Excel Applications for Accounting Principles

4th Edition

ISBN: 9781111581565

Author: Gaylord N. Smith

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

Please do not give image format and solve all required

Transcribed Image Text:4

Problem 9.32 Basic Variance Analysis, Revision of Standards, Journal Entries

Petrillo Company produces engine parts for large motors. The company uses a standard cost

system for production costing and control. The standard cost sheet for one of its higher volume

products (a valve) is as follows:

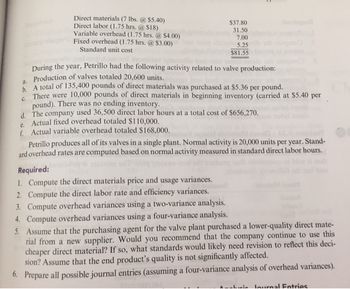

Transcribed Image Text:Direct materials (7 lbs. @ $5.40)

Direct labor (1.75 hrs. @ $18)

Variable overhead (1.75 hrs. @ $4.00)

Fixed overhead (1.75 hrs. @ $3.00)

Standard unit cost

$37.80

31.50

7.00

5.25

$81.55

During the year, Petrillo had the following activity related to valve production:

a. Production of valves totaled 20,600 units.

b. A total of 135,400 pounds of direct materials was purchased at $5.36 per pound.

C.

There were 10,000 pounds of direct materials in beginning inventory (carried at $5.40 per

pound). There was no ending inventory.

d. The company used 36,500 direct labor hours at a total cost of $656,270.

e. Actual fixed overhead totaled $110,000.

f. Actual variable overhead totaled $168,000.

Petrillo produces all of its valves in a single plant. Normal activity is 20,000 units per year. Stand-

ard overhead rates are computed based on normal activity measured in standard direct labor hours.

Required:

1. Compute the direct materials price and usage variances.

2. Compute the direct labor rate and efficiency variances.

3. Compute overhead variances using a two-variance analysis.

4. Compute overhead variances using a four-variance analysis.

5. Assume that the purchasing agent for the valve plant purchased a lower-quality direct mate-

rial from a new supplier. Would you recommend that the company continue to use this

cheaper direct material? If so, what standards would likely need revision to reflect this deci-

sion? Assume that the end product's quality is not significantly affected.

6. Prepare all possible journal entries (assuming a four-variance analysis of overhead variances).

in lournal Entries

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 5 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Provide answer A and Barrow_forwardPlease do not give solution in image format thankuarrow_forwardBasic Variance Analysis, Revision of Standards, Journal Entries Petrillo Company produces engine parts for large motors. The company uses a standard cost system for production costing and control. The standard cost sheet for one of its higher volume products (a valve) is as follows: Direct materials (7 lbs. @ $5.40) $37.80 Direct labor (1.75 hrs. @ $18) 31.50 Variable overhead (1.75 hrs. @ $4.00) 7.00 Fixed overhead (1.75 hrs. @ $3.00) 5.25 Standard cost per unit $81.55 During the year, Petrillo had the following activity related to valve production: Production of valves totaled 20,600 units. A total of 135,500 pounds of direct materials was purchased at $5.36 per pound. There were 10,000 pounds of direct materials in beginning inventory (carried at $5.40 per pound). There was no ending inventory. The company used 36,500 direct labor hours at a total cost of $656,270. Actual fixed overhead totaled $111,000. Actual variable overhead totaled $169,000. Petrillo produces…arrow_forward

