FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

thumb_up100%

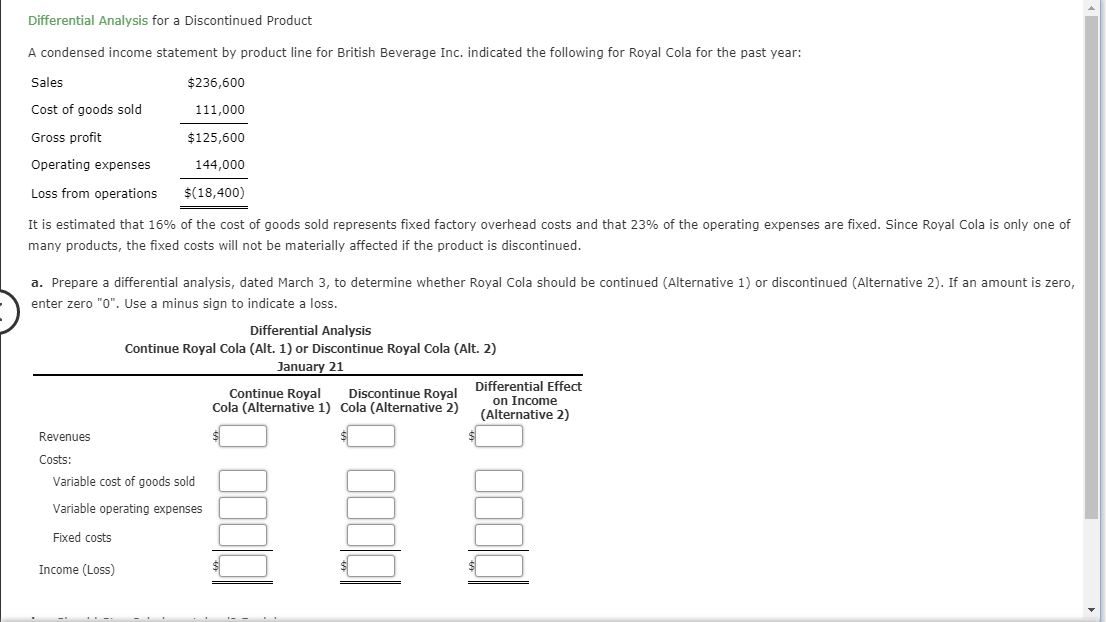

Transcribed Image Text:Differential Analysis for a Discontinued Product

A condensed income statement by product line for British Beverage Inc. indicated the following for Royal Cola for the past year:

Sales

$236,600

Cost of goods sold

111,000

Gross profit

$125,600

Operating expenses

144,000

Loss from operations

$(18,400)

It is estimated that 16 % of the cost of goods sold represents fixed factory overhead costs and that 23 % of the operating expenses are fixed. Since Royal Cola is only one of

many products, the fixed costs will not be materially affected if the product is discontinued

a. Prepare a differential analysis, dated March 3, to determine whether Royal Cola should be continued (Alternative 1) or discontinued (Alternative 2). If an amount is zero,

enter zero "0". Use a minus sign to indicate a loss.

Differential Analysis

Continue Royal Cola (Alt. 1) or Discontinue Royal Cola (Alt. 2)

January 21

Differential Effect

Continue Royal

Cola (Alternative 1) Cola (Alternative 2)

Discontinue Royal

on Income

(Alternative 2)

Revenues

Costs:

Variable cost of goods sold

Variable operating expenses

Fixed costs

$

Income (Loss)

Transcribed Image Text:decrease

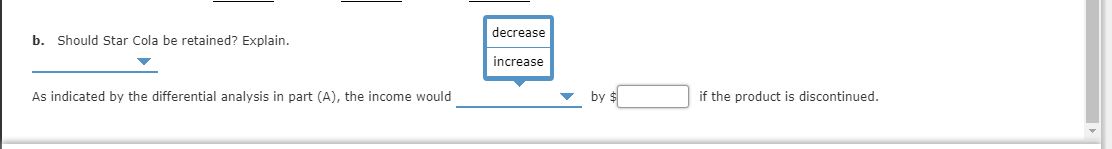

b. Should Star Cola be retained? Explain.

increase

by $

As indicated by the differential analysis in part (A), the income would

if the product is discontinued.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 1 images

Knowledge Booster

Similar questions

- QUESTION 22 Which of the following is an incorrect statement? Revenue - Operating Income = Gross Margin Revenue = Price * Qty sold or TR = P*Q EAT = EBT - Taxes Income - Expenses = Operating Income Revenue - CGS = Gross Profitarrow_forwardThe method of comparators can be applied using the ratio of operating income to revenue as a basis for valuation. If operating income is negative this means operating income cannot be used to create a value multiple the value of the business is negative the value of the business is zero the business cannot be soldarrow_forwardWhat is meant by discontinued operations, and what can I put as one example.What is meant by comprehensive income? and what example can I put downarrow_forward

- Your answer is incorrect. Divide the estimated average annual income by the average investment. Investment cost plus residual value, divided by two, equals average investment. Can you please redo it? Thanksarrow_forwardThe gross profit margin is unchanged, but the net profit margin declined over the same period. What could be the reason for this change? Cost of goods sold has increased Revenue has increased relative to expenses The tax rate on income has increased Dividends were decreasedarrow_forwardTrue or False: Gross profit is equal to the gross profit margin multiplied by the net sales. Select one: O True O False 4arrow_forward

- Which of the following items will not cause the company's ROA to increase? Multiple Choice O O Reducing costs. Reducing company assets without impacting sales. Increasing company assets. Increasing the selling price per unit. $arrow_forwardAssuming all other things are the same, selling price per unit must have even point. Select one: O A. remained the same O B. increased O C. increased first, then decreased O D. decreased if there was a decrease in the break-arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education