Cornerstones of Cost Management (Cornerstones Series)

4th Edition

ISBN: 9781305970663

Author: Don R. Hansen, Maryanne M. Mowen

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Question

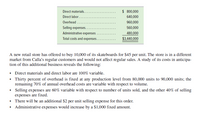

Calla Company produces skateboards that sell for $50 per unit. The company currently has the capacity to produce 90,000 skateboards per year but is selling 80,000 skateboards per year. Annual costs for 80,000 skateboards follow.

Transcribed Image Text:Direct materials.

$ 800,000

Direct labor...

640,000

Overhead .

960,000

Selling expenses..

560,000

Administrative expenses

480,000

Total costs and expenses.

$3,440,000

A new retail store has offered to buy 10,000 of its skateboards for $45 per unit. The store is in a different

market from Calla's regular customers and would not affect regular sales. A study of its costs in anticipa-

tion of this additional business reveals the following:

• Direct materials and direct labor are 100% variable.

• Thirty percent of overhead is fixed at any production level from 80,000 units to 90,000 units; the

remaining 70% of annual overhead costs are variable with respect to volume.

• Selling ex penses are 60% variable with respect to number of units sold, and the other 40% of selling

expenses are fixed.

• There will be an additional $2 per unit selling expense for this order.

• Administrative expenses would increase by a $1,000 fixed amount.

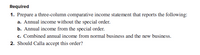

Transcribed Image Text:Required

1. Prepare a three-column comparative income statement that reports the following:

a. Annual income without the special order.

b. Annual income from the special order.

c. Combined annual income from normal business and the new business.

2. Should Calla accept this order?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Homework help. Chapter 25, number 5. Need help filling in the blanks. Thank you!arrow_forwardOwearrow_forwardYou are a marketing manager at a company that manufactures and sells handmade jewelry. Your company is considering participating in a sales carnival event held annually in your city. The sales carnival attracts a large number of visitors, providing an opportunity for businesses to showcase and sell their products. Here are the details of the scenario for Cost-Volume-Profit (CVP) analysis. Fixed costs: Booth rental: RM500 for the duration of the carnival. ✓ Marketing materials: RM200 for banners, flyers and promotional items. ✓ Staffing: RM300 for hiring extra personnel to manage the booth during the event. Variable costs: ➤ Cost of goods sold: RM10 per piece of handmade jewelry. Sales commission: 10% of the selling price for each piece sold at the carnival. Selling price: ■ The selling price of jewelry at the carnival is expected to be RM30 per piece. Your task is to conduct a CVP analysis to determine the feasibility of participating in the sales carnival. Consider the following…arrow_forward

- Boston Home Center (BHC) offers customers the use of a truck at $44 per trip to take purchased merchandise home. BHC reports the following information about the trucks it has for customer usage: Cost Driver Rate Cost Driver Volume Resources used Operation $ 0.55 per mile 45,400 miles Administration 25.00 per trip 1,870 trips Resources supplied Operation $ 35,000 Administration $ 62,000 Required: Compute the cost of unused operation and administration resource capacity for Boston Home Center. unused resource capacity operation administrationarrow_forwardCalla Company produces skateboards that sell for $55 per unit. The company currently has the capacity to produce 95,000 skateboards per year, but is selling 81,800 skateboards per year. Annual costs for 81,800 skateboards follow. Direct materials $ 948,880 Direct labor 597,140 Overhead 952,000 Selling expenses 542,000 Administrative expenses 480,000 Total costs and expenses $ 3,520,020 A new retail store has offered to buy 13,200 of its skateboards for $50 per unit. The store is in a different market from Calla's regular customers and would not affect regular sales. A study of its costs in anticipation of this additional business reveals the following: Direct materials and direct labor are 100% variable. 40 percent of overhead is fixed at any production level from 81,800 units to 95,000 units; the remaining 60% of annual overhead costs are variable with respect to volume. Selling expenses are 60% variable with respect to number of…arrow_forwardA furniture company manufactures desks and chairs. Each desk uses four units of wood, and each chair uses three units of wood. A desk contributes $250 to profit, and a chair contributes $145. Marketing restrictions require that the number of chairs produced be at least four times the number of desks produced. There are 2,000 units of wood available. Use Solver to maximize the company's profit. a. What is the optimized company's profit? Use SolverTable to see what happens to the decision variables and the total profit when the availability of wood varies from 1,000 to 3,000 in 100-unit increments. Based on your findings, how much would the company be willing to pay for each extra unit of wood over its current 2,000 units? How much profit would the company lose if it lost any of its current 2,000 units? Round the answer to a whole dollar amount.arrow_forward