- Basic Variance Analysis, Revision of Standards, Journal Entries Petrillo Company produces engine parts for large motors. The company uses a standard cost system for production costing and control. The standard cost sheet for one of its higher volume products (a valve) is as follows: Direct materials (7 lbs. @ $5.40) $37.80 Direct labor (1.75 hrs. @ $18) 31.50 Variable overhead (1.75 hrs. @ $4.00) 7.00 Fixed overhead (1.75 hrs. @ $3.00) 5.25 Standard cost per unit $81.55 During the year, Petrillo had the following activity related to valve production: Production of valves totaled 20,600 units. A total of 135,500 pounds of direct materials was purchased at $5.36 per pound. There were 10,000 pounds of direct materials in beginning inventory (carried at $5.40 per pound). There was no ending inventory. The company used 36,500 direct labor hours at a total cost of $656,270. Actual fixed overhead totaled $111,000. Actual variable overhead totaled $169,000. Petrillo produces…arrow_forwardBasic Variance Analysis, Revision of Standards, Journal Entries Petrillo Company produces engine parts for large motors. The company uses a standard cost system for production costing and control. The standard cost sheet for one of its higher volume products (a valve) is as follows: Direct materials (7 lbs. @ $5.40) $37.80 Direct labor (1.75 hrs. @ $18) 31.50 Variable overhead (1.75 hrs. @ $4.00) 7.00 Fixed overhead (1.75 hrs. @ $3.00) 5.25 Standard cost per unit $81.55 During the year, Petrillo had the following activity related to valve production: Production of valves totaled 20,600 units. A total of 135,600 pounds of direct materials was purchased at $5.36 per pound. There were 10,000 pounds of direct materials in beginning inventory (carried at $5.40 per pound). There was no ending inventory. The company used 36,500 direct labor hours at a total cost of $656,270. Actual fixed overhead totaled $110,000. Actual variable overhead totaled $170,000. Petrillo produces…arrow_forwardKamen Manufacturing Co. estimates the following labor and overhead costs for the period: Required: Use the four-variance method for overhead analysis. Calculate the variances for direct labor and overhead. Prove that the overhead variances equal over- or underapplied factory overhead for the period.arrow_forward

- If variances are recorded in the accounts at the time the manufacturing costs are incurred, what does a debit balance in Direct Materials Price Variance represent?arrow_forwardH.J. Heinz Company uses standards to control its materials costs. Assume that a batch of ketchup (7,650 pounds) has the following standards: The actual materials in a batch may vary from the standard due to tomato characteristics. Assume that the actual quantities of materials for batch 08-99 were as follows: a. Determine the standard unit materials cost per pound for a standard batch. b. Determine the direct materials quantity variance for batch 08-99.arrow_forwardThe worksheet you have developed will handle most simple variance analysis problems. Try the problem below for Pscheidl, Inc.: Actual production for October was 11,500 units. Compute the direct materials and direct labor variances for Pscheidl, Inc. Be careful when entering your input because this problem presents the information in a different format from the McGrade Industries data. Save the file as PRIMEVAR4. Print the worksheet when done.arrow_forward

- Computing materials variances D-List Calendar Co. specializes in manufacturing calendars that depict obscure comedians. The company uses a standard cost system to control its costs. During one month of operations, the direct materials costs and the quantities of paper used showed the following: Calculate the following: 1. Total cost of purchases for the month 2. Materials purchase price variance 3. Materials quantity variance 4. Net materials variancearrow_forwardDirect materials, direct labor, and factory overhead cost variance analysis Mackinaw Inc. processes a base chemical into plastic. Standard costs and actual costs for direct materials, direct labor, and factory overhead incurred for the manufacture of 40,000 units of product were as follows: Each unit requires 0.3 hour of direct labor. Instructions Determine (A) the direct materials price variance, direct materials quantity variance, and total direct materials cost variance; (B) the direct labor rate variance, direct labor time variance, and total direct labor cost variance; and (C) the variable factory overhead controllable variance, fixed factory overhead volume variance, and total factory overhead cost variance.arrow_forwardTokan company has the following information concerning it's direct material need answer this questionarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning

Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning Accounting (Text Only)AccountingISBN:9781285743615Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Accounting (Text Only)AccountingISBN:9781285743615Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning Financial & Managerial AccountingAccountingISBN:9781285866307Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial & Managerial AccountingAccountingISBN:9781285866307Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning Financial & Managerial AccountingAccountingISBN:9781337119207Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial & Managerial AccountingAccountingISBN:9781337119207Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Excel Applications for Accounting Principles

Accounting

ISBN:9781111581565

Author:Gaylord N. Smith

Publisher:Cengage Learning

Accounting (Text Only)

Accounting

ISBN:9781285743615

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Cengage Learning

Financial & Managerial Accounting

Accounting

ISBN:9781285866307

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Cengage Learning

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Principles of Cost Accounting

Accounting

ISBN:9781305087408

Author:Edward J. Vanderbeck, Maria R. Mitchell

Publisher:Cengage Learning

Financial & Managerial Accounting

Accounting

ISBN:9781337119207

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Cengage Learning