Reporting

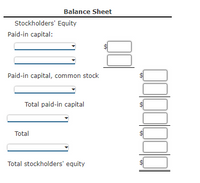

Using the following accounts and balances, prepare the “Stockholders’ Equity” section of the

Common Stock, $40 par $2,240,000

Paid-In Capital from Sale of

Paid-In Capital in Excess of Par—Common Stock 504,000

Retained Earnings 1,254,000

Treasury Stock 77,000

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps with 1 images

Dividends Per Share

Seventy-Two Inc., a developer of radiology equipment, has stock outstanding as follows: 80,000 shares of cumulative preferred 3% stock, $20 par and 405,000 shares of $25 par common.

During its first four years of operations, the following amounts were distributed as dividends: first year, $33,000; second year, $76,000; third year, $80,000; fourth year, $120,000.

Determine the dividends per share on each class of stock for each of the four years. Round all answers to two decimal places. If no dividends are paid in a given year, enter "0.00".

| 1st Year | 2nd Year | 3rd Year | 4th Year | |

| Common stock (dividends per share) |

Dividends Per Share

Seventy-Two Inc., a developer of radiology equipment, has stock outstanding as follows: 80,000 shares of cumulative preferred 3% stock, $20 par and 405,000 shares of $25 par common.

During its first four years of operations, the following amounts were distributed as dividends: first year, $33,000; second year, $76,000; third year, $80,000; fourth year, $120,000.

Determine the dividends per share on each class of stock for each of the four years. Round all answers to two decimal places. If no dividends are paid in a given year, enter "0.00".

| 1st Year | 2nd Year | 3rd Year | 4th Year | |

| Common stock (dividends per share) |

- The stockholders’ equity section of The Seventies Shop is presented here.THE SEVENTIES SHOP Balance Sheet (partial)($ in thousands)Stockholders’ equity:Preferred stock, $50 par value $ –0–Common stock, $5 par value 20,000Additional paid-in capital 100,000Total paid-in capital 120,000Retained earnings 53,000Treasury stock (3,700)Total stockholders’ equity $ 169,300Required:Based on the stockholders’ equity section of The Seventies Shop, answer the following questions. Remember that all amounts are presented in thousands.1. How many shares of preferred stock have been issued?2. How many shares of common stock have been issued?3. Total paid-in capital is $120 million. At what average price per share were the common shares issued?4. If retained earnings at the beginning of the period was $45 million and net income during the year was $9,907,500, how…arrow_forwardPlease help thanksarrow_forwardThe stockholders’ equity section of Bramble Corp.’s balance sheet at December 31 is presented here. BRAMBLE CORP.Balance Sheet (partial) Stockholders’ equity Paid-in capital Preferred stock, cumulative, 12,500 shares authorized, 7,500 shares issued and outstanding $ 787,500 Common stock, no par, 735,000 shares authorized, 565,000 shares issued 2,260,000 Total paid-in capital 3,047,500 Retained earnings 1,158,000 Total paid-in capital and retained earnings 4,205,500 Less: Treasury stock (6,900 common shares) 36,800 Total stockholders’ equity $4,168,700 From a review of the stockholders’ equity section, answer the following questions.(a) How many shares of common stock are outstanding? Common stock outstanding enter a number of shares shares (b) Assuming there is a stated value, what is the stated value of the common stock? The stated value of the common stock…arrow_forward

- Following is the stockholders' equity section as of June 30. Common stock-$20 par value, 200,000 shares authorized, 80,000 shares issued and outstanding Paid-in capital in excess of par value, common stock Retained earnings Total stockholders' equity On July 1, the directors declare a 5% stock dividend distributable on July 31 to the July 18 stockholders of record. The stock's market value is $50 per share on July 1 before the stock dividend. 1. Prepare entries to record both the dividend declaration and its distribution. 2. Prepare the stockholders' equity section after the stock dividend is distributed. (Assume no other changes to equity.) Enter answers in the tabs below. Required 1 Required 2 $ 1,600,000 400,000 750,000 $ 2,750,000 Prepare the stockholders' equity section after the stock dividend is distributed. (Assume no other changes to equity.) Stockholders' Equity Section of the Balance Sheet July 31 Retained earnings Common stock Paid-in capital in excess of par value, common…arrow_forwardThe stockholders’ equity section of Creighton Company’s balance sheet is shown as follows: CREIGHTON COMPANY As of December 31, Year 3 Stockholders’ equity Preferred stock, $10 stated value, 7% cumulative,300 shares authorized, 50 issued and outstanding $ 500 Common stock, $10 par value, 250 shares authorized,100 issued and outstanding 1,000 Common stock, class B, $20 par value, 400 sharesauthorized, 150 issued and outstanding 3,000 Common stock, no par, 150 shares authorized,100 issued and outstanding 2,200 Paid-in capital in excess of stated value—preferred 600 Paid-in capital in excess of par value—common 1,200 Paid-in capital in excess of par value—class B common 750 Retained earnings 7,000 Total stockholders’ equity $ 16,250 Requireda. Assuming the preferred stock was originally issued for cash, determine the amount of cash collected when the stock was issued.b. Based on the class B common stock alone,…arrow_forwardPlease do not give solution in image format thankuarrow_forward

