FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

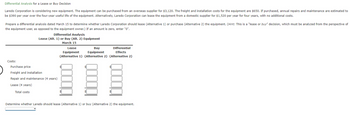

Transcribed Image Text:**Differential Analysis for a Lease or Buy Decision**

Laredo Corporation is considering new equipment. The equipment can be purchased from an overseas supplier for $3,120. The freight and installation costs for the equipment are $650. If purchased, annual repairs and maintenance are estimated to be $390 per year over the four-year useful life of the equipment. Alternatively, Laredo Corporation can lease the equipment from a domestic supplier for $1,520 per year for four years, with no additional costs.

Prepare a differential analysis dated March 15 to determine whether Laredo Corporation should lease (Alternative 1) or purchase (Alternative 2) the equipment. *(Hint: This is a "lease or buy" decision, which must be analyzed from the perspective of the equipment user, as opposed to the equipment owner.) If an amount is zero, enter "0".*

---

### Differential Analysis

**Lease (Alt. 1) or Buy (Alt. 2) Equipment**

**March 15**

| Costs | Lease Equipment (Alternative 1) | Buy Equipment (Alternative 2) | Differential Effects (Alternative 2) |

|------------------------------|---------------------------------|-------------------------------|--------------------------------------|

| Purchase price | $ | $ | $ |

| Freight and installation | $ | $ | $ |

| Repair and maintenance (4 years) | $ | $ | $ |

| Lease (4 years) | $ | $ | $ |

| **Total costs** | $ | $ | $ |

---

Determine whether Laredo should lease (Alternative 1) or buy (Alternative 2) the equipment.

---

**Explanation of the Table:**

This table presents a structured comparison to aid in the decision-making process regarding leasing or purchasing equipment. It outlines the cost components involved in each alternative:

1. **Purchase Price**: The initial purchase cost if the equipment is bought.

2. **Freight and Installation**: Additional costs for setting up the equipment if purchased.

3. **Repair and Maintenance (4 years)**: Estimated upkeep costs over four years if the equipment is purchased.

4. **Lease (4 years)**: Total lease payments over four years if the equipment is leased.

5. **Total Costs**: The sum of all expenditures for each alternative.

The "Differential Effects" column helps in identifying the cost difference between the two options

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Five Star is considering leasing a building and buying the necessary equipment to operate a public warehouse. Alternatively, the company could use the funds to invest in $149,600 of 5% U.S. Treasury bonds that mature in 16 years. The bonds could be purchased at face value. The following data have been assembled: Cost of equipment Life of equipment Estimated residual value of equipment Yearly costs to operate the warehouse, excluding depreciation of equipment Yearly expected revenues-years 1-8 Yearly expected revenues-years 9-16 Required: Differential revenue from alternatives: Revenue from operating warehouse Revenue from investment in bonds Differential revenue from operating warehouse 1. Prepare a differential analysis report of the proposed operation of the warehouse for the 16 years as compared with present conditions. Five Star Proposal to Operate Warehouse. Differential cost of alternatives: Costs to operate warehouse ✓ $149,600 16 years $27,500 Cost of equipment less residual…arrow_forwardDifferential Analysis for a Lease or Buy Decision Sloan Corporation is considering new equipment. The equipment can be purchased from an overseas supplier for $3,260. The freight and installation costs for the equipment are $610. If purchased, annual repairs and maintenance are estimated to be $390 per year over the four-year useful life of the equipment. Alternatively, Sloan can lease the equipment from a domestic supplier for $1,580 per year for four years, with no additional costs. Question Content Area Prepare a differential analysis dated December 3, to determine whether Sloan should lease (Alternative 1) or purchase (Alternative 2) the machine. (Hint: This is a "lease or buy" decision, which must be analyzed from the perspective of the machine user, as opposed to the machine owner.) If an amount is zero, enter "0". Use a minus sign to indicate a loss. Differential AnalysisLease Equipment (Alt. 1) or Buy Equipment (Alt. 2)December 3 Lease Equipment (Alternative 1) Buy…arrow_forwardDeutsche Transport can lease a truck for four years at a cost of €38,000 annually. It can instead buy a truck at a cost of €88,000, with annual maintenance expenses of €18,000. The truck will be sold at the end of four years for €24,500. Ignore taxes. a. What is the equivalent annual cost of buying and maintaining the truck if the discount rate is 12%? Note: Do not round intermediate calculations. Enter your answer in euros. Round your answer to the nearest whole number. b. Which is the better option: leasing or buying? a. Equivalent annual cost b. Better optionarrow_forward

