FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

Answer questions 1 through 4

Transcribed Image Text:What closing entries would McDonald's have made in 2019 based on its trial balance?

McDonald's Corporation (NYSE: MCD) is a publicly held corporation and issued its financial statements for 2019 at year end in 2019. To follow is a condensed and adapted trial balance

as of December 31, 2019, that was constructed from those financial statements

McDonald's Corporation

Trial Balance (adapted for classroom use)

For Year Ended December 31, 2019

Balance

In millions

Debit

Credit

Cash and cash equivalents

$

1,223.4

Accounts receivable, net

1,474.1

Inventories

58.9

Prepaid and other expenses

2,092.2

Property and equipment, net

21,257.6

Other long-term assets

4,917.7

Accounts payable

2$

756.0

Other current liabilities

2,712.3

25,878.5

Long-term debt

Other long-term liabilities

3,881.4

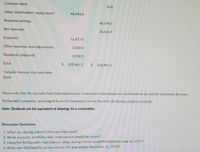

Transcribed Image Text:Common stock

16.6

Other stockholders' equity items*

48,443.6

Retained earnings

44,594.5

Net revenues

24,621.9

Expenses

16,877.4

Other expenses and adjustments

3,058.0

Dividends (adjusted)

3,058.3

Total

102,461.2

$

102,461.2

*includes treasury stock and other

items

Please note that the accounts have been adapted and condensed for educational use and should not be used for investment decisions.

McDonald's complete, unabridged financial statements can be found on its investor relations website.

Note: Dividends are the equivalent of drawings for a corporation.

Discussion Questions

1. What are closing entries? Why are they made?

2. What accounts on McDonald's trial balance should be closed?

3. Using the McDonald's trial balance, what closing entries would McDonald's make for 2019?

4. What was McDonald's net income for the year ended December 31, 2019?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- What information is included in Form 10-K?arrow_forwardQuestion list O Question 1 O Question 2 O Question 3 O Question 4 More Info N 1 2 3 4 5 6 7 8 9 10 To Find F Given P FIP 1.1200 1.2544 1.4049 1.5735 1.7623 1.9738 2.2107 2.4760 2.7731 3.1058 K 0.8929 0,7972 0.7118 0.6355 0.5674 0.5066 0.4523 0.4039 Most likely estimates for a project are as follows. 0.3606 0.3220 To Find P Given F PIF Choose the correct choice below. Determine whether the statement "This project (based upon the most likely estimates) is profitable." is true or false. ✔Click the icon to view the relationship between the PW and the percent change in parameter. Click the icon to view the interest and annuity table for discrete compounding when the MARR is 12% per year False O True To Find F Given A FIA 1.0000 2.1200 3.3744 4.7793 6.3528 8.1152 10.0890 12.2997 14.7757 17.5487 To Find P Given A PIA 0.8929 1.6901 2.4018 3.0373 3.6048 4.1114 4.5638 4.9676 5.3282 5.6502 To Find A Given F AIF 1.0000 04717 0.2963 0.2092 0.1574 0.1232 0.0991 0.0813 0.0877 0.0570 To Find A Given P…arrow_forwardred Question 11 4) Listen Use the graphs below to categorize the statements to describe either Graph A or Graph B. 3 Graph A Graph B 0 #12 " 3/2 2x 0 */2 3/2 2 -1 T graph a graph b Add an answer item! Add an answer item! Answer Bank amplitude = 1 midline is y=3 f(x)= cos(x)+3 amplitude =3 f(x)=3sin(x)+1 midline is y=1 All Changearrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education