FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

Note: In answering the question, use 2 decimal places for the Book Value per share.

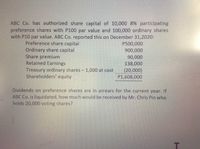

Transcribed Image Text:ABC Co. has authorized share capital of 10,000 8% participating

preference shares with P100 par value and 100,000 ordinary shares

with P10 par value. ABC Co. reported this on December 31,2020:

Preference share capital

Ordinary share capital

Share premium

Retained Earnings

Treasury ordinary shares - 1,000 at cost

Shareholders' equity

P500,000

900,000

90,000

138,000

(20,000)

P1,608,000

Dividends on preference shares are in arrears for the current year. If

ABC Co. is liquidated, how much would be received by Mr. Chris Pin who

holds 20,000 voting shares?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Fraud Investigators Incorporated operates a fraud detection service. a. On March 31, 10 customers were billed for detection services totaling $33,000. b. On October 31, a customer balance of $1,900 from a prior year was determined to be uncollectible and was written off. c. On December 15, a customer paid an old balance of $820, which had been written off in a prior year. d. On December 31, $580 of bad debts were estimated and recorded for the year.arrow_forwardCredit terms of 1/10, n/30 meansarrow_forward2. What is the "Check" on the bottom of the balance sheet?arrow_forward

- What is the impact of writing off a $500 account under the allowance method on Net Realizable Value?arrow_forwardWhich of the following accounts are increased with a credit! O Common Stock, Accounts Receivable, Unearned Revenue. Land, Accounts Payable, Common Stock. Accounts Payable, Unearned Revenue, Common Stock. Cash, Accounts Receivable, Common Stock.arrow_forwardAssuming the current ratio equals 2, which of the following would cause the current ratio to increase? O Accrual for payroll. Declaration of cash dividend. O Payment for inventory purchased on account. O Inventory purchased on account.arrow_forward

- In the balance sheet, accounts Receivable, where did you get 489,555 from?arrow_forward23) Under the allowance method, the entry to record the write-off of a specific account would A. Decrease both accounts receivable and net income B. Increase the allowance for uncollectible accounts and decrease net income C. Decrease both accounts receivable and the allowance for uncollectible accounts D. Decrease accounts receivable and increase the allowance for uncollectible accountsarrow_forwardWhich of the following entries properly closes a temporary account? Select one: a. Income Summary XX Cash b. C. Debit Credit Expense Accumulated Depreciation XX Income Summary Income Summary d. e. XX Retained Earnings XX Dividends Debit Credit Debit Credit XX Debit Credit Income Summary XX Revenue XX XX Debit Credit XX XXarrow_forward

- Identify the correct pair of formula from the following column I and II: (Choose the correct alternative) Column I Column II A Current Account Surplus i. Receipts Payments C Balance Current Account i. Receipts + Payments D Current Account Deficit iv. Receipts < Payments Alternatives: а) А -i b) В - ii c) C - ii d) D - ivarrow_forwardFive account classifications are shown as column headings in the table below. For each accountclassification, indicate the manner in which increases and decreases are recorded (i.e., by debits orby credits).Owners’Revenue Expenses Assets Liabilities EquityIncreases recorded by:Decreases recorded by:arrow_forwardSuggest three accounts typical of the liability side of a Balance Sheet. In what side would you enter “discounts earned?”arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education