FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

thumb_up100%

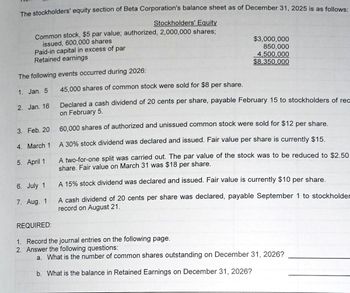

Transcribed Image Text:The stockholders' equity section of Beta Corporation's balance sheet as of December 31, 2025 is as follows:

Stockholders' Equity

Common stock, $5 par value; authorized, 2,000,000 shares;

issued, 600,000 shares

Paid-in capital in excess of par

Retained earnings

The following events occurred during 2026:

1. Jan. 5

2. Jan. 16

3. Feb. 20

4. March 1

5. April 1

6. July 1

7. Aug. 1

$3,000,000

850,000

4,500,000

$8,350,000

45,000 shares of common stock were sold for $8 per share.

Declared a cash dividend of 20 cents per share, payable February 15 to stockholders of rec

on February 5.

60,000 shares of authorized and unissued common stock were sold for $12 per share.

A 30% stock dividend was declared and issued. Fair value per share is currently $15.

A two-for-one split was carried out. The par value of the stock was to be reduced to $2.50

share. Fair value on March 31 was $18 per share.

A 15% stock dividend was declared and issued. Fair value is currently $10 per share.

A cash dividend of 20 cents per share was declared, payable September 1 to stockholder

record on August 21.

REQUIRED:

1. Record the journal entries on the following page.

2. Answer the following questions:

a. What is the number of common shares outstanding on December 31, 2026?

b. What is the balance in Retained Earnings on December 31, 2026?

Expert Solution

arrow_forward

Step 1

Note :

Stock dividend is nothing but capitalisation of profit, it is a payment to shareholders that is made in additional shares instead of cash, and adverse effect of diluting EPS.

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Follow-up Questions

Read through expert solutions to related follow-up questions below.

Follow-up Question

For March 1, how did you get the 211,500 that you multiply by 5

Solution

by Bartleby Expert

Follow-up Questions

Read through expert solutions to related follow-up questions below.

Follow-up Question

For March 1, how did you get the 211,500 that you multiply by 5

Solution

by Bartleby Expert

Knowledge Booster

Similar questions

- Please provide assistance and explanation for scenario provided in the attached image.arrow_forwardOn January 1, 2024, Dolar Incorporated had the following account balances in its shareholders' equity accounts. Common stock, $1 par, 241,000 shares issued $241,000 Paid-in capital-excess of par, common 482,000 Paid-in capital-excess of par, preferred. 195,000 Preferred stock, $100 par, 19,500 shares outstanding 1,950,000 Retained earnings Treasury stock, at cost, 4,100 shares 3,900,000 20,500 During 2024, Dolar Incorporated had several transactions relating to common stock. January 15: February 17: April 10: July 18: December 1: December 28: Required: Declared a property dividend of 100,000 shares of Burak Company (book value $11.9 per share, fair value $9.95 per share). Distributed the property dividend. A 2-for-1 stock split was declared and distributed on outstanding common stock and effected in the form of a stock dividend. (Dolar chose to reduce Paid-in capital-excess of par.) The fair value of the stock was $4 on this date.. Declared and distributed a 4% stock dividend on…arrow_forwardThe stockholders' equity section of the January 1, 2031 balance sheet for XYZ Company is given below: Common stock, $14 par value ................. $525,000 Paid-in capital – common stock .............. $150,000 Treasury stock (14,000 shares @ $16 cost) ... $224,000 Paid-in capital – treasury stock ............ $ 13,000 Retained earnings ........................... $107,000 XYZ Company entered into the following transactions during 2031: a. Re-issued 2,000 of the treasury shares for $11 per share. b. Re-issued 3,000 of the treasury shares for $13 per share. c. Issued 5,000 shares of previously un-issued common stock for $21 per share. d. Re-issued 6,000 of the treasury shares for $19 per share. Calculate the balance in the retained earnings account after all four transactions above are recorded.arrow_forward

