FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

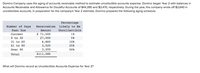

Transcribed Image Text:Domino Company uses the aging of accounts receivable method to estimate uncollectible accounts expense. Domino began Year 2 with balances in

Accounts Receivable and Allowance for Doubtful Accounts of $44,390 and $3,470, respectively. During the year, the company wrote off $2,640 in

uncollectible accounts. In preparation for the company's Year 2 estimate, Domino prepared the following aging schedule:

Percentage

Number of Days

Receivables Likely to Be

Past Due

Amount

Uncollectible

Current

$ 71,000

18

0 to 30

27,000

5%

31 to 60

6,860

10%

61 to 90

3,520

25%

Over 90

3,200

50%

Total

$111,580

What will Domino record as Uncollectible Accounts Expense for Year 2?

Expert Solution

arrow_forward

Step 1: Concept of uncollectible accounts

Uncollectible accounts are those which cannot be collected due to them being converted into bad debts

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Analysis of Receivables Method At the end of the current year, Accounts Receivable has a balance of $950,000, Allowance for Doubtful Accounts has a credit balance of $8,500, and sales for the year total $4,280,000. Using the aging method, the balance of Allowance for Doubtful Accounts is estimated as $29,800. a. Determine the amount of the adjusting entry for uncollectible accounts. b. Determine the adjusted balances of Accounts Receivable, Allowance for Doubtful Accounts, and Bad Debt Expense. Accounts Receivable Allowance for Doubtful Accounts Bad Debt Expense c. Determine the net realizable value of accounts receivable.arrow_forwardA year-end review of Accounts Receivable and estimated uncollectible percentages revealed the following: $1300. Days Outstanding 1-30 days 2% 31-60 days 5% 61-90 days 10% Over 90 days 52% Before the year-end adjustment, the credit balance in Allowance for Uncollectible Accounts was $1100. Under the aging-of- receivables method, the Uncollectible-Account Expense at year-end is: $9390. $10,490. Accounts Receivable $8290. Est. Percent Uncollectible $65,000 $45,000 $22,000 $7000arrow_forwardAllegheny Company ended Year 1 with balances in Accounts Receivable and Allowance for Doubtful Accounts of $86,000 and $4,800, respectively. During Year 2, Allegheny wrote off $9,000 of Uncollectible Accounts. Using the percent of receivables method, Allegheny estimates that the ending Allowance for Doubtful Accounts balance should be $7,200. What amount will Allegheny report as Uncollectible Accounts Expense on its Year 2 income statement? Multiple Choice $2,400 $9,000 $7,200 $11,400arrow_forward

- Seaforth International wrote off the following accounts receivable as uncollectible for the year ending December 31: Customer Amount Kim Abel $ 24,300 Lee Drake 31,195 Jenny Green 29,715 Mike Lamb 17,890 Total $103,100 The company prepared the following aging schedule for its accounts receivable on December 31: Aging Class (Number of Days Past Due) Receivables Balance on December 31 Estimated Percent of Uncollectible Accounts 0–30 days $ 735,000 1% 31–60 days 290,000 2 61–90 days 111,000 15 91–120 days 70,000 30 More than 120 days 94,000 60 Total receivables $1,300,000 A. Journalize the write-offs under the direct write-off method. If no entry is required, simply skip to the next transaction. Refer to the Chart of Accounts for exact wording of account titles. B. Journalize the write-offs and the year-end adjusting entry under the allowance method, assuming that the…arrow_forwardWohoo Publishers uses the allowance method to estimate uncollectible accounts receivables. The company produced the following aging of the accounts receivable at year-end (Y in thousands). Accounts receivable % uncollectible Estimated bad debts Total 200,000 0-30 days 77,000 2% 31-60 days 46,000 5% 61-90 days 91-120 days 39,000 6% 23,000 10% Over 120 days 15,000 25%arrow_forwardAt the end of the current year, the accounts receivable account has a debit balance of $1,117,000 and sales for the year total $12,670,000. a. The allowance account before adjustment has a credit balance of $15,100. Bad debt expense is estimated at 1/2 of 1% of sales. b. The allowance account before adjustment has a credit balance of $15,100. An aging of the accounts in the customer ledger indicates estimated doubtful accounts of $48,300. c. The allowance account before adjustment has a debit balance of $6,400. Bad debt expense is estimated at 1/4 of 1% of sales. d. The allowance account before adjustment has a debit balance of $6,400. An aging of the accounts in the customer ledger indicates estimated doubtful accounts of $53,100. Determine the amount of the adjusting entry to provide for doubtful accounts under each of the assumptions (a through d) listed above. a. b. $ C. $ d. $arrow_forward

