Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

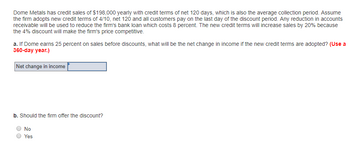

Transcribed Image Text:Dome Metals has credit sales of $198,000 yearly with credit terms of net 120 days, which is also the average collection period. Assume

the firm adopts new credit terms of 4/10, net 120 and all customers pay on the last day of the discount period. Any reduction in accounts

receivable will be used to reduce the firm's bank loan which costs 8 percent. The new credit terms will increase sales by 20% because

the 4% discount will make the firm's price competitive.

a. If Dome earns 25 percent on sales before discounts, what will be the net change in income if the new credit terms are adopted? (Use a

360-day year.)

Net change in income

b. Should the firm offer the discount?

No

Yes

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- CJ Stores has current cash-only sales of 218 units per month at a price of $236.55 a unit. If it switches to a net 30 credit policy, the credit sales price will be $249 while the cash price will remain at $236.55. The switch is not expected to affect the sales quantity but a 3 percent default rate is expected. The monthly interest rate is 1.4 percent. What is the net present value of the proposed credit policy switch? a. 24,727 b. 27,965 c. 26,893 d. 29,481 e. 25,978arrow_forwardABC Company is considering to establish a line of credit with a local bank to make up for the cash deficit for the next three months. The company expects a 60% chance for a $280,100 deficit and a 40% chance for no deficit at all. The line of credit charges 0.60% of interest rate per month on the amount borrowed plus a commitment fee of $2,500 for a quarter. It also requires a 5% compensation balance for outstanding loans. The company can reinvest any excess cash at an annual rate of 8%. What will the expected cost of establishing a line of credit be? Round your answer to the nearest dollar. (Hint: Refer to a numerical example in short-term financing choices.) Group of answer choices $5,671 $5,678 $5,699 $5,684 $5,692arrow_forwardWontaby Ltd. is extending its credit terms from 30 to 45 days. Sales are expected to increase from $4.78 million to $5.88 million as a result. Wontaby finances short-term assets at the bank at a cost of 10 percent annually. Calculate the additional annual financing cost of this change in credit terms. (Use 365 days in a year. Do not round intermediate calculations. Round the final answer to the nearest whole dollar. Enter answer in whole dollar not in million.) Annual financing cost $ 110000arrow_forward

- Peanut Inc. is evaluating whether to change its credit terms from 2/10 net 30 to 3/10 net 30. At present, 50% of Peanut's sales are paid at day 10. Regardless of the credit terms, half of the customers who do not take the discount are expected to pay on day 30 whereas the remainder will pay 15 days late (no bad debts exist). But as a result of the higher cash discount offered with the new terms, sales are expected to increase from 757,000 to 801,000 per year. Peanut's variable cost ratio is 75% and its cost of funds is 8.7%. All production costs are paid on the day of the sale. Should the change be made?arrow_forwardmine plc has annual credut of k15m and allows 90 days credit. it is consideringba 2% discount payment with 15 days and reducing the credit period to 60 days. it estimates that 60% of its customers will take advantage of the discount, while the volume of sales will not be affected. tge company finances working capital from an overdraft at a cost of 10%. is the proposed change in policy worth implementing.arrow_forwardMLX has annual sales of $320 million per year and has calculated the collection float to be 12 days. If MLX is currently paying 9.35% on its line of credit, what amount of interest expense could be saved if the collection float is reduced by 3 days? (Assume 365 days per year.)arrow_forward

- The sales director of ABC Corp suggest the following credit terms. He estimated the following:Sales will increase by at least 20%AR turnover will be reduced to 8 times from present turnover of 10 times.Bad debts will increase to 1.5%. Current bad debts are 1%.Current sales is P 900,000Variable cost ratio is 55%.Desired rate of return is 20%Fixed expenses is P 150,000What is the net advantage of changing the credit terms?arrow_forwardEverbusiness Corporation has been reviewing its credit policies. The credit standard it has been applying have resulted in an annual credit sales of $5,000,000.00. Its average collection period is 30 days with a bad debts/loss ratio of 1%. Everbusiness Corporation is considering a reduction in its credit standards. As a result, it expects incremental credit sales of $400,000.00 of which the average collection period would be 60 days, in which the bad BCR to sales for Everbusiness Corporation is 70%. The required investment on receivables is 15%. Evaluate the relaxation in credit standards that Everbusiness Corporation is considering. Use 0.04% per year/365 days. Provide detailed explanation and solutions.arrow_forwardWarren Motor Company sells $30 million of its products to wholesalers on terms of "net 30." Currently, the firm's average collection period is 48 days. In an effort to speed up the collection of receivables, Warren is considering offering a cash discount of 2 percent if customers pay their bills within 10 days. The firm expects 50 percent of it's customers to take the discount and it's average collection period to decline to 30 days. The firm's required pretax return (i.e. opportunity cost) on receivables investment is 16 percent. Determine the cost of the cash discounts to Warren. a. $300,000 b. $ 60,000 c. $ 40,000 d. $48,000arrow_forward

- Neveready Flashlights Inc. needs $340,000 to take a cash discount of 3/17, net 72. A banker will lend the money for 55 days at an interest cost of $10,400. What is the effective rate on the bank loan? tion in mind. 20.04% 3.06% 4.25% 10% How much would it cost (in percentage terms) if the firm did not take the cash discount, but paid the bill in 72 days instead of 17 days? 3.0% 97% 6.55% 15% Should the firm borrow the money to take the discount? No Yes I don't know Sometimes If the banker requires a 20 percent compensating balance, how much must the firm borrow to end up with the $340,000? $10,000 $1,000 $100,000 ○ $425,000 What would be the effective interest rate in part d if the interest charge for 55 days were $13,000? Should the firm borrow with the 20 percent compensating balance? (The firm has no funds to count against the compensating balance requirement.) 3.0% 6.55% 6.0% 5.0%arrow_forwardYen Corporation will be relaxing its credit policy. Under the old policy of 2/10, n/25, sales total P5,000,000. Around 40% take the discount while the remainder pay on the 25th day. The proposed policy is 3/10, n/40. The increase in the cash discount and the payment term will like result to a P6,000,000 sales. This is expected to result to average days in receivables of 26.5 days (45% will be settled on the 10h day and the remainder on the 40h day). Variable cost rate will remain at 75%. The weighted average cost of capital is 15%. Using a 360-day year, how much is the annual net benefit/cost of this change? iness 28°Carrow_forward(Cost of factoring) MDM Inc. is considering factoring its receivables. The firm has credit sales of $300,000 per month and has an average receivables balance of $600,000 with 60-day credit terms. The factor has offered to extend credit equal to 89 percent of the receivables factored less interest on the loan at a rate of 1.3 percent per month. The 11 percent difference in the advance and the face value of all receivables factored consists of a 2 percent factoring fee plus a 9 percent reserve, which the factor maintains. In addition, if MDM Inc. decides to factor its receivables, it will sell them all, so that it can reduce its credit department costs by $1,200 a month. a. What is the cost of borrowing the maximum amount of credit available to MDM Inc. through the factoring agreement? Note: Assume a 30-day month and 360-day year. b. What considerations other than cost should MDM Inc. account for in determining whether to enter the factoring agreement? The cost of borrowing the maximum…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education