FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

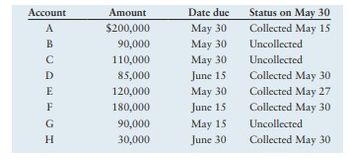

Factoring Blair Finance factors the accounts of the Holder Company. All eight factored accounts are shown in the following table, with the amount factored, the date due, and the status on May 30. Indicate the amounts that Blair should have remitted to Holder as of May 30 and the dates of those remittances. Assume that the factor’s commission of 2% is deducted as part of determining the amount of the remittance.

Transcribed Image Text:Account

ABCDEFGH

Amount

$200,000

90,000

110,000

85,000

120,000

180,000

90,000

30,000

Date due

May 30

May 30

May 30

June 15

May 30

June 15

May 15

June 30

Status on May 30

Collected May 15

Uncollected

Uncollected

Collected May 30

Collected May 27

Collected May 30

Uncollected

Collected May 30

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Similar questions

- Majestic Corporation holds an investment in Cromwell bonds that pays interest eachOctober 31. Majestic’s balance sheet at December 31 should reporta. interest expense.b. interest revenue.c. interest payable.d. interest receivable.arrow_forwardplease give me answerarrow_forwardVaughn Manufacturing assigns $7300000 of its accounts receivables as collateral for a $2.64 million 9% loan with a bank. Vaughn Manufacturing also pays a finance fee of 2% on the transaction upfront. What would be recorded as a gain (loss) on the transfer of receivables?arrow_forward

- Clark Company paid Sherman Company for merchandise with a $4,000, 60-day, 9% note dated April 1. If Clark Company pays the note at maturity, what entry should Sherman make at that time? Select one: a. BALANCE SHEET INCOME STATEMENT ASSETS = LIABILITIES + STOCKHOLDER'SEQUITY REVENUE - EXPENSE Cash NotesReceivable NotesPayable Retained Earnings InterestIncome InterestExpense A) +4,360 -4,000 +360 +360 b. BALANCE SHEET INCOME STATEMENT ASSETS = LIABILITIES + STOCKHOLDER'SEQUITY REVENUE - EXPENSE Cash NotesReceivable NotesPayable Retained Earnings InterestIncome InterestExpense B) -4,360 -4,000 -360 +360 c. BALANCE SHEET INCOME STATEMENT ASSETS = LIABILITIES + STOCKHOLDER'SEQUITY REVENUE - EXPENSE Cash NotesReceivable NotesPayable Retained Earnings InterestIncome InterestExpense C) +4,060 -4,000 +60 +60 d. BALANCE SHEET INCOME STATEMENT ASSETS =…arrow_forwardThe following information is available in respect of Vegas plc for the last 2 years ended 31 December. Non-current Assets (at Net Book Value) Current Assets: Inventory Trade receivables Cash at bank Equity and Liabilities: Equity Share capital £1 Share premium Revenue reserve Vegas plc: Statement of Financial Position 31.12.2021 Non-current Liabilities: Loan Current Liabilities: Trade payables Taxation (accrual) Operating profit Taxation £000 390 462 80 88 142 £000 2,100 932 3.032 900 50 852 1,802 1,000 230 3.032 274 (156) 118 (87) 31 31.12.2020 Vegas plc: Income Statement (Extract) for the year ended 31.12.2021 £000 Dividends Retained profit for the year The following information is also available: • There were no non-current asset disposals during the year. • Depreciation for the year was £240,000. £000 210 346 50 73 137 £000 1,975 606 2.581 700 821 1,521 850 210 2.581 Prepare, in a suitable format, the Statement of Cash Flow for Vegas plc for the year ended 31.12.2021, presenting…arrow_forwardOn June 1, Taci Company lent $86,200 to L. Kaler on a 90-day, 2% note. 12. Journalize for Taci Company the lending of the money on June 1. 13. Journalize the collection of the principal and interest at maturity. Specify the date. Round interest to the nearest dollar. 12. Journalize for Taci Company the lending of the money on June 1. (Record debits first, then, credits. Select the explanation on the last line of the journal entry table. For notes stated in days, use a 365-day year.) Accounts and Explanation Date Jun. 1 Debit Creditarrow_forward

- We are given the following information for Pettit Corporation. Sales (credit) Cash Inventory Current liabilities Asset turnover Current ratio Debt-to-assets ratio Receivables turnover $2,068,000 150,000 923,000 763,000 a. Accounts receivable b. Marketable securities c. Capital assets. d. Long-term debt $ Current assets are composed of cash, marketable securities, accounts receivable, and inventory. Calculate the following balance sheet items: LA LA LA $ $ 1.00 times 2.60 times $ 40 % 4 times 517000arrow_forwardGolden Corporation's current year income statement, comparative balance sheets, and additional information follow. For the year, (1) all sales are credit sales, (2) all credits to Accounts Receivable reflect cash receipts from customers, (3) all purchases of inventory are on credit, (4) all debits to Accounts Payable reflect cash payments for inventory, and (5) any change in Income Taxes Payable reflects the accrual and cash payment of taxes. GOLDEN CORPORATION Comparative Balance Sheets December 31 Current Year Prior Year Assets Cash $ 171,000 $ 114,700 Accounts receivable 93,500 78,000 Inventory 611,500 533,000 Total current assets 876,000 725,700 Equipment 353,800 306,000 Accumulated depreciation—Equipment (161,500) (107,500) Total assets $ 1,068,300 $ 924,200 Liabilities and Equity Accounts payable $ 101,000 $ 78,000 Income taxes payable 35,000 28,600 Total current liabilities 136,000 106,600 Equity Common stock, $2 par value…arrow_forwardabardeen corporation borrowed 58,000 from the bank on october 1, year 1. The note had a 4 percent annual rate of interest and matured on march 31, year 2. interest and principal were paid in cash on the maturity date. a. what amount of cash did abardeen pay for interest in year 1? b. what amount of interest expense was recognized on the year 1 income statement? c. what amount of total liabilities was reported on december 31, year 1, balance sheet?arrow_forward

- Please! help me with this questionarrow_forwardOn August 1, 2022, Colombo Company’s treasurer signed a note promising to pay $122,700 on December 31, 2022. The proceeds of the note were $116,100. Use the horizontal model to show the effects of recording interest expense for the month of September. Indicate the financial statement effect. What is the discount on notes payable and what is the interest expense?arrow_forwardGalubhaiarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education