FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

Rank the support departments based on the percentage of their services provided to other support departments. Use this ranking to allocate the support departments’ costs to the operating departments based on the step-down method.

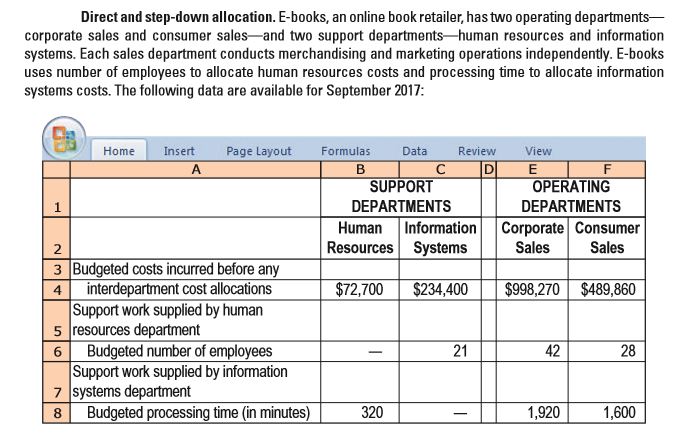

Transcribed Image Text:Direct and step-down allocation. E-books, an online book retailer, has two operating departments-

corporate sales and consumer sales-and two support departments-human resources and information

systems. Each sales department conducts merchandising and marketing operations independently. E-books

uses number of employees to allocate human resources costs and processing time to allocate information

systems costs. The following data are available for September 2017:

Page Layout

Data

Home

Insert

Formulas

Review

View

в

SUPPORT

ID

OPERATING

DEPARTMENTS

DEPARTMENTS

Corporate Consumer

Sales

Sales

Human

Information

Resources Systems

3 Budgeted costs incurred before any

interdepartment cost allocations

Support work supplied by human

5 resources department

Budgeted number of employees

Support work supplied by information

7 systems department

Budgeted processing time (in minutes)

$72,700

$234,400

$998,270 $489,860

4

21

42

28

8.

320

1,920

1,600

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps with 4 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- What is the measured mile approach used for?a. Calculate budget spentb. Measure office overheadc. Calculate loss of productivityd. Measure unit costs on sitearrow_forwardFor each of the following expenses, select the best allocation basis. A. Value of insured assets. B. Square feet of space occupied. C. Proportion of total purchase orders for each operating department. D. Number of employees in department. Maintenance department expenses of the operating departments. Payroll department expenses of all departments. Purchasing department expenses for the operating departments. Insurance expenses of all departments.arrow_forwardA department’s conversion costs are equal to the ________ and assigned direct labor costs. Select answer from the options below A. sum of its allocated overhead costs B. difference between its materials costs C. sum of its materials costs D. difference between its allocated overhead costsarrow_forward

- Discuss the components of the Contribution Margin Income Statement, how does management use this in the decision making process?arrow_forwardPart 1: Allocate the costs of the 3 service departments using the direct method. Part 2: Allocate the costs of the 3 service departments using the step method, with the order determined by the greater percentage usage. Part 3: Allocate the costs of the 3 service departments using the reciprical method. Part 4:What is one strength and one drawback of each of the methods?arrow_forwardCost accounting provides management with a variety of cost classifications that can be used for different decision-making processes. Write your opinion on how management could use each of the following cost classification for decision making: Direct and indirect costs. Fixed, variable, and mixed costs. Period and product costs. Manufacturing and selling costs. Standards and actual costs.arrow_forward

- Which one of the following options can be used when allocating cafeteria costs? Select one: a. Number of square feet b. Appraised value of square footage c. Number of direct labor hours d. Number of employeesarrow_forwardcompany You are a management accountant of EON and Brothers Ltd., a manufacturing that produces two products simultaneously in one of their production plants. You are asked to produce a management report on costing techniques. This company follows a traditional approach to costing and absorbs production overhead using machine hours. The company's policy is to add a 50% markup on the unit cost to obtain the selling price. The relevant information is given below: EON and Brothers Ltd. produces two similar products called Alfa and Beta. Total Overheads = £155,000 Machine Hours = 58980 hrs Product Alfa Beta Production Units 2,580 5,100 Material Cost per unit £31 £51 Labour Cost per unit £21 £17 Machine Hours per unit 11 16 After discussing with all the important people of the production plant you have allocated the overhead costs as mentioned below: % Overheads Set up Costs 30 Inspections 40 Materials Handling 30 Cost Pools are as mentioned below: Alfa Beta Total Setups 400 65 465…arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education