- Lawrence Corp. is considering the purchase of a new piece of equipment. When discourtaed at a hurde rete l te project hant etw of $24,58O, When discounted at a hurdie rate of 10%, the project has a net present value of ($28340), The intemal rate of retum d te pis Multiple Choice zero. between zero and 8% between 8% and 10% greater than 10% Next> 18 of 20 # ( Prev lulook Airarrow_forwardDifferential Analysis for a Lease or Buy Decision Laredo Corporation is considering new equipment. The equipment can be purchased from an overseas supplier for $3,000. The freight and installation costs for the equipment are $620. If purchased, annual repairs and maintenance are estimated to be $420 per year over the four-year useful life of the equipment. Alternatively, Laredo Corporation can lease the equipment from a domestic supplier for $1,380 per year for four years, with no additional costs. Prepare a differential analysis dated March 15 to determine whether Laredo Corporation should lease (Alternative 1) or purchase (Alternative 2) the equipment. (Hint: This is a "lease or buy" decision, which must be analyzed from the perspective of the equipment user, as opposed to the equipment owner.) If an amount is zero, enter "0". Differential Analysis Lease (Alt. 1) or Buy (Alt. 2) Equipment March 15 Lease Buy Differential Equipment (Alternative 1) (Alternative 2) (Alternative 2)…arrow_forwardDifferential Analysis for a Lease or Buy Decision Laredo Corporation is considering new equipment. The equipment can be purchased from an overseas supplier for $3,220. The freight and installation costs for the equipment are $660. If purchased, annual repairs and maintenance are estimated to be $400 per year over the four-year useful life of the equipment. Alternatively, Laredo Corporation can lease the equipment from a domestic supplier for $1,420 per year for four years, with no additional costs. Prepare a differential analysis dated March 15 to determine whether Laredo Corporation should lease (Alternative 1) or purchase (Alternative 2) the equipment. (Hint: This is a "lease or buy" decision, which must be analyzed from the perspective of the equipment user, as opposed to the equipment owner.) If an amount is zero, enter "0". Differential Analysis Lease (Alt. 1) or Buy (Alt. 2) Equipment March 15 Lease Buy Differential Equipment (Alternative 1) (Alternative 2) (Alternative 2)…arrow_forward

- Seroja Berhad (Seroja) wishes to evaluate the following two alternatives available to acquire a machine: Lease Alternative Seroja can lease the machine under a 5-year lease requiring lease payment of RM5,000 at the beginning of each year. All maintenance costs will be borne by the lessor and the insurance and other costs will be borne by the lessee. “Borrowing to Buy” Alternative The machine costs RM20,000 and will have a 5-year life. The purchase will be financed by a 5year, 15% interest. Seroja will pay RM1,000 per year for a service contract that covers insurance and other costs. Seroja Berhad plans to keep the machine and use it beyond its 5-year life. The machine will be depreciated as given below: Year Depreciation RM 1 5,000 2 4,000 3 3,000 4 2,000 5 1,000 Given that the corporate tax rate is 30%. Prepare the Cash Flows Analysis by clearly showing the Net Advantage of Leasing (NAL).…arrow_forwardClick to see additional instructions A company is considering an investment in a new product with a 10-year horizon (product will be sold for 10 years). The upfront investment is $5 million and it is assumed to depreciate on a straight-line basis for 10 years, with no residual value. Fixed costs are assumed to be $550,000 per year. The company estimates variable cost per unit (v) to be $120 and expects to sell each unit for $425. There are no taxes and the required rate of return is 17% per year. Assume that the investment would occur today, and all future cash-flows will occur at the end of each year beginning in one year. What is the annual financial breakeven quantity? [Keep at least 3 decimals for intermediate answers. Round your final answer UP to the next highest WHOLE unit. (ie 421.2 would be rounded to 422)]arrow_forwardPlease solve the problemarrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education