FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

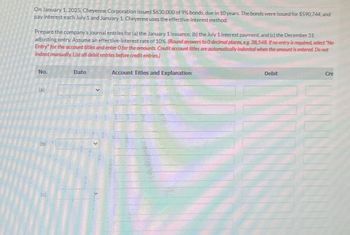

Transcribed Image Text:On January 1, 2025, Cheyenne Corporation issued $630,000 of 9% bonds, due in 10 years. The bonds were issued for $590,744, and

pay interest each July 1 and January 1 Cheyenne uses the effective-interest method.

Prepare the company's journal entries for (a) the January 1 issuance, (b) the July 1 interest payment, and (c) the December 31

adjusting entry. Assume an effective-interest rate of 10%. (Round answers to O decimal places, eg. 38,548. If no entry is required, select "No

Entry" for the account titles and enter O for the amounts. Credit account titles are automatically indented when the amount is entered. Do not

indent manually. List all debit entries before credit entries)

No.

(a)

(b)

(c)

Date

Account Titles and Explanation

Debit

Cre

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Hillside issues $4,000,000 of 6%, 15-year bonds dated January 1, 2019, that pay interest semiannually on June 30 and December 31. The bonds are issued at a price of $3,456,448. Required 1. Prepare the January 1 journal entry to record the bonds’ issuance. 2. For each semiannual period, compute (a) the cash payment, (b) the straight-line discount amortization, and (c) the bond interest expense. 3. Determine the total bond interest expense to be recognized over the bonds’ life. 4. Prepare the first two years of a straight-line amortization table like Exhibit 14.7. 5. Prepare the journal entries to record the first two interest payments.arrow_forwardLaudie Company issued $400,000 of 5%, 10-year bonds on January 1, 2020, at 94. Interest is payable annually on January 1, 2021. Instructions: Prepare the journal entries to record the following events. a. The issuance of the bonds. b. The accrual of interest and amortization of the discount on December 31, 2020. c. The payment of interest on January 1, 2021. d. Calculate the carrying value of the bond on 12/31/20. #2 Gridley Company issued $800,000, 11%, 10-year bonds on December 31, 2019, at 104. Interest is payable annually on December 31. Gridley Company uses the straight-line method to amortize bond premium or discount. Instructions: Prepare the journal entries to record the following. a. The issuance of the bonds. b. The payment of interest December 31, 2020. (Extra credit for amortization of the premium entry) c. The redemption of the bond at maturityarrow_forwardOn January 1, 2025, Shamrock Corporation issued $680,000 of 9% bonds, due in 8 years. The bonds were issued for $643,152, and pay interest each July 1 and January 1. Shamrock uses the effective-interest method. Prepare the company's journal entries for (a) the January 1 issuance, (b) the July 1 interest payment, and (c) the December 31 adjusting entry. Assume an effective-interest rate of 10%. (Round answers to O decimal places, e.g. 38,548. If no entry is required, select "No Entry" for the account titles and enter O for the amounts. Credit account titles are automatically indented when the amount is entered. Do not indent manually. List all debit entries before credit entries.) No. (a) (b) (c) Date Jan. 1, 2025 July 1, 2025 Dec. 31, 2025 Account Titles and Explanation Debit Crearrow_forward