- Analyzing and Computing Issue Price, Treasury Stock Cost, and Shares Outstanding Following is the stockholders' equity section of the 2018 Merck & Co. Inc. balance sheet. Stockholders' Equity ($ millions, except par value) 2018 Common stock, $0.50 par value; 6,500,000 authorized shares; 3,577,107,522 issued shares $1,789 Other paid-in capital 31,046 Retained earnings 34,063 Accumulated other comprehensive loss (4,436) Stockholders' equity before deduction for treasury stock $62,103 Less treasury stock, at cost: 984,543,979 shares Total Merck & Co. Inc. stockholders' equity 40,743 $21,360 a. Show the computation of the $1,789 million in the common stock account. shares x $ per share is approximately $ million on the balance sheet. b. At what average price were the Merck common shares issued? Note: Round your answers to two decimal places (for example, enter 67.49 for 67.48555). per share c. At what average cost was the Merck treasury stock purchased? Note: Round your answers to two…arrow_forwardStockholders' Equity: Transactions and StatementThe stockholders' equity section of Night Corporation's balance sheet at January 1 follows: Common stock, $6 par value, 300,000 shares authorized, 60,000 shares 360,000 issued, 6,000 shares in treasury Additional paid-in capital In excess of par value 600,000 From treasury stock 37,500 637,500 Retained earnings 435,000 1,432,500 Less: Treasury stock (6,000 shares) at cost 172,500 Total Stockholders’ Equity 1,260,000 The following transactions affecting stockholders’ equity occurred during the year: Jan. 8 Issued 15,000 shares of previously unissued common stock for $26 cash per share. Mar. 12 Sold all of the treasury shares for $35 cash per share. June 30 Declared a five percent stock dividend on all outstanding shares of common stock. The market value of the stock was $31 per share. July 10 Issued the stock dividend declared on June 30. Oct. 7 Acquired 2,500 shares of common…arrow_forwardReporting Stockholders' Equity Using the following accounts and balances, prepare the “Stockholders’ Equity” section of the balance sheet. 70,000 shares of common stock authorized, and 1,000 shares have been reacquired. Common Stock, $80 par $4,480,000 Paid-In Capital from Sale of Treasury Stock 90,000 Paid-In Capital in Excess of Par—Common Stock 784,000 Retained Earnings 2,330,000 Treasury Stock 60,000 Balance Sheet Stockholders' Equity Paid-in capital: $fill in the blank 2 fill in the blank 4 Paid-in capital, common stock $fill in the blank 5 fill in the blank 7 Total paid-in capital $fill in the blank 8 fill in the blank 10 Total $fill in the blank 11 fill in the blank 13 Total stockholders' equity $fill in the blank 14arrow_forward

- Journalize transactions, post, and prepare a stockholders' equity section; calculate ratios. P11-2B The stockholders' equity accounts of Warden Corporation on January 1, 2014, were as follows. Preferred Stock (9%, $50 par cumulative, 10,000 shares authorized) Common Stock ($1 stated value, 2,000,000 shares authorized) Paid-in Capital in Excess of Par Value-Preferred Stock Paid-in Capital in Excess of Stated Value-Common Stock Retained Earnings Treasury Stock (8,000 common shares) $ 200,000 1,000,000 16,000 1,400,000 1,716,000 20,000 (LO 2, 3, 5, 7, 8), AP GLS During 2014 the corporation had these transactions and events pertaining to its stock- holders' equity. Feb. Issued 20,000 shares of common stock for $160,000. Purchased 4,000 shares of common stock for the treasury at a cost of $16,000. Declared a 9% cash dividend on preferred stock, payable December 15. Declared a $0.30 per share cash dividend to common stockholders of record on December 15, payable December 31, 2014. Nov. 10…arrow_forwardThe stockholders' equity section of Jun Company's balance sheet as of April 1 follows. On April 2, Jun declares and distributes a 10% stock dividend. The stock's per share market value on April 2 is $20 (prior to the dividend). Common stock-$5 par value, 375,000 shares authorized, 200,000 shares issued and outstanding Paid-in capital in excess of par value, common stock Retained earnings Total stockholders' equity Prepare the stockholders' equity section immediately after the stock dividend is distributed. Total paid-in capital JUN COMPANY Stockholders' Equity April 2 (after stock dividend) Total stockholders' equity $ $ 1,000,000 600,000 833,000 $ 2,433,000 0arrow_forwardUsing the following accounts and balances, prepare the stockholders' equity section of the balance sheet. Fifty thousand shares of common stock are authorized, and 5,000 shares have been reacquired. Common Stock, $60 par $2,340,000 Paid-In Capital in Excess of Par 201,060 Paid in Capital from Sale of Treasury Stock 6,060 Retained Earnings 117,000 Treasury Stock 4,560 Stockholders' Equity Contributed capital: $fill in the blank 2 fill in the blank 4 Total contributed capital $fill in the blank 5 fill in the blank 7 Total $fill in the blank 8 fill in the blank 10 Total stockholders' equity $fill in the blank 11arrow_forward

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education