FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

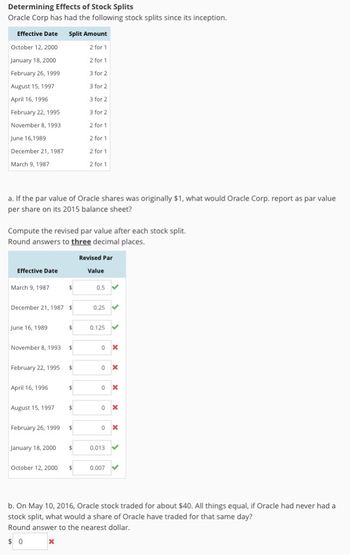

Transcribed Image Text:Determining Effects of Stock Splits

Oracle Corp has had the following stock splits since its inception.

Effective Date Split Amount

October 12, 2000

2 for 1

January 18, 2000

2

for 1

February 26, 1999

3 for 2

August 15, 1997

3 for 2

April 16, 1996

3 for 2

February 22, 1995

3 for 2

November 8, 1993

2 for 1

June 16,1989

2 for 1

December 21, 1987

2 for 1

March 9, 1987

2 for 1

a. If the par value of Oracle shares was originally $1, what would Oracle Corp. report as par value

per share on its 2015 balance sheet?

Compute the revised par value after each stock split.

Round answers to three decimal places.

Effective Date

March 9, 1987

December 21, 1987 $

June 16, 1989.

February 22, 1995

November 8, 1993 $

April 16, 1996

August 15, 1997

February 26, 1999

January 18, 2000

$

October 12, 2000

X

$

$

$ 0.125

$

$

$

Revised Par

$

Value

0.5

0.25

0x

0x

0 X

0X

0x

0.013

0.007

b. On May 10, 2016, Oracle stock traded for about $40. All things equal, if Oracle had never had a

stock split, what would a share of Oracle have traded for that same day?

Round answer to the nearest dollar.

$0

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 4 steps

Knowledge Booster

Similar questions

- If C CORP. had 3,518,000 shares of common stock outstanding when it paid dividends last year, how much did it pay in dividends? Click the icon to view the portion of Stock Exchange Listing. Data table TERE AL shares of common stock Quistenalleg when it bald dividends last year now much did it pay in dividend Portion of Stock Exchange Listing Name A CORP BLID C CORP DLTD. E CORP. Symbol Open High 30.6 31.24 28.14 28.57 48.6 49.07 14.35 14.58 23.76 24.3 A B C D E CIDO 994,770 32.9. 270,400 28.87 19.4 16.11 Low Close Net Chg %Chg Volume 52 Wk High 52 Wk Low Div 30.5 31.12 0.58 1.9 1 0.6 1.11. 0.97 1,598,100 50.33 25.3 27.67 28.42 0.28 48.52 28.42 0.29 13.92 14.51 0.16 23.62 24.03 0.23 54,900 16.55 12.6 570,711 27.45 17.95 Print Done Yield P/E Ytd % Chg 24 6.6 14 25.1 52.1 -6.1 172-9.2 yove THE 0.48 1.7 1.48 3arrow_forwardEffect of Stock Split a. What will be the number of shares outstanding after the split? shares b. If the common stock had a market price of $95 per share before the stock s plit, what would be an approximate market price per share after the split? per sharearrow_forwardShow Attempt History Current Attempt in Progress * Your answer is incorrect. On October 31, the stockholders' equity section of Concord Corporation's balance sheet consists of common stock $801,000 and retained earnings $927,000. Concord is considering the following two courses of action: (1) declaring a 4% stock dividend on the 80,100 $10 par value shares outstanding or (2) effecting a 2-for-1 stock split that will reduce par value to $5 per share. The current market price is $16 per share. Prepare a tabular summary of the effects of the alternative actions on the company's stockholders' equity and outstanding shares. Before Action After Stock Dividend After Stock Split Stockholders' equity Paid-in capital Retained earnings Attempts: unlimited Submit Answer Total stockholders' equity Outstanding shares eTextbook and Media Solution Save for Later LA $ LA $ $arrow_forward

- Effect of Stock Split Copper Grill Restaurant Corporation wholesales ovens and ranges to restaurants throughout the Southwest. Copper Grill Restaurant Corporation, which had 39,000 shares of common stock outstanding, declared a 3-for-1 stock split. a. What will be the number of shares outstanding after the split? shares b. If the common stock had a market price of $84 per share before the stock split, what would be an approximate market price per share after the split?$ per sharearrow_forwardEffect of Stock Split Willey’s Grill & Restaurant Corporation wholesales ovens and ranges to restaurants throughout the Southwest. Willey’s Grill & Restaurant, which had 45,000 shares of common stock outstanding, declared a 3-for-1 stock split.arrow_forwardEarnings per share Financial statement data for the years 20Y5 and 20Y6 for Black Bull Inc. follow: 20Y5 20Y6 Net income $1,761,000 $2,532,500 Preferred dividends $60,000 $60,000 Average number of common shares outstanding 90,000 shares 115,000 shares a. Determine the earnings per share for 20Y5 and 20Y6. Round to two decimal places. 20Y5 20Y6 Earnings per Share $fill in the blank 1 $fill in the blank 2 b. Is the change in the earnings per share from 20Y5 to 20Y6 favorable or unfavorable? fill in the blankarrow_forward

- Effect of Stock Split Willey's Grill & Restaurant Corporation wholesales ovens and ranges to restaurants throughout the Southwest. Willey's Grill & Restaurant, which had 27,000 shares of common stock outstanding, declared a 4-for-1 stock split. a. What will be the number of shares outstanding after the split? shares b. If the common stock had a market price of $240 per share before the stock split, what would be an approximate market price per share after the split? per sharearrow_forwardEffect of Stock Split Willey's Grill & Restaurant Corporation wholesales ovens and ranges to restaurants throughout the Southwest. Willey's Grill & Restaurant, which had 325,000 shares of common stock outstanding, declared a 3-for-1 stock split. a. What will be the number of shares outstanding after the split? shares b. If the common stock had a market price of $450 per share before the stock split, what would be an approximate market price per share after the split? per share LAarrow_forwardJoint Cost Allocation—Market Value at Split-off Method Sugar Sweetheart, Inc., jointly produces raw sugar, granulated sugar, and caster sugar. After the split-off point, raw sugar is immediately sold for $0.20 per pound, while granulated and caster sugar are processed further. The market value of the granulated sugar and caster sugar is estimated to both be $0.25 at the split-off point. One batch of joint production costs $1,640 and yields 3,000 pounds of raw sugar, 3,600 pounds of granulated sugar, and 2,000 pounds of caster sugar at the split-off point. Allocate the joint costs of production to each product using the market value at split-off method. Joint Product Allocation Raw sugar $fill in the blank 1 Granulated sugar fill in the blank 2 Caster sugar fill in the blank 3 Totals $fill in the blank 4arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education