- The stockholders’ equity accounts of Grouper Company have the following balances on December 31, 2020. Common stock, $10 par, 290,000 shares issued and outstanding $ 2,900,000 Paid-in capital in excess of par—common stock 1,120,000 Retained earnings 5,110,000 Shares of Grouper Company stock are currently selling on the Midwest Stock Exchange at $ 36.Prepare the appropriate journal entries for each of the following cases. (Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter 0 for the amounts.) (a) A stock dividend of 7% is (1) declared and (2) issued. (b) A stock dividend of 100% is (1) declared and (2) issued. (c) A 2-for-1 stock split is (1) declared and (2) issued. No. Account Titles and Explanation Debit Credit (a) (1) enter an account title for case A to record the declaration of stock dividends…arrow_forwardOn January 1, 2020, the stockholders’ equity section of Skysong, Inc. shows common stock ($6 par value) $1,800,000; paid-in capital in excess of par $1,070,000; and retained earnings $1,220,000. During the year, the following treasury stock transactions occurred. Mar. 1 Purchased 51,000 shares for cash at $15 per share. July 1 Sold 10,500 treasury shares for cash at $17 per share. Sept. 1 Sold 9,000 treasury shares for cash at $14 per share.arrow_forwardOn January 1, 2023, Sunland Ltd. had 498,000 common shares outstanding. During 2023, it had the following transactions that affected the common share account: Feb. 1 Mar. 1 May 1 June 1 Oct. 1 Issued 180,000 shares Issued a 10% stock dividend Acquired 195,000 common shares and retired them Issued a 2-for-1 stock split Issued 74,000 shares The company's year end is December 31. Determine the weighted average number of shares outstanding as at December 31, 2023. (Round answer to 0 decimal places, e.g. 5,275.) Weighted average number of shares outstanding eTextbook and Media Assume that Sunland earned net income of $3,164,460 during 2023. In addition, it had 110,000 of 8%, $100 par, non-convertible, non-cumulative preferred shares outstanding for the entire year. Because of liquidity limitations, however, the company did not declare and pay a preferred dividend in 2023. Calculate earnings per share for 2023, using the weighted average number of shares determined above. (Round answer to 2…arrow_forward

- Stockholders' equity accounts, arranged aphabetically are the ledger of Pina Colada Corp. at December 31, 2020. Common Stock ($5 stated value) $1,675,000 Paid-in capital inexcess of par-preferred stock 279,000 Paid-in capital in excess of stated value-common stock. 936,000 Preferred stock (8%, $103 par) 489,250 Ratained Earnings 1,120,000 Treasury Stock (12,000 common shares) 144,000 Prepare the stockholders' equity section of the balance sheet at December 31, 2020. *please solve and explain process. Thank youarrow_forwardComparative statements of shareholders’ equity for Anaconda International Corporation were reported as follows for the fiscal years ending December 31, 2021, 2022, and 2023. ANACONDA INTERNATIONAL CORPORATIONStatements of Shareholders' EquityFor the Years Ended Dec. 31, 2021, 2022, and 2023($ in millions) Preferred Stock$10 par Common Stock$1 par AdditionalPaid-In Capital Retained Earnings TotalShareholders' Equity Balance at January 1, 2021 65 520 1,860 2,445 Sale of preferred shares 30 900 930 Sale of common shares 7 56 63 Cash dividend, preferred (3 ) (3 ) Cash dividend, common (17 ) (17 ) Net income 340 340 Balance at December 31, 2021 30 72 1,476 2,180 3,758 Retirement of shares (2 ) (16 ) (24 ) (42 ) Cash dividend, preferred…arrow_forwardKk28. help me solve june 8arrow_forward

- The stockholders’ equity accounts of Cheyenne Company have the following balances on December 31, 2020. Common stock, $10 par, 295,000 shares issued and outstanding $2,950,000 Paid-in capital in excess of par—common stock 1,280,000 Retained earnings 5,950,000 Shares of Cheyenne Company stock are currently selling on the Midwest Stock Exchange at $39.Prepare the appropriate journal entries for each of the following cases. (Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter 0 for the amounts.) (a) A stock dividend of 7% is (1) declared and (2) issued. (b) A stock dividend of 100% is (1) declared and (2) issued. (c) A 2-for-1 stock split is (1) declared and (2) issued.arrow_forwardjarrow_forwardPrepare the journal entries to record the above stock transactionsarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education