- Before the year-end adjustment the Allowance for Doubtful Accounts has a debit balance of $5,000. Using the aging of receivables method, the desired balance of the Allowance for Doubtful Accounts is estimated as $35,000. a) What is the uncollectible accounts expense for the period? b) What is the journal entry required? c) What is the balance of the Allowance for Doubtful Accounts after adjustment? d) If the accounts receivable balance is $325,000, what is the net realizable value of the receivables after adjustment?arrow_forwardGregg company uses the allowance method for recording its expected credit losses. It estimates credit losses at 3% of credit sales, which were $900,000 during the year. On December 31 the accounts receivable balance was 150,000, and the allowance for doubtful accounts had a credit balance of 12,200 before adjustment. A. Prepare the adjusting entry to record the credit losses for the year. B. Show how accounts receivable and the allowance for doubtful accounts would appear in the December 31 balance sheet. The top 2 shaded blanks have the options of Bad debts expense, allowance for doubtful accounts. The bottom 2 shaded blanks have the options of accounts receivable, less: allowance for doubtful accounts.arrow_forwardProviding for Doubtful Accounts At the end of the current year, the accounts receivable account has a debit balance of $1,132,000 and sales for the year total $12,840,000. The allowance account before adjustment has a credit balance of $15,300. Bad debt expense is estimated at 1/4 of 1% of sales. The allowance account before adjustment has a credit balance of $15,300. An aging of the accounts in the customer ledger indicates estimated doubtful accounts of $49,000. The allowance account before adjustment has a debit balance of $9,200. Bad debt expense is estimated at 3/4 of 1% of sales. The allowance account before adjustment has a debit balance of $9,200. An aging of the accounts in the customer ledger indicates estimated doubtful accounts of $76,400. Determine the amount of the adjusting entry to provide for doubtful accounts under each of the assumptions (a through d) listed above.arrow_forward

- Providing for Doubtful Accounts At the end of the current year, the accounts receivable account has a debit balance of $777,000 and sales for the year total $8,810,000. a. The allowance account before adjustment has a credit balance of $10,500. Bad debt expense is estimated at 3/4 of 1% of sales. b. The allowance account before adjustment has a credit balance of $10,500. An aging of the accounts in the customer ledger indicates estimated doubtful accounts of $33,600. c. The allowance account before adjustment has a debit balance of $5,700. Bad debt expense is estimated at 1/4 of 1% of sales. d. The allowance account before adjustment has a debit balance of $5,700. An aging of the accounts in the customer ledger indicates estimated doubtful accounts of $47,300. Determine the amount of the adjusting entry to provide for doubtful accounts under each of the assumptions (a through d) listed above. a. $ b. $ d. $ %24arrow_forwardPharoah Ltd. prepared an aging of its accounts receivable at December 31, 2023 and determined that the net realizable value of the receivables was $324800. Additional information for calendar 2023 follows: Allowance for expected credit losses, beginning $38080 Uncollectible account written off during year 25760 Accounts receivable, ending 358400 Uncollectible accounts recovered during year 5600 For the year ended December 31, 2023, Pharoah's loss on impairment should be $20000. $15680. ○ $17920. $25760.arrow_forwardAllegheny Company ended Year 1 with balances in Accounts Receivable and Allowance for Doubtful Accounts of $70,000 and $3,600, respectively. During Year 2, Allegheny wrote off $6,600 of Uncollectible Accounts. Using the percent of receivables method, Allegheny estimates that the ending Allowance for Doubtful Accounts balance should be $5,600. What amount will Allegheny report as Uncollectible Accounts Expense on its Year 2 income statement? Multiple Choice $8,600 $5,600 $2,000 $6,600arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education