ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

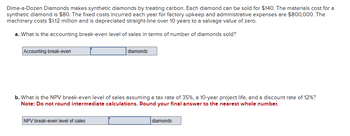

Transcribed Image Text:Dime-a-Dozen Diamonds makes synthetic diamonds by treating carbon. Each diamond can be sold for $140. The materials cost for a

synthetic diamond is $80. The fixed costs incurred each year for factory upkeep and administrative expenses are $800,000. The

machinery costs $1.12 million and is depreciated straight-line over 10 years to a salvage value of zero.

a. What is the accounting break-even level of sales in terms of number of diamonds sold?

Accounting break-even

diamonds

b. What is the NPV break-even level of sales assuming a tax rate of 35%, a 10-year project life, and a discount rate of 12%?

Note: Do not round intermediate calculations. Round your final answer to the nearest whole number.

NPV break-even level of sales

diamonds

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 4 steps with 3 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- Cost Flow Relationships The following information is available for the first month of operations of Bahadir Company, a manufacturer of mechanical pencils: Sales $792,000 Gross profit 462,000 Cost of goods manufactured 396,000 Indirect labor 171,600 Factory depreciation 26,400 Materials purchased 244,200 Total manufacturing costs for the period 455,400 Materials inventory, ending 33,000 Using the above information, determine the following missing amounts: a. Cost of goods sold $330,000 b. Finished goods inventory at the end of the month 66,000 c. Direct materials cost 211,200 d. Direct labor cost e. Work in process inventory at the end of the montharrow_forwardProblem 16-15 (Algo) The owner of a large machine shop has just finished Its financial analysis from the prior fiscal year. Following is an excerpt from the final report: Net revenue Cost of goods sold Value of production materials on hand Value of work-in-process inventory Value of finished goods on hand $368,000 317,000 42,500 59,000 23,500 a. Compute the inventory turnover ratio (ITR). (Round your answer to 1 decimal place.) Inventory turnover ratio per year b. Compute the weeks of supply (WS). (Do not round Intermediate calculations. Round your answer to 1 decimal place.) Weeks of supplyarrow_forwardUse tables to answer questionarrow_forward

- Can you please show me how to do these parts on excel? I have included the solutions to the parts, but I need to see how it is done with the formulas/equations on Excel, so I can fully understand what is going on. Thank you in advance!arrow_forwardEconomic Dispatch Question It is required to investigate the economic dispatch of three power plants located in the western part of Victoria. The total load (PD) to be supplied by those power plants is 1500 MW. Assume the cost functions and the generation limits for these power plants are as follows. 350+ 4.2 P₁ + 0.006 P² 600 + 3.1 P₂ + 0.004 P² 500+ 4.2 P3 +0.007 P3 a) b) c) Plant 1: C₁ Plant 2: C₂ Plant 3: C3 = = = 150 ≤ P₁ ≤ 550 350 ≤ P₂ ≤ 700 120 ≤P3 ≤ 400 If the total load is shared among the three power plants equally, what is power generation of each power plant and what is the total operating cost in $/hr in this case. Find the optimal (economic) dispatch of each plant, the incremental operating cost 1, and the total operation cost in $/hr. (You don't need to use the iteration method). If it is expected that those power plant will operate in average 18 hrs a day, how much saving in cost if the economic dispatch operation with shared power operation (in part a).arrow_forwardPLease Helparrow_forward

- D.1.arrow_forwardManagerial economics not account so please answer this asap!!!arrow_forwardFirm XYZ sells calculators. It operates in a plant worth $2,500,000 and maintains production equipment worth $4,000,000. Currently, it has 150,000 calculators in reserved inventory that it plans to sell next month to retail stores for $50 each. Its board of directors has $1.50 million in government bonds and $105,000 in savings for use as payroll and emergency funds. In addition, XYZ employs several workers whose collective worth in terms of skill and knowledge is equal to $305,000. The capital stock of firm XYZ is S. (Enter your response rounded to the nearest dollar.)arrow_forward

- lamps: Lampshares Brass posts Straight-line depreciation Supervisors salaries Utilities Total N 100 500 600 1,800 200 N 3,200 b. What was the cost per lamp? For each component of the lamp? What type of cost behaviour would each of the costs exhibit? If Wally Company produces 300 lamps this month, would you expect the cost per lamp to increase or decrease? Why?arrow_forwardA builder paid $120,000 for a house and lot. The value of the land was appraised at $65,000, and the value of the house at $55,000. The house was then torn down at an additional cost of $8,000 so that a warehouse could be built on the lot at a cost of $50,000. What is the total value of the property with the warehouse? For depreciation purposes, what is the cost basis for the warehouse?arrow_forwardUrgent...arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education