FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

Transcribed Image Text:Check n

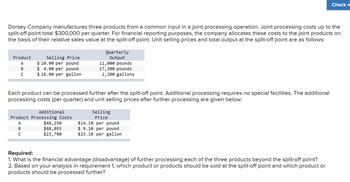

Dorsey Company manufactures three products from a common input in a joint processing operation. Joint processing costs up to the

split-off point total $300,000 per quarter. For financial reporting purposes, the company allocates these costs to the joint products on

the basis of their relative sales value at the split-off point. Unit selling prices and total output at the split-off point are as follows:

Quarterly

Output

Product

Selling Price

A

$ 10.00 per pound

11,000 pounds

B

$ 4.00 per pound

с

$16.00 per gallon.

17,300 pounds

2,200 gallons

Each product can be processed further after the split-off point. Additional processing requires no special facilities. The additional

processing costs (per quarter) and unit selling prices after further processing are given below:

Additional

Product Processing Costs

ABC

$48,250

$68,055

$23,780

Selling

Price

$14.10 per pound

$ 9.10 per pound

$23.10 per gallon

Required:

1. What is the financial advantage (disadvantage) of further processing each of the three products beyond the split-off point?

2. Based on your analysis in requirement 1, which product or products should be sold at the split-off point and which product or

products should be processed further?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Dorsey Company manufactures three products from a common input in a joint processing operation. Joint processing costs up to the split-off point total $330,000 per quarter. For financial reporting purposes, the company allocates these costs to the joint products on the basis of their relative sales value at the split-off point. Unit selling prices and total output at the split-off point are as follows: Product A B C Product A B Selling Price $ 16.00 per pound $ 10.00 per pound $ 22.00 per gallon Each product can be processed further after the split-off point. Additional processing requires no special facilities. The additional processing costs (per quarter) and unit selling prices after further processing are given below: Additional Processing Costs $ 61,390 $ 87,645 $ 35,300 Quarterly Output 12,200 pounds 19, 100 pounds 3,400 gallons Required 1 Required: 1. What is the financial advantage (disadvantage) of further processing each of the three products beyond the split-off point? 2.…arrow_forwardnot graded Joint CostCheyenne, Inc. produces three products from a common input. The joint costs for a typical quarter follow: Direct materials $49,000 Direct labor 59,000 Overhead 64,000 The revenues from each product are as follows: Product A $77,000 Product B 82,000 Product C 32,000 Management is considering processing Product A beyond the split-off point, which would increase the sales value of Product A to $116,000. However, to process Product A further means that the company must rent some special equipment costing $17,500 per quarter. Additional materials and labor also needed would cost $12,650 per quarter. a. What is the gross profit currently being earned by the three products for one quarter? $Answer b. What is the effect on quarterly profits if the company decides to process Product A further? $Answerarrow_forwardDorsey Company manufactures three products from a common input in a joint processing operation. Joint processing costs up to the split-off point total $385,000 per quarter. For financial reporting purposes, the company allocates these costs to the joint products on the basis of their relative sales value at the split-off point. Unit selling prices and total output at the split-off point are as follows: Product A B с Product A B с Selling Price $27.00 per pound $21.00 per pound $ 33.00 per gallon Each product can be processed further after the split-off point. Additional processing requires no special facilities. The additional processing costs (per quarter) and unit selling prices after further processing are given below: Additional Processing Costs $ 89,220 $ 129,170 $ 60,160 Quarterly Output 14,400 pounds 22,400 pounds 5,600 gallons Required 1 Required: 1. What is the financial advantage (disadvantage) of further processing each of the three products beyond the split-off point? 2.…arrow_forward

- Royal Lawncare Company produces and sells two packaged products-Weedban and Greengrow. Revenue and cost information relating to the products follow: Selling price per unit Variable expenses per unit Traceable fixed expenses per year Weedban $ 12,00 $ 2.80 $ 129,000 Product Sales Variable expenses Contribution margin Traceable fixed expenses Product line segment margin Common fixed expenses not traceable to products Net operating income Greengrow $.33.00 $12.00 $ 41,000 Last year the company produced and sold 41,000 units of Weedban and 22.500 units of Greengrow. Its annual common fixed expenses are $100,000. Required: Prepare a contribution format income statement segmented by product lines. Product Line Total Weedban Greengrow Company $ 5,289,500 $4,502,000 $ 607,500 3,270,000 143,500 270,000 2,019,500 4,448,500 427,500 2,019,500 $4,448,500 $ 427,500 $ 2,019,500arrow_forwardDomesticarrow_forwardDorsey Company manufactures three products from a common input in a joint processing operation. Joint processing costs up to the split-off point total $395,000 per quarter. For financial reporting purposes, the company allocates these costs to the joint products based on their relative sales value at the split-off point. Unit selling prices and total output at the split-off point are as follows: Product A Selling Price $29.00 per pound $23.00 per pound Quarterly Output 14,800 pounds B 23,000 pounds C $ 35.00 per gallon 6,000 gallons Each product can be processed further after the split-off point. Additional processing requires no special facilities. The additional processing costs (per quarter) and unit selling prices after further processing are given below: Product A Additional Processing Costs $ 94,800 Selling Price $ 35.00 per pound $ 30.00 per pound B $ 137,500 C $ 65,200 $ 44.00 per gallon Required: 1. What is the financial advantage (disadvantage) of further processing each of…arrow_forward

