FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

Down Under Products, Limited, of Australia has budgeted sales of its popular boomerang for the next four months as follows:

|

|

Unit Sales |

|

April |

76,000 |

|

May |

85,000 |

|

June |

116,000 |

|

July |

93,000 |

The company is now in the process of preparing a production budget for the second quarter. Past experience has shown that end-of-month inventory levels must equal 15% of the following month’s unit sales. The inventory at the end of March was 11,400 units.

Required:

Prepare a production budget by month and in total, for the second quarter.

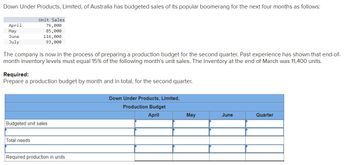

Transcribed Image Text:### Production Budget Preparation for Down Under Products, Limited

Down Under Products, Limited, of Australia has projected the sales of its popular boomerang for the coming four months as follows:

| Month | Unit Sales |

|--------|------------|

| April | 76,000 |

| May | 85,000 |

| June | 116,000 |

| July | 93,000 |

#### Objective:

The company aims to prepare a production budget for the second quarter, considering that end-of-month inventory levels must constitute 15% of the next month’s sales. The inventory at the end of March was 11,400 units.

#### Task:

Prepare a detailed production budget, breaking it down by month and in total for the second quarter.

#### Provided Table:

The table below outlines the format that needs to be completed to prepare the production budget.

| Down Under Products, Limited | April | May | June | Quarter |

|-------------------------------|--------|------|---------|---------|

| **Production Budget** | | | | |

| Budgeted unit sales | | | | |

| **Total needs** | | | | |

| Required production in units | | | | |

1. **Budgeted unit sales:** This includes the forecasted sales for each month.

2. **Total needs:** This involves calculating the total number of units needed for each month to meet the sales forecast and desired inventory levels.

3. **Required production in units:** The number of units that need to be produced each month to meet the total needs, after accounting for the existing inventory.

This information forms the foundation of the production planning process to ensure that Down Under Products, Limited can successfully meet its sales targets while maintaining the required inventory levels.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Frolic Corporation has budgeted sales and production over the next quarter as follows: July August September Sales in units 70,000 83,000? question mark Production in units 73,250 84, 750 91,750 The company has 17,500 units of product on hand at July 1. 25% of the next month's sales in units should be on hand at the end of each month. October sales are expected to be 97,000 units. Budgeted sales for September would be (in units):arrow_forwardTasty Foods expects to have 20,000 units of finished goods inventory on hand on March 31 and reports the following expected sales (in units) for the months of April through July: April 120,000 May June July 130,000 140,000 120,000 At the end of each month the company desires its ending finished goods inventory to be 20% of the next month's projected sales (in units). The budgeted production (in units) for Tasty Foods for May should be: A. 104,000. B. 128,000. C. 130,000. D. 132,000. E. 138,000. A O B C D Earrow_forwardAggrava Limited is currently preparing budgets for September to December. Its estimated sales figures in units are as follows: (financial information) = September October November December Sales (units) 5,569 14,234 14,847 15,121 Inventories at 31 August totalled 16,234 units, and inventories are to be kept at a constant level for all months except December, when opening inventories on 1 December are to be increased to 23,118. Inventories will revert to the normal level on 31 December. Inventories will cost £2 per unit throughout the period, and suppliers allow Aggrava Ltd to pay in the month following an order. Other relevant information is that 3,497 units were bought in August. Requirement 1: Prepare Aggrava Ltd's inventories budget (in units) for September to December. Requirement 2: Prepare the information relevant to inventories purchases that would appear in the cash budget for the period. Question content area bottom Part…arrow_forward

- Down Under Products, Limited, of Australia has budgeted sales of its popular boomerang for the next four months as follows: Unit Sales April 74,000 May 85,000 June 114,000 July 92,000 The company is now in the process of preparing a production budget for the second quarter. Past experience has shown that end-of-month inventory levels must equal 10% of the following month’s unit sales. The inventory at the end of March was 7,400 units. Required: Prepare a production budget by month and in total, for the second quarter.arrow_forwardFRANCORP is preparing budgets for the quarter ending March 31. Budgeted sales for the next 5 months are as follows: January February March 16250 units 16950 units 17200 units 18350 units 17900 units April May The selling price per unit is $15. Determine the total budgeted sales for the entire quarter ending March 31st. O $756,000 O $815,000 O $850,350 O $750,550arrow_forwardSilver Company makes a product with peak sales in May of each year. Its sales budget for the second quarter is given below: April May June Total Budgeted sales (all on account) $300,000 $500,000 $200,000 $1,000,000 The company estimates 20% of a month's sales are collected in the month of sale, another 70% are collected in the month following sale, and the remaining 10% are collected in the second month following sale. Bad debts are negligible and can be ignored. February sales totaled $230, 000, and March sales totaled $260,000. Required: Prepare a schedule of expected cash collections from sales, by month and in total, for the second quarter. What is the accounts receivable balance on June 30th?arrow_forward

- Zira Company reports the following production budget for the next four months. Each finished unit requires four pounds of direct materials, and the company wants to end each month with direct materials inventory equal to 30% of next month's production needs. Beginning direct materials inventory for April was 847 pounds. Direct materials cost $5 per pound. Prepare a direct materials budget for April, May, and June. (Round your answers to the nearest whole number.) Units to produce April May June 706 760 738 Units to produce Materials required per unit Materials needed for production (pounds) Add: Desired ending materials inventory (pounds) Total materials required (pounds) Less: Beginning materials inventory (pounds) Materials to purchase (pounds) Materials cost per pound Cost of direct materials purchases July 718 ZIRA COMPANY Direct Materials Budget April $ $ 706 4 2,824 2,824 ↑ 5 $ 0 $ May 760 4 3,040 Saved 3,040 June 5 $ 0 $ 738 units 4 pounds 2,952 pounds 2,952 pounds 5 per pound 0…arrow_forwardBlue Wave Co. predicts the following unit sales for the coming four months: September, 3,300 units; October, 4,900 units; November, 6,700 units; and December, 7,900 units. The company's policy is to maintain finished goods inventory equal to 50% of the next month's sales. At the end of August, the company had 2,800 finished units on hand. Prepare a production budget for each of the months of September, October, and November. Blue Wave Co. Production Budget September, October and November September Next month's budgeted sales (units) Units to be produced % October % November %arrow_forwardABC Company’s budgeted sales for June, July, and August are 12,800, 16,800, and 14,800 units, respectively. ABC requires 30% of the next month’s budgeted unit sales as finished goods inventory each month. Budgeted ending finished goods inventory for May is 3,840 units. Required: Calculate the number of units to be produced in June and July.arrow_forward

- Harris Inc., has budgeted sales in units for the next five months as follows: June July August September October 9,400 units 7,800 units 7,300 units 5,400 units 4,100 units Past experience has shown that the ending inventory for each month should be equal to 20% of the next month's sales in units. The inventory on May 31 contained 1,880 units. The company needs to prepare a production budget for the next five months.arrow_forwardShalom Company prepared the following sales budget for the first two quarters of 2023: January February March April 10,000 14,000 11,000 15,000 May 18,000 June 20,000 Unit sales Shalom Company sells the product at P15 per unit. 20% of sales is cash, and the balance is on credit. The company estimates that collection of sales on account will be 60% in the month of sales with the remainder in the following month. On December 31, 2022, accounts receivable was P60,000. Amounts must be in whole numbers. Example: 88,000 or (88,000) How much is the expected total cash receipts for January?arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education