- Hillside issues $1,900,000 of 5%, 15-year bonds dated January 1, 2019, that pay interest semiannually on June 30 and December 31. The bonds are issued at a price of $1,641,812. Required: 1. Prepare the January 1 journal entry to record the bonds’ issuance. 2(a) For each semiannual period, complete the table below to calculate the cash payment. 2(b) For each semiannual period, complete the table below to calculate the straight-line discount amortization. 2(c) For each semiannual period, complete the table below to calculate the bond interest expense. 3. Complete the below table to calculate the total bond interest expense to be recognized over the bonds' life. 4. Prepare the first two years of a straight-line amortization table. 5. Prepare the journal entries to record the first two interest payments.arrow_forwardDuring Year 1 and Year 2, Kale Co. completed the following transactions relating to its bond issue. The company’s fiscal year ends on December 31. Year 1 Mar. 1 Issued $200,000 of 8 year, 6 percent bonds for $194,000. The semiannual cash payment for interest is due on March 1 and September 1, beginning September Year 1. Sept. 1 Recognized interest expense including the amortization of the discount and made the semiannual cash payment for interest. Dec. 31 Recognized accrued interest expense including the amortization of the discount. Year 2 Mar. 1 Recognized interest expense including the amortization of the discount and made the semiannual cash payment for interest. Sept. 1 Recognized interest expense including the amortization of the discount and made the semiannual cash payment for interest. Dec. 31 Recognized accrued interest expense including the amortization of the discount. Prepare the liabilities section of the balance sheet at December…arrow_forwardOn January 1, 2020, Swifty Corporation issued $450,000 of 7% bonds, due in 8 years. The bonds were issued for $423,784, and pay interest each July 1 and January 1. Swifty uses the effective-interest method.Prepare the company’s journal entries for (a) the January 1 issuance, (b) the July 1 interest payment, and (c) the December 31 adjusting entry. Assume an effective-interest rate of 8%.arrow_forward

- On January 1, 2018, Technicians Credit Union, (TCU), issued 8%, 20-year bonds payable with a face value of $900,000. These bonds pay interest on June 30 and December 31. The issue price of the bonds is 108. How do I Journalize the payment of interest and amortization on December 31, 2018?arrow_forwardOn January 1, 2020, Cullumber Company issued $400,000, 10%, 10-year bonds at face value. Interest is payable annually on January 1.(a) Prepare the journal entry to record the issuance of the bonds. Date Account Titles and Explanation Debit Credit Jan. 1 (b) Prepare the journal entry to record the accrual of interest on December 31, 2020. Date Account Titles and Explanation Debit Credit Dec. 31 (c) Prepare the journal entry to record the payment of interest on January 1, 2021. Date Account Titles and Explanation Debit Credit Jan. 1arrow_forwardFlamingo Inc. issued $2,000,000, 5%, 5-year bonds on January 1, 2019, at 104. Interest is payable annually on December 31. Flamingo uses straight-line amortization for bond premium or discount. Prepare the journal entries to record the following events.arrow_forward

- On January 1, 2020, Grouper Corporation issued $480,000 of 7% bonds, due in 10 years. The bonds were issued for $515,707, and pay interest each July 1 and January 1. The effective-interest rate is 6%.Prepare the company’s journal entries for (a) the January 1 issuance, (b) the July 1 interest payment, and (c) the December 31 adjusting entry. Grouper uses the effective-interest methodarrow_forwardOn the first day of the current fiscal year, $1,500,000 of 10-year, 8% bonds, with interest payable semiannually, were sold for $1,225,000. Present entries to record the following transactions for the current fiscal year (for the issuer’s books): (a) Issuance of the bonds. (b) First semiannual interest payment. (c) Amortization of bond discount for the year, using the straight-line method of amortization. (for each Journal Entry, omit the step of providing a brief explanation) JOURNAL Date Post. DR CR (a) (b) (c)arrow_forwardOn August 1, 2022, Bramble Corp. issued $482,400, 8%, 10-year bonds at face value. Interest is payable annually on August 1. Bramble’s year-end is December 31. Prepare the journal entry to record the issuance of the bonds. (Credit account titles are automatically indented when amount is entered. Do not indent manually.) Date Account Titles and Explanation Debit Credit Aug. 1 enter an account title to record the issuance of the bonds on August 1 enter a debit amount enter a credit amount enter an account title to record the issuance of the bonds on August 1 enter a debit amount enter a credit amount eTextbook and Media List of Accounts Prepare the journal entry to record the accrual of interest on December 31, 2022. (Credit account titles are automatically indented when amount is entered. Do not indent manually.) Date Account Titles and Explanation Debit Credit Dec. 31 enter an…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education