- Please do not give solution in image format ? And Fast Answering Please ? And Explain Proper Step by Step.arrow_forwardRequire mation [The following information applies to the questions displayed below.] The Fashion Shoe Company operates a chain of women's shoe shops that carry many styles of shoes that are all sold at the same price. Sales personnel in the shops are paid a sales commission on each pair of shoes sold plus a small base salary. The following data pertains to Shop 48 and is typical of the company's many outlets: Per Pair of Shoes Selling price $ 40.00 Variable expenses: Invoice cost $ 14.00 Sales commission 6.00 Total variable expenses $ 20.00 Annual Fixed expenses: Advertising $ 49,000 41,000 Rent Salaries 195,000 $ 285,000 Total fixed expenses 5. Refer to the original data. As an alternative to (4) above, the company is considering paying the Shop 48 store manager 55 cents commission on each pair of shoes sold in excess of the break-even point. If this change is made, what will be Shop 48's net operating income (loss) if 17,050 pairs of shoes are sold? (Do not round intermediate…arrow_forward4. Boutique El caballero, S.A., manufactures three types of garments that require the use of a special machine. There are only 36,000 machine hours available, per month. We have the following information: Pants Shirt Coat Sale price $ 160 $ 80 $ 170 Variable cost $ 45 $ 20 $ 40 Machine hours 5 7 6 Monthly demand 1,000 1,200 4,000 How many units of the coat product should be sold to maximize your profits? Procedure pleaseearrow_forward

- The company produced 500 boxes during the year. Variable selling and administrative expenses are P0.90 per box unit. Variable manufacturing costs are P5.25 per box and fixed manufacturing overhead costs total P1,375 for the year. What is the company’s direct costing profit? P2,540 P2,265 P1,000 P725arrow_forwardCalla Company produces skateboards that sell for $50 per unit. The company currently has the capacity to produce 90,000 skateboards per year but is selling 80,000 skateboards per year. Annual costs for 80,000 skateboards follow. Direct materials $ 800,000 Direct labor 640,000 Overhead . 960,000 Selling expenses 560,000 Administrative expenses . 480,000 Total costs and expenses $3,440,000 A new retail store has offered to buy 10,000 of its skateboards for $45 per unit. The store is in a different market from Calla’s regular customers and would not affect regular sales. A study of its costs in anticipation of this additional business reveals the following: ∙ Direct materials and direct labor are 100% variable. ∙ Thirty percent of overhead is fixed at any production level from 80,000 units to 90,000 units; the remaining 70% of annual overhead costs are variable with respect to volume. ∙ Selling expenses are 60% variable with respect to number of units sold, and the other 40% of selling…arrow_forwardPROBLEM. Please show your computations to receive full credit. Mariposa Manufacturing builds custom wooden cabinets. Mariposa Manufacturing has reported the following costs for the previous year. Assume no production inventories. Advertising $70,500 $34,000 $117,800 $63,000 $17,500 $76,000 $3,800 $40,700 $41,600 $22,900 $31,800 Cost of hardware (sides, handles, etc.) Cost of Wood Depreciation on Production Equipment Factory Property Taxes Factory Rent Glue Production Supervisor Salary Sales Manager Salary Utilities for Factory Wages for Maintenance Workers Wages of Assembly Workers Wages of Finishing Workers $91,400 $77,800 Compute the following: i. Direct material costs ii. Direct labor cost iii. Manufacturing overhead iv. Total manufacturing cost v. Prime cost vi. Conversion cost vii. Total period cost Edit Format Table 12pt v Paragraph B IU Aarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...

Accounting

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Cengage Learning