Question

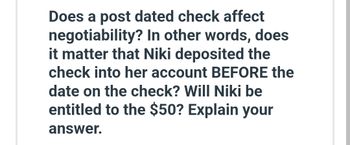

Transcribed Image Text:Does a post dated check affect

negotiability? In other words, does

it matter that Niki deposited the

check into her account BEFORE the

date on the check? Will Niki be

entitled to the $50? Explain your

answer.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Similar questions

- What safeguards are in place to protect the confidentiality of electronic transfers?arrow_forwardhelp asaparrow_forward1.A borrowed P30,000.00 from B to be paid on September 10, 2016, in exchange for the loan, A surrendered his Iphone7 to B as security. On September 11, 2016, B demanded that A pay the P30,000.00 loan. Since A do not have enough money, he just told B that B can just have his Iphone/ as payment for his loan to which B agreed. Is the contract extinguished? Explain . 2. A, B, C and D are the solidary debtors of X for 240,000. X released D from the payment of his share of P10,000. When the obligation became due and demandable, C turned out to be insolvent. Considering the said incidents, what are the liabilitites of A, B, C, and D? 3. Aida, Lorna and Fe borrowed money from Juan, Pedro and Mario P3,000.00. Aida's obligation is due today, September 5, 2019, Lorna is a minor and Fe's obligation is due on September 10, 2019. Can Pedro alone proceed against Lorna alone for the payment of the entire P3,000.00? Explain . 4.Explain and Give an example of the following modes of extinguishing an…arrow_forward

- John goes to a bar. Harry starts to talk to him about a car he has for sale. John tells him he wishes he could buy the car but does not have that much cash. Harry tells John he can make payments over the next year. Harry writes on a napkin John shall pay me $100.00 per month for 12 months starting December 1, 2018. They both sign and date the napkin. Discuss whether this is a negotiable instrument. Defend your position. Ensure you discuss each element of negotiability.arrow_forwardJoseph and Mai each bought shares of Apple stock at $200 per share. About a week later, Joseph called his stockbroker and told him that if Apple was trading below $195, he wanted to sell. The broker was very busy, so he didn’t check but Apple was trading at $194 per share. He told Joseph that it was not below $195, so Joseph did not sell the stock. Mai also called her stockbroker that day also and told him that if Apple was trading below $195, she wanted to sell. Once again, the broker was very busy, so he didn’t check but Apple was trading at $194 per share. He told Mai that it was not below $195. However, Mai saw the price on her computer and knew it was $94. However, Mai did not sell either. Apple dropped to $180 per share by the end of the day and they both sold suffering a large loss. They both sue the brokers. What are the probable outcomes of the suits?arrow_forwardAfter researching Best Buy common stock, Sally Wang is convinced the stock is overpriced. She contacts her account executive and arranges to sell short 550 shares of Best Buy. At the time of the sale, a share of common stock had a value of $148. Three months later, Best Buy is selling for $140 a share, and Sally instructs her broker to cover her short transaction. Total commissions to buy and sell the stock were $58. What is her profit for this short transaction?arrow_forward

- You are a broker. Your sales associate is new and can't remember the key differences between lien types. You remind them: Liens can be voluntary or involuntary. Voluntary liens are created with the owner's consent. A lien can only apply to one piece of property a debtor owns Because of this, liens are always specific. Legally, liens cannot be involuntary. They must be created with the owner's consent and if they're not, they're illegal All liens affect all of the debtor's property. That's why they're also called general liens.arrow_forwardBuyer Bert can't believe that Seller Sam has had a last-second change of heart about entering into an agreement to sell his home to Bert. Sam has offered to refund Bert's earnest money and even pay him something in acknowledgment of Bert's inconvenience and disappointment, but Bert's not having it. He wants Sam's house. Choose the remedy for breach of trust that Bert will most likely take. demand specific performance initiate rescission accept compensatory damages settle for liquidated damagesarrow_forward4.Bryson issues a $5,000 negotiable check "payable to the order of Yolanda or cash." Yolanda places her signature on the back of the check. Yolanda then negotiates the check to Casey. Given these facts, which of the following is generally correct? а. The check was issued as a bearer instrument and Yolanda could not have converted it into an order instrument. b. Yolanda's indorsement on the instrument is not required in order for Casey to qualify or assert that he is a holder in due course. С. Yolanda's indorsement on the instrument is generally referred to as a special indorsement. d. Yolanda's indorsement on the instrument is required in order for Casey to qualify or assert that he is a holder in due course.arrow_forward

- Bill offers to sell Mary his computer for $500. Mary counters with an offer of $400 Bill rejects this offer. Mary tells Bill: "OK, I'll buy the computer for $500." Bill tells Mary: "I've decided not to sell the computer after all." Bill is in breach of contract because Mary made a valid offer. True Falsearrow_forwardDigiTech Corporation pays its employees every two weeks. Eve gets her paycheck, indorses the back (“Eve Anderson”), and, on her lunch hour, goes to cash it at DigiTech’s bank, First State Bank. On the street, in a crowd, she loses the check. Greg Smith finds it. Has the check been negotiated to Greg? Greg signs the back of the check beneath Eve’s signature and cashes it. What might Eve have done to avoid this loss?arrow_forwardGemma promises a local hardware store that she will pay for a lawn mower that her brother is purchasing on credit if the brother fails to pay the debt. Must this promise be in writing to be enforceable? Why or why not?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios