FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

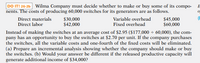

Transcribed Image Text:DO IT! 26-26 Wilma Company must decide whether to make or buy some of its compo-

nents. The costs of producing 60,000 switches for its generators are as follows.

E

Direct materials

Direct labor

$30,000

$42,000

$45,000

$60,000

Variable overhead

Fixed overhead

Instead of making the switches at an average cost of $2.95 ($177,000 + 60,000), the com-

pany has an opportunity to buy the switches at $2.70 per unit. If the company purchases

the switches, all the variable costs and one-fourth of the fixed costs will be eliminated.

(a) Prepare an incremental analysis showing whether the company should make or buy

the switches. (b) Would your answer be different if the released productive capacity will

generate additional income of $34,000?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- San Clemente Inc. incurs the following costs to produce 10,000 units of a subcomponent: Direct materials $8,400 Direct labor 11,250 Variable overhead 12,600 Fixed overhead 16,200 An outside supplier has offered to sell San Clemente the subcomponent for $2.85 a unit. If San Clemente accepts the offer, by how much will net income increase (decrease)? ($8,850) decrease ($2,850) decrease O $19,950 increase $3,750 increasearrow_forwardSheffield Corp. incurs the following costs to produce 10500 units of a subcomponent: Direct materials Direct labor Variable overhead Fixed overhead $(3600). $9200 Ⓒ$8150. $950. $(950). 11750 13000 An outside supplier has offered to sell Sheffield the subcomponent for $2.80 a unit. No fixed costs are avoidable. If Sheffield accepts the offer, it could use the production capacity to produce another product that would generate additional income of $3600. The increase (decrease) in net income from accepting the offer would be 20800arrow_forwardSheffield Corp. incurs the following costs to produce 9000 units of a subcomponent: Direct materials Direct labor Variable overhead Fixed overhead $9000 O $28950 O $(3500) $8950 O $(3250) 12500 12200 20000 An outside supplier has offered to sell Sheffield the subcomponent for $2.75 a unit. No fixed overhead costs are avoidable. If Sheffield accepts the offer, by how much will net income increase (decrease)?arrow_forward

- i need the answer quicklyarrow_forwardConcord Corporation can produce 100 units of a necessary component part with the following costs: Direct Materials $23000 Direct Labor 9000 Variable Overhead Fixed Overhead 25000 O $50000 O $57000 O $62000 O $64000 12000 If Concord Corporation purchases the component externally, $5000 of the fixed costs can be avoided. Below what external price for the 100 units would Concord choose to buy instead of make the units?arrow_forwardEdidas Company needs 20,000 units of Part GX to use in producing one of its products. If Edidas buys the Part GX from McMillan Company for $79 instead of making it, Edidas will not use the released facilities in another manufacturing activity. Twenty percent of the fixed overhead will continue irrespective of CEO Donald Mickey's decision. The cost per unit data are as follows: Cost to make the part Direct Materials Direct Labor (S) 30 15 Variable Overhead 20 Fixed Overhead 20 85 Required : 1. Explain which alternative is more attractive to Edidas, make or buy Part GX. 2. Assume there is new information that Edidas is negotiating to purchase cheaper raw materials from supplier (Twenty percent lower price). Is this information relevant or irrelevant? On the basis of financial considerations alone, should Edidas make or buy Part GX? Show your calculations 3. Based on requirement 2, what are relevant qualitative factors that Edidas should consider to decide whether to make or buy Part GX?…arrow_forward

- Zion Manufacturing had always made its components in-house. However, Bryce Component Works had recently offered to supply one component, K2, at a price of $13 each. Zion uses 4,400 units of Component K2 each year. The cost per unit of this component is as follows: Direct materials Direct labor Variable overhead Fixed overhead Total $7.84 2.84 1.67 4.00 $16.35 The fixed overhead is an allocated expense; none of it would be eliminated if production of Component K2 stopped. Required: 1. What are the alternatives facing Zion Manufacturing with respect to production of Component K2? 2. List the relevant costs for each alternative. If required, round your answers to the nearest cent. Total Relevant Cost Make per unit Buy per unit Differential Cost to Make per unitarrow_forwardPlease solve this onearrow_forwardAhrends Corporation makes 70,000 units per year of a part it uses in the products it manufactures. The unit product cost of this part is computed as follows: Direct materials Direct labor Variable manufacturing overhead. Fixed manufacturing overhead Unit product cost $ 17.80 19.00 1.00 17.10 $ 54.90 An outside supplier has offered to sell the company all of these parts it needs for $48.50 a unit. If the company accepts this offer, the facilities now being used to make the part could be used to make more units of a product that is in high demand. The additional contribution margin on this other product would be $273,000 per year. If the part were purchased from the outside supplier, all of the direct labor cost of the part would be avoided. However, $8.20 of the fixed manufacturing overhead cost being applied to the part would continue even if the part were purchased from the outside supplier. This fixed manufacturing overhead cost would be applied to the company's remaining products.…arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education