Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

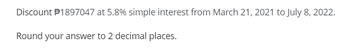

Transcribed Image Text:Discount #1897047 at 5.8% simple interest from March 21, 2021 to July 8, 2022.

Round your answer to 2 decimal places.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- On January 1, 2020, you borrowed S1000 from a bank On December 31, 2020 YON DOO on O N complotely by depositing $1040 ir the rate of innation was 3% the REAL rate of interest on VONGONDN or39 closest fo Select one O 12% O. DO% Oc 1.00% 0.07%arrow_forwardA document for 6,000 pesos for 365 days with interest at 19.5% simple interest, dated August 10, 2023, was discounted 240 days before its maturity at 15.4% simple interest. Find the amount of the operation Question 3 options: 6102.46 6485.46 6370.46 6448.46arrow_forwardPLEASE ANSWER ASAParrow_forward

- https://education.wiley.com/content/Kieso_Intermediate_Accounting_17e/media/simulations/interest_rate_tables.pdfarrow_forward(Click on the following icon in order to copy its contents into a spreadsheet.) Number of Payments or Years 8 16 29 340 Annual Interest Rate 7% 13% 3% 1% Present Value OO 0 0 Annuity $278.45 $1,299.25 $778.69 $464 49 Future Value ? 2 2 2arrow_forwardOn 1st July 2020 Bashir purchase a machine for RO 15,000. The terms of purchase was 20% cash and the balance to be paid in monthly instalments of RO 500. What amount of the loan will be disclosed under Long term liabilities in the balance sheet on 31 Dec 2020? a. RO 3,000 b. RO 5,000 c. RO 7,000 d. RO 6,000arrow_forward

- I need fast answer plz without plagiarismarrow_forwardOn 1st July 2020 Bashir purchase a machine for RO 15,000. The terms of purchase was 20% cash and the balance to be paid in monthly instalments of RO 500. What amount of the loan will be disclosed under current liabilities in the balance sheet on 31 Dec 2020? a. RO 3,000 b. RO 6,000 c. RO 7,000 d. RO 5,000arrow_forward1. Download the monthly prices for IVV and VOO for the time period between January 1, 2018 and December 31, 2022 [60 observations]arrow_forward

- Question 1 Today is 22th March 2020. Jane just purchased a 180-day $100,000 bank bill at a simple interest rate. The purchase price is $98,500. She sold this bank bill on 24th May 2020 at 3.98% p.a. simple interest rate. a) What is the implied per annual simple interest rate for her purchasing (expressed as a percentage and rounded to three decimal places)? Select one: a. 0.076 b. 0.032 c. 0.031 d. 0.088 Question 2 Today is 22th March 2020. Jane just purchased a 180-day $100,000 bank bill at a simple interest rate. The purchase price is $98,500. She sold this bank bill on 24th May 2020 at 3.98% p.a. simple interest rate. b) What is her selling price (rounded to four decimal places)? Select one: a. 98740.2903 b. 98634.0935 c. 98846.7161 d. 99317.7280 Question 3 Today is 22th March 2020. Jane just purchased a 180-day $100,000 bank bill at a simple interest rate. The purchase price is $98,500. She sold this bank bill on 24th May 2020 at 3.98% p.a. simple interest…arrow_forwardCalculate the rebate on bills discounted for each bill for the year end 31.12.2020 Date of bill OMR Period Rate of discount A 15/12/2020 5,000 3 months 12% 5/10/2020 2,000 4 months 14% 2/11/2020 15,000 2 months 5% Rebate on bills discounted on A Rebate on bills discounted on B Rebate on bills discounted on Carrow_forwardUrgent, please answer the question below.This is how you answer the problem,(a) Identify the given (b)Identify the unknown or what is being asked in the problem(c)Solution, include the formula used to solve the problem(d)box the final answerarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education