ The equipment purchase by the pessimistic estimate is (Click to select) The equipment purchase by the most likely estimate is [(Click to select) The equipment purchase by the optimistic estimate is [(Click to select)arrow_forwardSolomon Auto Repair, Inc. is evaluating a project to purchase equipment that will not only expand the company's capacity but also improve the quality of its repair services. The board of directors requires all capital investments to meet or exceed the minimum requirement of a 10 percent rate of return. However, the board has not clearly defined the rate of return. The president and controller are pondering two different rates of return: unadjusted rate of return and internal rate of return. The equipment, which costs $106,000, has a life expectancy of five years. The increased net profit per year will be approximately $6,100, and the increased cash inflow per year will be approximately $29,405. (PV of $1 and PVA of $1) (Use appropriate factor(s) from the tables provided.) Required a-1. Determine the unadjusted rate of return and (use average investment) to evaluate this project. (Round your answer to 2 decimal places. (i.e., 0.2345 should be entered as 23.45).) a-2. Based on the…arrow_forward

- You work for a pharmaceutical company that has developed a new drug. The patent on the drug will last 19 years. You expect that the drug's profits will be $4 million in its first year and that this amount will grow at a rate of 3 * 0/o per year for the next 19 years. Once the patent expires, other pharmaceutical companies will be able to produce the same drug and competition will likely drive profits to zero. What is the present value of the new drug if the interest rate is 12% per year? The present value of the new drug is $ (enter your response here) million.arrow_forwardNote:- Do not provide handwritten solution. Maintain accuracy and quality in your answer. Take care of plagiarism. Answer completely. You will get up vote for sure.arrow_forwardPerez Auto Repair, Inc. is evaluating a project to purchase equipment that will not only expand the company's capacity but also improve the quality of its repair services. The board of directors requires all capital investments to meet or exceed the minimum requirement of a 10 percent rate of return. However, the board has not clearly defined the rate of return. The president and controller are pondering two different rates of return: unadjusted rate of return and internal rate of return. The equipment, which costs $109,000, has a life expectancy of five years. The increased net profit per year will be approximately $6,600, and the increased cash inflow per year will be approximately $28,023. (PV of $1 and PVA of $1) (Use appropriate factor(s) from the tables provided.) Required a-1. Determine the unadjusted rate of return and (use average investment) to evaluate this project. (Round your answer to 2 decimal places. (i.e., 0.2345 should be entered as 23.45).) a-2. Based on the…arrow_forward

- Pfizer is currently in the process of creating and producing life-saving medicines and medical devices for people in need. As an industry leader, Pfizer employs a number of scientists and doctors that research and test potential new medications and medical self-testing technologies. These research teams incurred $1,040,000 in salaries and $2,264,300 in laboratory rent during 2021. Once there are feasible production plans in place and a customer base has been identified and vetted, the development team works on producing and testing prototypes. The cost of development activities for 2021 amounts to $7,550,000 and there are several projects with fair values amounting to $5,230,400 planned and scheduled for 2022. Part of the total 2021 development costs includes $995,000 for routine alternations to the manufacturing processes. As the year-end approaches, Pfizer must begin the closing process to produce their 2021 U.S. GAAP financial statements. what is the problem statementarrow_forwardYou are an investor in a start-up company that has a patent on a new medical device. It has been approved by the FDA and is now going to marketing. The venture capital group supporting the venture believe the device will enjoy an excellent market reception, a decent reception, or a very poor reception with probabilities 0.3, 0.5, and 0.2, respectively. As an investor, you have three options available to you: (1) you can go with the market ride where the return to you in profit will be $80K, $30K, or -$25K, respectively, for the three possible market receptions. (2) You can “pool” your investment with others, sharing both the good and the bad outcomes, and your profits would be $60K, $20K, or $0K, respectively. Finally, (3) you could sell your investment for cash; the current market value of your investment is $30K. Assume you are an expected return maximizer and ignore the time value of money when answering the following questions. Which of the three options is the most…arrow_forwardVigour Pharmaceuticals Ltd. is considering investing in a newproduction line for its pain-reliever medicine for individuals whosuffer from cardio vascular diseases. The company has to invest inequipment which costs $2,500,000 and will be depreciated under theMACRS system for a 5-year asset class. It is expected to have a scrapvalue of $700,000 at the end of the project. Other than the equipment,the company needs to increase its cash and cash equivalents by$100,000, increase the level of inventory by $30,000, increaseaccounts receivable by $250,000 and increase account payable by$50,000 at the beginning of the project. Vigour Pharmaceuticals expectthe project to have a life of five years. The company would have topay for transportation and installation of the equipment which has aninvoice price of $450,000.The company has already invested $75,000 in Research and Developmentand therefore expects a positive impact on the demand for the newpain-reliever. Expected annual sales for the…arrow_forward

- Your firm has acquired a bag of 29 pills of the cognitive-enhancing, nootropic drug called NZT-48. This has opened up four new potential projects for your firm that would not be possible with only your regular unenhanced employees’ feeble meatbag brains. Each project is non-repeatable and of equal time. You have calculated the NPV of each project as well as the requested number of NZT-48 pills by each project’s exploratory team: Project Codename NPV Pills Requested Commodus $42,800 14 Caligula $70,500 20 Nero $24,150 5 Elagabalus $72,200 19 Assume that you can do partial projects whereby you can allocate less pills than the number requested by the team. This would give you a pro-rata portion of that project’s NPV (i.e. the amount of pills you allocate as a proportion of the number requested). The maximum total NPV your firm can achieve through allocating its 29 NZT-48 pills across these four projects is $$.(Round up to the nearest dollar)arrow_forwardYou are a manager at Northern Fibre, which is considering expanding its operations in synthetic fibre manufacturing. Your boss comes into your office, drops a consultant's report on your desk, and complains, "We owe these consultants $1.5 million for this report, and I am not sure their analysis makes sense. Before we spend the $17 million on new equipment needed for this project, look it over and give me your opinion." You open the report and find the following estimates (in millions of dollars): Sales revenue - Cost of goods sold = Gross profit - General, sales, and administrative expenses - Depreciation = Net operating income 1 2 28.000 28.000 16.800 16.800 11.200 11.200 1.360 1.360 1.700 1.700 8.1400 8.1400 9 28.000 16.800 11.200 1.360 1.700 8.1400 10 28.000 16.800 11.200 1.360 1.700 8.1400 b. If the cost of capital for this project is 9%, what is your estimate of the value of the new project? Value of project = $ million (Round to three decimal places.)arrow_forwardNote:- Do not provide handwritten solution. Maintain accuracy and quality in your answer. Take care of plagiarism. Answer completely. You will get up vote for sure.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education