FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

Transcribed Image Text:Complete this question by entering your answers in the tabs below.

Required 1 Required 2

Based on your analysis in requirement 1, which product or products should be sold at the split-off point and which should be

processed further?

Sell at split-off point?

Process further?

Product A

Product B

< Required 1

Product C

Required 2

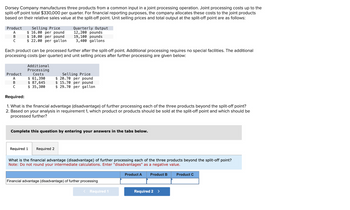

Transcribed Image Text:Dorsey Company manufactures three products from a common input in a joint processing operation. Joint processing costs up to the

split-off point total $330,000 per quarter. For financial reporting purposes, the company allocates these costs to the joint products

based on their relative sales value at the split-off point. Unit selling prices and total output at the split-off point are as follows:

Product

A

B

с

Selling Price

$16.00 per pound

$ 10.00 per pound

$22.00 per gallon

Product

A

B

C

Each product can be processed further after the split-off point. Additional processing requires no special facilities. The additional

processing costs (per quarter) and unit selling prices after further processing are given below:

Additional

Processing

Costs

$ 61,390

$ 87,645

$ 35,300

Quarterly Output

12,200 pounds

19,100 pounds

3,400 gallons

Required 1

Required:

1. What is the financial advantage (disadvantage) of further processing each of the three products beyond the split-off point?

2. Based on your analysis in requirement 1, which product or products should be sold at the split-off point and which should be

processed further?

Selling Price

$20.70 per pound

$15.70 per pound

$29.70 per gallon

Complete this question by entering your answers in the tabs below.

Required 2

What is the financial advantage (disadvantage) of further processing each of the three products beyond the split-off point?

Note: Do not round your intermediate calculations. Enter "disadvantages" as a negative value.

Financial advantage (disadvantage) of further processing

< Required 1

Product A Product B

Required 2 >

Product C

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- i need the answer quicklyarrow_forwardDock Corporation makes two products from a common input. Joint processing costs up to the split-off point total $33,600 a year. The company allocates these costs to the joint products on the basis of their total sales values at the split-off point. Each product may be Isold at the split-off point or processed further. Data concerning these products appear below: Allocated joint processing costs Sales value at split-off point Product X Product Y Total $ 16,800 $16,800 $33,600 $24,000 $24,000 $ 48,000 $33,700 Costs of further processing $ 15,000 $18,700 Sales value after further processing $35,500 $ 45,100 $80,600 What is the financial advantage (disadvantage) for the company of processing Product X beyond the split-off point? O $20,500 ($3,500) $3,700 $27,700arrow_forwardUrmilabenarrow_forward

- Harris Company manufactures and sells a single product. A partially completed schedule of the company's total costs and costs per unit over the relevant range of 55,000 to 95,000 units is given below: Required: 1. Complete the schedule of the company's total costs and costs per unit as given in the relevant tab below. 2. Assume that the company produces and sells 85,000 units during the year at a selling price of $7.40 per unit. Prepare a contribution format income statement for the year. Complete this question by entering your answers in the tabs below. Required 1 Required 2 Complete the schedule of the company's total costs and costs per unit as given in the relevant tab below. (Round the per variable cost and fixed cost to 2 decimal places.) Total cost: Variable cost Fixed cost Total cost Cost per unit: Variable cost Fixed cost Total cost per unit 55,000 Units Produced and Sold $ $ 132,000 300,000 432,000 75,000 Units Produced and Sold 95,000 Units Produced and Soldarrow_forwardDengerarrow_forwardDorsey Company manufactures three products from a common input in a joint processing operation. Joint processing costs up to the split-off point total $360,000 per quarter. For financial reporting purposes, the company allocates these costs to the joint products on the basis of their relative sales value at the split-off point. Unit selling prices and total output at the split-off point are as follows. Product Selling Price Quarterly Output A $ 22.00 per pound 13,400 pounds B $ 16.00 per pound 20,900 pounds C $ 28.00 per gallon 4,600 gallons Each product can be processed further after the split-off point. Additional processing requires no special facilities. The additional processing costs (per quarter) and unit selling prices after further processing are given below. Product Additional Processing Costs $ 75,970 Selling Price $ 27.30 per pound $ 22.30 per pound A B $ 109,395 C $ 48,260 $ 36.30 per gallon Required: 1. What is the financial advantage (disadvantage) of further processing…arrow_forward

- Dorsey Company manufactures three products from a common input in a joint processing operation. Joint processing costs up to the split-off point total $305,000 per quarter. For financial reporting purposes, the company allocates these costs to the joint products on the basis of their relative sales value at the split-off point. Unit selling prices and total output at the split-off point are as follows: Product A B C Product A Selling Price $11.00 per pound $5.00 per pound $ 17.00 per gallon Each product can be processed further after the split-off point. Additional processing requires no special facilities. The additional processing costs (per quarter) and unit selling prices after further processing are given below: B C Additional Processing Costs $ 50,340 $71,170 $ 25,600 Quarterly Output 11,200 pounds 17,600 pounds 2,400 gallons Required: 1. What is the financial advantage (disadvantage) of further processing each of the three products beyond the split-off point? 2. Based on your…arrow_forwardOwearrow_forwardplease help me with this questionarrow_forward

- Harmon Inc. produces joint products L, M, and N from a joint process. Information concerning a batch produced in May at a joint cost of $85,000 was as follows: The amount of joint costs allocated to product L using the physical measure method is (calculate all ratios and percentages to 4 decimal places, for example 33.3333%, and round all dollar amounts to the nearest whole dollar): J Harmon Inc. produces joint products L, M, and N from a joint process. Information concerning a batch produced in May at a joint cost of $85,000 was as follows: C Separable Processing cost Units Produced Sales Value (after addt'l processing) L M N Total $11,000 $27,000 $5,000 $ 43,000 1,600 3,500 4,700 9,800 $64,000 $55,000 $13,000 $132,000 The amount of joint costs allocated to product L using the physical measure method is (calculate all ratios and percentages to 4 decimal places, for example 33.3333%, and round all dollar amounts to the nearest whole dollar):arrow_forwardnot graded Joint CostCheyenne, Inc. produces three products from a common input. The joint costs for a typical quarter follow: Direct materials $49,000 Direct labor 59,000 Overhead 64,000 The revenues from each product are as follows: Product A $77,000 Product B 82,000 Product C 32,000 Management is considering processing Product A beyond the split-off point, which would increase the sales value of Product A to $116,000. However, to process Product A further means that the company must rent some special equipment costing $17,500 per quarter. Additional materials and labor also needed would cost $12,650 per quarter. a. What is the gross profit currently being earned by the three products for one quarter? $Answer b. What is the effect on quarterly profits if the company decides to process Product A further? $Answerarrow_forwardDorsey Company manufactures three products from a common input in a joint processing operation. Joint processing costs up to the split-off point total $385,000 per quarter. For financial reporting purposes, the company allocates these costs to the joint products on the basis of their relative sales value at the split-off point. Unit selling prices and total output at the split-off point are as follows: Product A B с Product A B с Selling Price $27.00 per pound $21.00 per pound $ 33.00 per gallon Each product can be processed further after the split-off point. Additional processing requires no special facilities. The additional processing costs (per quarter) and unit selling prices after further processing are given below: Additional Processing Costs $ 89,220 $ 129,170 $ 60,160 Quarterly Output 14,400 pounds 22,400 pounds 5,600 gallons Required 1 Required: 1. What is the financial advantage (disadvantage) of further processing each of the three products beyond the split-off point? 2.…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education