FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

Hi, I'm having trouble solving this problem. I tried watching the video provided but I'm still very lost. Can you help me solve this per step on how to get the value of dividend per share?

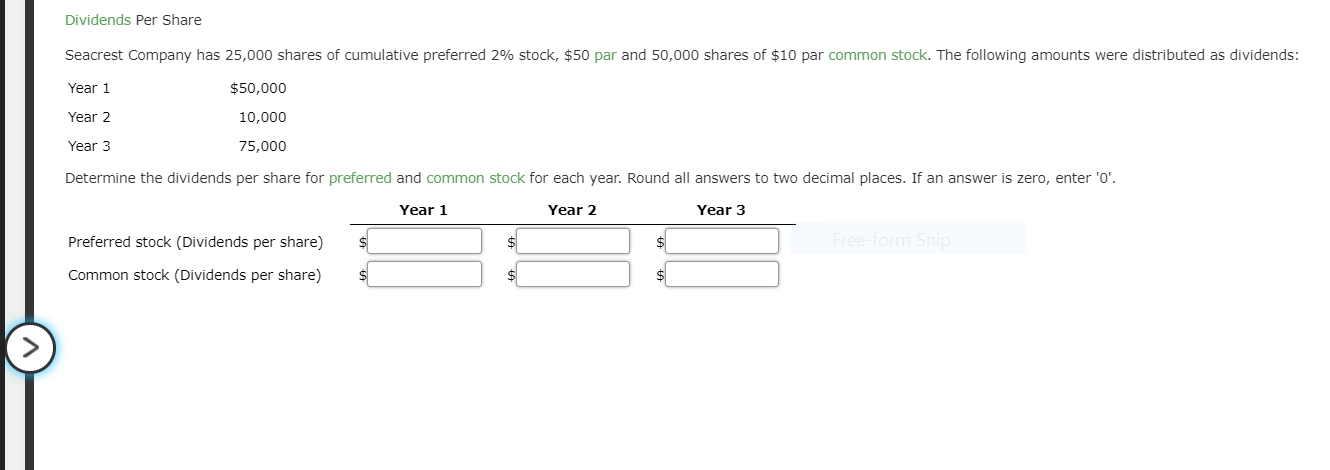

Transcribed Image Text:Dividends Per Share

Seacrest Company has 25,000 shares of cumulative preferred 296 stock, $50 par and 50,000 shares of $10 par common stock. The following amounts were distributed as dividends

Year 1

Year 2

Year 3

Determine the dividends per share for preferred and common stock for each year. Round all answers to two decimal places. If an answer is zero, enter 'O'

$50,000

10,000

75,000

Year 1

Year 2

Year 3

Preferred stock (Dividends per share)

Common stock (Dividends per share)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 3 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- T/F Person A works for Global Payments Inc. They will take a portion of their pay check to buy Global Payments Stock every pay period. This is an example of Gain sharing.arrow_forwardThis solution seems to be wrong. I also do not see where you got your numbers for the percentage return. Please continue to assist me.arrow_forwardFind the owners equity, have answers in millionsarrow_forward

- This is an individual assignment. Everyone needs to work on the firm that your team chooses [prefer simple business] for your industry analysis. Follow my class video, do the following: 1. compute your company's free cash flow for the past 3 years. This requires you to compute each of the components in the FCF. Compare your FCF for the most recent year to that reported from the barchart website. Are you close? Explain why you cannot get close to it. Note for MSFT that I did in class, deferred tax is a big deal, it may not be a problem for you. NOPAT = EBIT - tax. Either find the line for tax, or do tax = EBT-NI. Also check their cash flow statement and that should give you a clue of what to include. 2. do a free cash flow model to value your stock for next year. Is your price close to the current stock price? If not, what could be the reason? 3. do a sensitivity table by varying terminal growth g and the WACC. Upload your excel file with a sheet explaining your results. Always…arrow_forwardFor the next problem, I am going to explain a scenario and you need to state True OR False. You will then need a written rationale explaining your choice. Be sure to be specific in rationalizing your answer. You must use your own words. It is a good idea to provide a solved example to reinforce your point. To receive full credit, be sure to give a thorough explanation of why this statement is true or false (approximately 50 words). Michael decided that investing at a higher interest rate for 7 years is a better choice for his $7,500 investment (he got for his birthday). The company he chose offered 3.5% monthly, and the other company offered 3.425% continuously. Michael chose the better option! You will need to submit your work on this problem, giving a detailed explanation of WHY and how much more the better option will produce. O True O Falsearrow_forwardGayner Corporation is an oil well service company that measures its output by the number of wells serviced. The company has provided the following fixed and variable cost estimates that it uses for budgeting purposes and the actual results of operations for November. Variable Actual Fixed Element Element per Total for per Month November Well Serviced 4,300 $ 148,400 Revenue Employee salaries and 1,000 $ 006 wages 009 2$ 20,200 Servicing materials $29,600 30,300 Other expenses When the company prepared its planning budget at the beginning of November, it assumed that 30 wells would have been serviced. However, 34 wells were actually serviced during November. The spending variance for "Servicing materials" for November would have been closest to: MacBook Air い DD 888 delete 8. 6 9 %24 %24 %24 %24 %24arrow_forward

- Which of the following is not a central problem of an economy? A) What to produce B) How to produce C) For whom to produce D) When to produce Don't use chatgpt or other ai tool. If you know correct answer then attempt if you gave wrong answer I will give 10 dislikes and more from my friends accountarrow_forwardPlease tell me what type of the analysis is if the analysis wants to know which customer purchased over $5000 last year but bought nothing this year. Descriptive analytics. B. Diagnostic analytics. Predictive analytics. D. Prescriptive analyticsarrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education