FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

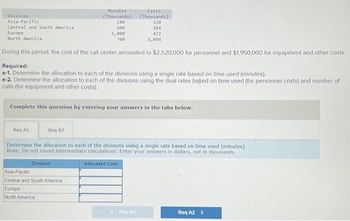

Transcribed Image Text:Calls

(Thousands)

220

184

472

1,084

During this period, the cost of the call center amounted to $2,520,000 for personnel and $1,950,000 for equipment and other costs.

Required:

a-1. Determine the allocation to each of the divisions using a single rate based on time used (minutes).

a-2. Determine the allocation to each of the divisions using the dual rates based on time used (for personnel costs) and number of

calls (for equipment and other costs).

Division

Asia-Pacific

Central and South America

Europe

North America

Req A1

Complete this question by entering your answers in the tabs below.

Reg A2

Minutes

(Thousands)

280

608

1,000

760

Asia-Pacific

Central and South America

Europe

North America

Determine the allocation to each of the divisions using a single rate based on time used (minutes).

Note: Do not round intermediate calculations. Enter your answers in dollars, not in thousands.

Division

Allocated Cost

Req A1

Req A2 >

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Complete the following (assume $93,500 of overhead to be distributed): (Round the "Ratio" to 2 decimal places.) Amount of Overhead Square Feet Ratio Allocated Department A Department B 15,040 31,960arrow_forwardVishnuarrow_forwardExercise 11-31 (Algo) Cost Allocation: Reciprocal Method, Two Service Departments (LO 11-1) Activity and selected costs for three production departments (Training. Independent, and Commercial) and two service departments (Accounting and Facilities) at DuBay Films for the past month follow: Supplying Department Accounting Facilities Direct cost From: Service department costs Accounting Facilities Total allocations Accounting 8 0.20 $ 190,000 Direct costs Total costs Facilities 0.40 $ 184,500 Required: Allocate service department costs to Training, Independent, and Commercial using the reciprocal method. What are the total costs of Training, Independent, and Commercial after this allocation? Note: Amounts to be deducted should be indicated by a minus sign. Do not round Intermediate calculations. Round your final answers to the nearest whole dollar amounts. Accounting Using Department Training 0.30 0.20 $ 330,000 Facilities Independent 0.20 0.20 $ 201,000 Cost Allocation To: Training…arrow_forward

- The following is a partially completed departmental expense allocation spreadsheet for Brickland. It reports the total amounts of direct and indirect expenses for its four departments. Purchasing department expenses are allocated to the operating departments on the basis of purchase orders. Maintenance department expenses are allocated based on square footage. Compute the amount of Maintenance department expense to be allocated to Fabrication. Operating costs No. of purchase orders Sq. ft. of space Multiple Choice O $6,400. $9,900. $8,100. $9,000. $25,600. Purchasing Maintenance Fabrication Assembly $32,000 $18,000 $96,000 16 3,300 $62,000 4 2,700arrow_forwardAssume a company provided the following information: Departmental costs Number of employees Square feet of space occupied Multiple Choice If the company (1) uses the direct method to allocate service department costs to operating departments, (2) allocates Cafeteria costs based on the number of employees, and (3) allocates Janitorial costs based on square feet of space of occupied, then the cost allocated from the Cafeteria Department to the Lab Department is closest to: C $58,338. $63,467. $76,800. Service Departments Operating Departments Cafeteria Janitorial Lab Tech $232,000 $950,000 32 68 $240,000 $140,000 20 2,000 11,000 9,000 $116,800. 10 3,000arrow_forwardam104.arrow_forward

- Department Personnel Custodial Services Maintenance Printing Binding Personnel Custodial Services Maintenance Printing Binding Total budgeted cost Total Labor- Square Feet of Space Occupied Printing Department Binding Department Total hours Hours 16,000 8,200 14,300 30,600 108,000 177,100 Budgeted overhead costs in each department for the current year are shown below: $ 300,000 66,000 93,400 Req 1 Req 2 12,400 3,100 10,500 40,400 20,900 87,300 Machine-Hours 2,400 500 2,900 414,000 170,000 $ 1,043,400 Number of Employees 22 49 69 Req 3A 105 300 545 Because of its simplicity, the company has always used the direct method to allocate service department costs to the two operating departments. Machine- Hours Required: 1. Using the step-down method, allocate the service department costs to the consuming departments. Then compute predetermined overhead rates in the two operating departments. Use machine-hours as the allocation base in the Printing Department and direct labor-hours as the…arrow_forwardAnswer question Darrow_forwardAssume that Swifty has identified three activity cost pools.arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education