- Dorsey Company manufactures three products from a common input in a joint processing operation. Joint processing costs up to the split-off point total $330,000 per quarter. For financial reporting purposes, the company allocates these costs to the joint products based on their relative sales value at the split-off point. Unit selling prices and total output at the split-off point are as follows: Product A B с Selling Price $16.00 per pound $ 10.00 per pound $22.00 per gallon Product A B C Each product can be processed further after the split-off point. Additional processing requires no special facilities. The additional processing costs (per quarter) and unit selling prices after further processing are given below: Additional Processing Costs $ 61,390 $ 87,645 $ 35,300 Quarterly Output 12,200 pounds 19,100 pounds 3,400 gallons Required 1 Required: 1. What is the financial advantage (disadvantage) of further processing each of the three products beyond the split-off point? 2. Based on…arrow_forwardHarris Company manufactures and sells a single product. A partially completed schedule of the company's total costs and costs per unit over the relevant range of 58,000 to 98,000 units is given below: Required: 1. Complete the schedule of the company's total costs and costs per unit as given in the relevant tab below. 2. Assume the company produces and sells 88,000 units during the year at a selling price of $9.74 per unit. Prepare a contribution format income statement for the year. Complete this question by entering your answers in the tabs below. Required 1 Required 2 Complete the schedule of the company's total costs and costs per unit as given in the relevant tab below. Note: Round the per unit variable cost and fixed cost to 2 decimal places. Units Produced and Sold 58,000 78,000 98,000 Total cost: Variable cost $ 179,800 Fixed cost 440,000 Total cost $ 619,800 Cost per unit: Variable cost Fixed cost Total cost nor unitarrow_forwardThe following information applies to the questions displayed below.]Dowell Company produces a single product. Its income statements under absorption costing for its first two years of operation follow. 2018 2019 Sales ($46 per unit) $ 920,000 $ 1,840,000 Cost of goods sold ($31 per unit) 620,000 1,240,000 Gross margin 300,000 600,000 Selling and administrative expenses 290,000 340,000 Net income $ 10,000 $ 260,000 Additional Information Sales and production data for these first two years follow. 2018 2019 Units produced 30,000 30,000 Units sold 20,000 40,000 Variable cost per unit and total fixed costs are unchanged during 2018 and 2019. The company's $31 per unit product cost consists of the following. Direct materials $ 5 Direct labor 9 Variable overhead 7 Fixed overhead ($300,000/30,000 units) 10 Total product cost per unit $ 31 Selling…arrow_forward

- Vinubhaiarrow_forwardA company has two divisions, C and E; both are operating as a profit center. C charges E $35 per unit for each unit transferred to B. Other data follow:C's variable cost per unit $35C's fixed costs $25,000C's annual sales to B 15,000 unitsC's annual sales to outsiders 70,000 unitsC is planning to raise its transfer price to $45 per unit. Division E can purchase units at $43 each from outsiders, but doing so would idle C's facilities now committed to producing units for E. Division C cannot increase its sales to outsiders. From the perspective of the company as a whole, from whom should Division E acquire the units, assuming E's market is unaffected? a. Division C, but only at the variable cost per unit b. Outside vendors c. Division C, in spite of the increased transfer price d. Division C, but only until fixed costs are covered, then should purchase from outside vendorsarrow_forwardDorsey Company manufactures three products from a common input in a joint processing operation. Joint processing costs up to the split-off point total $355,000 per quarter. For financial reporting purposes, the company allocates these costs to the joint products based on their relative sales value at the split-off point. Unit selling prices and total output at the split-off point are as follows: Product A a С Selling Price $ 21.00 per pound $15.00 per pound $27.00 per gallon Product A D C Each product can be processed further after the split-off point. Additional processing requires no special facilities. The additional processing costs (per quarter) and unit selling prices after further processing are given below. Additional Processing Costa $ 73,440 Quarterly Output 13,200 pounds 20,600 pounds 4,400 gallons $ 105,620 $ 46,000 Selling Price $26.20 per pound $ 21.20 per pound $35.20 per gallon Required: 1. What is the financial advantage (disadvantage) of further processing each of the…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education