FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

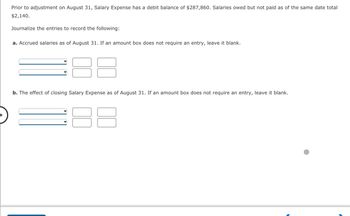

Transcribed Image Text:**Prior to adjustment on August 31, Salary Expense has a debit balance of $287,860. Salaries owed but not paid as of the same date total $2,140.**

Journalize the entries to record the following:

**a. Accrued salaries as of August 31. If an amount box does not require an entry, leave it blank.**

- The entry tables below are provided with dropdown menus for selecting accounts (e.g., "Salaries Payable") and columns for entering debits and credits.

**b. The effect of closing Salary Expense as of August 31. If an amount box does not require an entry, leave it blank.**

- The entry tables below include dropdown menus and columns similar to those in part (a), designed for documenting the closing of the Salary Expense account as of the specified date.

(Note: The image provides fields for inputting specific journal entries, with no pre-filled data or specific account labels in place.)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- On July 1, 2025, Novak Co. pays $10,200 to Splish Insurance Co. for a 2-year insurance policy. Both companies have fiscal years ending December 31. Journalize the entry on July 1 and the adjusting entry on December 31 for Splish Insurance Co. Splish uses the accounts Unearned Service Revenue and Service Revenue. (Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No entry" for the account titles and enter O for the amounts. Record journal entries in the order presented in the problem. List all debit entries before credit entries.) Date July 1 Dec. 31 Account Titles and Explanation Prepaid Insurance Cash Service Revenue Unearned Service Revenue Debit 10200 2550 Credit 10200 2550arrow_forwardExercise 3-07 A partial adjusted trial balance of Concord Company at January 31, 2020, shows the following. CONCORD COMPANY ADJUSTED TRIAL BALANCE JANUARY 31, 2020 Debit Credit Supplies $840 Prepaid Insurance Salaries and Wages Payable 3,240 $940 Unearned Service Revenue 890 Supplies Expense 950 Insurance Expense 540 Salaries and Wages Expense 1,940 Service Revenue 2,140 Answer the following questions, assuming the year begins January 1. If the amount in Supplies Expense is the January 31 adjusting entry, and $850 of supplies was purchased in January, what was the balance in Supplies on January 1? Beginning balance of supplies If the amount in Insurance Expense is the January 31 adjusting entry, and the original insurance premium was for one year, what was the total premium? Total premium $arrow_forwardAdjusting, Closing, and Reversing Entries Prepare adjusting, closing, and payroll entries for wages using two methods. Wages paid during 20-1 are $24,080. Wages earned but not paid (accrued) as of December 31, 20-1, are $240. On January 3, 20-2, payroll of $920 is paid, which includes the $240 of wages earned but not paid in December. 1. Prepare the entries without making a reversing entry.arrow_forward

- At the end of the year, Dahir Incorporated’s balance of Allowance for Uncollectible Accounts is $1,500 (credit) before adjustment. The company estimates future uncollectible accounts to be $7,500. What adjusting entry would Dahir record for Allowance for Uncollectible Accounts? (If no entry is required for a particular transaction/event, select "No Journal Entry Required" in the first account field.)arrow_forwardCrane Company has the following year-end account balances on November 30, 2024: Service Revenue $37,000; Insurance Expense $2,700; Rent Expense $6,000; Supplies Expense $1,350; L. Johnson, Capital $42,000; and L. Johnson, Drawings $28,000. (a) Prepare the closing entries. (Credit account titles are automatically indented when amount is entered. Do not Indent manually. If no entry is required, select "No Entry" for the account titles and enter Ofor the amounts. List all debit entries before credit entries.) Date Account Titles Nov. 30 Nov. 30 Nov. 30 Nov. 30 To close revenue account) < To close expense accounts) To close income summary) To close drawings account) Debit Credit | |||| |||||arrow_forwardThe Allowance balance is a $200 credit before adjustment. Uncollectible accounts are estimated to be $2,000. The adjusting entry to record uncollectible accounts is: GENERAL JOURNAL 1 2 1 2 Date Chapter 8-Receivables Now, the adjusting entry to record uncollectible accounts is: GENERAL JOURNAL Description a. Description If the Allowance balance started with a $200 DEBIT balance and uncollectible accounts are estimated to be $2,000. Date с. Post ref Debit Post ref Note: Bad Debt Expense estimate in the prior year was wrong, it was not an error. It was still a good faith estimate and the apparent violation of the matching principle is allowed under GAAP. Age Interval Not Past Due 1-30 days past due Debit At the end of the current year, the accounts receivable account has a debit balance of $1,400,000 and sales for the year total $15,350,000. Determine the amount of the adjustment needed. Page Credit The allowance account before adjustment has a debit balance of $23,000. Bad debt expense…arrow_forward

- On July 1, 2022, Blossom Company pays $18,000 to Sunland Company for a 2-year insurance contract. Both companies have fiscal years ending December 31. Journalize the entry on July 1 and the adjusting entry on December 31 for Sunland Company. Sunland uses the accounts Unearned Service Revenue and Service Revenue. (Record journal entries in the order presented in the problem. If no entry is required, select "No Entry" for the account titles and enter 0 for the amounts. Credit account titles are automatically indented when the amount is entered. Do not indent manually.)arrow_forwardThe balance in the unearned fees account, before adjustment at the end of the year, is $13,010. Journalize the adjusting entry required if the amount of unearned fees at the end of the year is $4,110. If an amount box does not require an entry, leave it blank.arrow_forwardJournalize the adjusting entries and post to the general ledger - Adjusting entries: 1. Expired insurance for the period $500 2.Accrued salary expense ( earned but not paid ) owed to Sophia LeBron,$5600. (Credit Salaries Payable. Payroll taxes are not considered in this entry. 3.Provision for uncollectible accounts estimated at 3.0% of March creadit sales,$927arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education