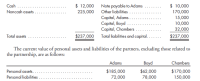

Twelve years ago, Adams, Boyd, and Chambers formed a

Boyd is extremely concerned that after liquidation of the partnership they would still continue to be personally insolvent. This would be devastating to Boyd, and they have come to you with their concerns.

Prepare a response to each of Boyd’s independent questions noting that

1. If assets with a book value of $180,000 were sold for $200,000 and the partners agreed to maintain a minimum cash balance of $5,000, would any of the available cash be distributed to Boyd?

2. If all of the noncash assets were sold for net proceeds of $280,000 and all cash was distributed, would any of the available cash be distributed to Boyd?

3. Assume that all of the noncash assets were sold for net proceeds of $150,000 and all cash was distributed. If Adams contributed the necessary assets to the partnership to liquidate unsatisfied outside creditors, how much would Boyd be liable to Adams for?

4. How much would all of the noncash assets have to be sold for so that after distributing all available cash Boyd could liquidate their personal liabilities?

Trending nowThis is a popular solution!

Step by stepSolved in 4 steps

- From the records of the DTA Partnership, *please refer on the image below a. P2,000; P200, respectively b. P5,000; P-0-, respectively c. P1,500; P1,000, respectively d. P-0-; P500, respectivelyarrow_forwardGiven:Cash 1,200,000Noncash assets 800,000Total Liabilities 1,500,000A, Capital 150,000B, Capital 300,000C, Capital 50,000 On December 31, 2019, the Statement of Financial Position of ABC Partnership with profit or loss ratio of 1:4:5 is presented as follows: On January 1, 2020, the partners decided to liquidate the partnership. All partners are legally declared to be personally insolvent. The other noncash assets were sold at a specific price. Liquidation expenses amounting to P50,000 were incurred. At the end of liquidation, A received P80,000. What is the net proceeds from the sale of noncash asset during partnership liquidation?arrow_forwardUndefinedarrow_forward

- sarrow_forwardThe liabilities and capital balances of the partners before the sale of the assets and payment of liabilities including personal assets and liabilities of the partners were: Partnership Personal Assets Personal Liabilities Cash P10,000 Liabilities 70,000 Kath 65,000 P1,200,000 P1,500,000 Pau 20,000 2,500,000 · 2,490,000 Jas 15,000 3,000,000 3,200,000 After the assets were sold the capital balances of the partners where as follows: Kath, P48,000, Pau, P12,000; and Jas, (P10,000). How much is the proceeds from sale of non-cash assets? Select the correct response. O P110,000 O P160,000 P90,000 P100,000 < Previousarrow_forwardUrmilabenarrow_forward

- The assets and equities of the A, B and C Partnership at the end of its fiscal year on October 31, 2019 are as follows: Assets: Liabilities and capital Liabilities – creditors P50,000 Loan from C Cash P15,000 Receivable – net 20,000 10,000 Inventory Plant assets – net 40,000 70,000 5,000 A, Capital B, Capital C, Capital 45,000 30,000 15,000 Loan to B The partners decide to liquidate the partnership. They estimate that the noncash assets, other than the loan to B, can be converted into P100,000 cash over the two months period ending December 31, 2021. Cash is to be distributed to the appropriate parties as it becomes available during the liquidation process. Assuming P65,000 is available for first distribution, it should be paid to (and how much)arrow_forwardThe Statement of Financial Position of the XY partnership on December 31, 2018, appears below. $ 60,000 LIABILITIES $ 60,000 CASH OTHER ASSETS TOTAL ASSETS 200,000 a. $260,000 X, CAPITAL Y, CAPITAL TOTAL LIABILITIES AND CAPITAL 90,000 110,000 $260,000 X and Y share profits and losses in the ratio 50:50. Each of the following questions is independent of the others. Prepare journal entries for each of the following: Use bonus method where appropriate and show all computations. Refer to the above information. Assume that Z purchases a one-fourth proportionate capital interest directly from Y for a total of $60,000. (Direct purchase) b. Refer to the above information. Assume Z invests $60,000 cash into the XY partnership for a one-fourth interest in partnership capital and profits. c. Refer to the above information. Assume that Z invests $80,000 cash into the XY partnership for a one-fifth interest in partnership capital and profits.arrow_forwardsarrow_forward

- Multiple Choice The condensed statement of financial position of Ricablanca, Tac-an and Dimalanta partnership as of March 31, 2019 follows: ents to P 28,000 265,000 P293,000 Assets efore t Cash Non-cash Assets Total P 48,000 Liabilities 95,000 80,000 Ricablanca, Capital Tac-an, Capital Dimalanta, Capital Total 70,000 P293,000 S. Profit and loss ratio is 50:25:25, respectively. The partners voted to dissolve the partnership and liquidate by selling assets in installments. P70,000 was realized on the first cash sale of other non-cash assets which has a book value of P150,000. After settlement with creditors, all cash available was distributed to partners. How much cash did Dimalanta receive? P10,500 b. P20,000 a. C. P32,500 d. P21,250 2. The statement of financial position of the partnership of Balino, Andres and Ignacio who share in the profits and losses in the ratio of 5:3:2, respectively, is as follows: Assets Liabilities and Capital P 30,000 Liabilities Balino, Capital Andres,…arrow_forwardpart carrow_forwardOn December 31, x2 the total partnership capital (assets less liabilities) for the Bird, Cage, and Dean partnership is P744,000.Selected information related to the preclosing capital balances is as follows: How much is the partnership net income during the year?a. P84,000b. P144,000c. P204,000d. P44,000arrow_forward

- Principles of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College