FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

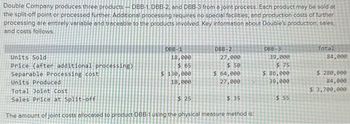

Transcribed Image Text:Double Company produces three products - DBB-1, DBB-2, and DBB-3 from a joint process. Each product may be sold at

the split-off point or processed further. Additional processing requires no special facilities, and production costs of further

processing are entirely variable and traceable to the products involved. Key information about Double's production, sales,

and costs follows.

Units Sold

Price (after additional processing)

Separable Processing cost

Units Produced

Total Joint Cost

Sales Price at Split-off

DBB-1

18,000

$ 65

$ 130,000

18,000

$25

DBB-2

27,000

$50

$ 64,000

27,000

$ 35

The amount of joint costs allocated to product DBB-1 using the physical measure method is:

DBB-3

39,000

$75

$ 86,000

39,000

$ 55

Total

84,000

$ 280,000.

84,000

$ 3,700,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- 1. Find minimum transfer price is transfer division has; a) excess capacity b) operates at full capacity 2. Find maximum transfer price system division would buy transistor from internal divisionarrow_forwardanswer in text form please (without image)arrow_forwardMarin Products produces three products — DBB-1, DBB-2, and DBB-3 from a joint process. Each product may be sold at the split-off point or processed further. Additional processing requires no special facilities, and production costs of further processing are entirely variable and traceable to the products involved. Key information about Marin's production, sales, and costs follows. DBB-1 DBB-2 DBB-3 Total Units Sold 16,000 25,000 36,000 77,000 Price (after addt’l processing) $ 30 $ 15 $ 40 Separable Processing cost $ 179,000 $ 72,000 $ 107,000 $ 358,000 Units Produced 16,000 25,000 36,000 77,000 Total Joint Cost $ 3,600,000 Sales Price at Split-off $ 20 $ 30 $ 50 The amount of joint costs allocated to product DBB-2 using the sales value at split-off method is (calculate all ratios and percentages to 2 decimal places, for example 33.33%, and round all dollar amounts to the…arrow_forward

- TB MC Qu. 7-66 (Algo) Joint costs allocated to product DBB-1 using the physical measure method: Double Company Double Company produces three products - DBB-1, DBB-2, and DBB-3 from a joint process. Each product may be sold at the split- off point or processed further. Additional processing requires no special facilities, and production costs of further processing are entirely variable and traceable to the products involved. Key information about Double's production, sales, and costs follows. Units Sold Price (after additional processing) Separable Processing cost Units Produced Total Joint Cost Sales Price at Split-off Multiple Choice $783,333. $812,973. $1,727,568. The amount of joint costs allocated to product DBB-1 using the physical measure method is: $1,253,333. DBB-1 19, 200 $ 65 $ 142,000 19, 200 $1,219,459. $ 25 DBB-2 28,800 $ 50 $ 76,000 28,800 $ 35 DBB-3 40,800 $75 $ 98,000 40,800 $ 55 Total 88,800 $ 316,000 88,800 $ 3,760,000arrow_forwardListmann Corporation processes four different products that can either be sold as is or processed further. Listed below are sales and additional cost data: Sales Value with no further Additional Processing Sales Value after further Product Processing Costs processing Premier $ 1,350 $ 900 $ 2,700 Deluxe 450 225 630 Super 900 450 Basic 90 45 1,800 180 Which product(s) should not be processed further?arrow_forwardMarin Products produces three products — DBB-1, DBB-2, and DBB-3 from a joint process. Each product may be sold at the split-off point or processed further. Additional processing requires no special facilities, and production costs of further processing are entirely variable and traceable to the products involved. Key information about Marin's production, sales, and costs follows. DBB-1 DBB-2 DBB-3 Total Units Sold 11,000 17,000 24,000 52,000 Price (after addt’l processing) $ 10 $ 25 $ 30 Separable Processing cost $ 282,000 $ 114,000 $ 169,000 $ 565,000 Units Produced 17,600 31,000 39,400 88,000 Total Joint Cost $ 4,800,000 Sales Price at Split-off $ 20 $ 30 $ 50 The amount of joint costs allocated to product DBB-3 using the physical measure method is (calculate all ratios and percentages to 2 decimal places, for example 33.33%, and round all dollar amounts to the nearest…arrow_forward

- The following information relates to a joint production process for three products, with a total joint production cost of $165,000. There are no separable processing costs for any of the three products. Product 1 2 Sales Value at Split-Off $ 181,500 Product 1 2 3 99,000 49,500 $ 330,000 Assume that the total sales value at the split-off point for product 1 is $66,000 instead of $181,500 and the sales value of product 3 is $3,300 instead of $49,500. Assume also that the firm treats product 3 as a joint product and uses the net realizable value method for accounting for joint costs. There are no separable processing costs for product 3. What amount of joint costs would be allocated to the three products using the relative sales value method? (Round your intermediate percentage values to 2 decimal places (i.e. 24.35%) and final answers to nearest whole dollar amount.) Units at Split-Off 320 960 1,920 3,200 Allocated Joint Costarrow_forwardSunland Inc. produces three separate products from a common process costing $100,100. Each of the products can be sold at the split- off point or can be processed further and then sold for a higher price. Shown below are cost and selling price data for a recent period. Product 10 Product 12 Product 14 (c) Product Your answer is partially correct. Product 10 Product 12 Product 14 $ Sales Value at Split-Off Point $59,700 $ 15,800 $ 55,400 Calculate incremental profit/(loss) and determine which products should be sold at the split-off point and which should be processed further. (Enter negative amounts using either a negative sign preceding the number e.g. -45 or parentheses e.g. (45).) Incremental profit (loss) Cost to Process Further eTextbook and Media $100,100 30,800 149,700 Sales Value after Further Processing $191,000 34,700 Decision 214,000 Should be processed further Should be sold at the split-off point Should be processed further Assistance Usedarrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education