ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

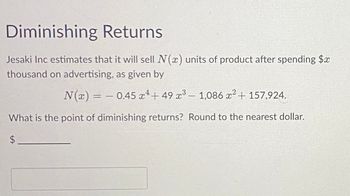

Transcribed Image Text:Diminishing Returns

Jesaki Inc estimates that it will sell N(x) units of product after spending $x

thousand on advertising, as given by

N(x) = -0.45x¹+49 x³ - 1,086 x² + 157,924.

What is the point of diminishing returns? Round to the nearest dollar.

$

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- The table below depicts the prices and total costs a local used-book store faces. The bookstore competes with a number of similar stores, but it capitalizes on its location and the word-of-mouth reputation of the coffee it serves to its customers. Calculate the store's total revenue, total profit, marginal revenue, and marginal cost at each level of output, beginning with the first unit (Enter all values rounded to the nearest penny.) Total Price per Book (S) Costs ($) Total Total Marginal Revenue (S) Marginal Cost ($) Revenue ($) Profit (S) - 4 Output 5.75 4.00 1 5.50 7.25 5.5 - 1.75 5.5 3.25 2 5.25 9.50 10.5 1 2.25 3 5.00 11.60 15 3.4 4.5 2.1 4 4.75 14.10 19 4.9 4 25 4.50 17.60 22.5 4.9 3.5 3.5 6 4.25 21.75 25.5 3.75 3 4.15 7 4.00 26.50 28 1.5 2.5 4.75 Based on marginal analysis, what is the approximate profit-maximizing level of output for this business?arrow_forwardKasey Puzzle, Inc. sells geography-based puzzles. Kasey currently sells 25,000 units a month for $40 each, has variable costs of $20 per unit, and fixed costs of $300,000. Kasey Puzzle is considering increasing the price of its units to $60 per unit. This will not affect costs, but demand is expected to drop 20%. Should Kasey Puzzle increase the price of its product? с Multiple Choice O O Yes, profit will increase $500,000. No, profit will decrease $500,000. No, profit will decrease $300,000. Yes; profit will increase $300,000.arrow_forwardFITnest is one of the few fitness centers serving the greater area. The gym has been open for 3 years. It charges a flat price of $25 per visit to its clients, and the firm’s current average cost of production is $10 per visit. (You may assume that average cost has the “traditional U-shape”.) a) The owners of the gym heard you are studying economics, and they want some advice on how they could possibly increase their profits through price discrimination, which is a concept they have heard of but do not know much about. Provide an explanation of what price discrimination is and give them an example of how they could use group pricing in their climbing gym business. Explain how group pricing works to increase their profit. b) Given the current situation in the market for fitness in the area, would you expect to see competitors enter or exit the market? Explain. c) Given the current market conditions, what would you predict to observe in the long run with respect to the demand for…arrow_forward

- Could you fully explain the part (C)? And please dont miss any details.arrow_forwardA demand of 230 banquet attendees can be expected at a dinner plate price of $80.00 each. A demand of 370 banquet attendees can be expected at a dinner plate price of $45.00 each. Catering Service A has a fixed cost of $1,800 and a marginal cost of $30 for each plate. Catering Service B has a fixed cost of $2,500 and a marginal cost of $22 for each plate. Costs for both caterers include the food, drinks, plates, utensils, tablecloths, glasses, crew, and cleanup. Dinner plates will only be sold as an entire unit. To justify company resources and to ensure the event will benefit the charity, the CEO insists the tickets be sold for no less than $40. All profits will go toward a charity of the committee's choosing. Additional spontaneous donation to the charity will be accepted the night of the banquet. Studies estimate that 5% will give $5, 23% will give $20, 18% will give $50, 7% will give $100, and 2% will give $500. Find the Profit function, P(x) , for each of the two possible…arrow_forwardIn the following problem, find the profit maximizing quantity and graph the marginal revenue and marginal cost. Interpret your first-order condition in terms of marginal benefit and marginal cost. max π = (12 - Q)Q-20² 9arrow_forward

- Note:- Do not provide handwritten solution. Maintain accuracy and quality in your answer. Take care of plagiarism. Answer completely. You will get up vote for sure.arrow_forwardTo produce x units of t-shirts costs C(x) = 7.50x + 1200. The revenue is R(x) = 16x. a) Find the break-even point b) How many t-shirts needs to be produced and sold in order to make a profit of $500?arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education