Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

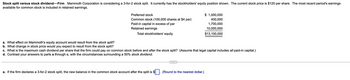

Transcribed Image Text:Stock split versus stock dividend-Firm Mammoth Corporation is considering a 3-for-2 stock split. It currently has the stockholders' equity position shown. The current stock price is $120 per share. The most recent period's earnings

available for common stock is included in retained earnings.

a. What effect on Mammoth's equity account would result from the stock split?

b. What change in stock price would you expect to result from the stock split?

Preferred stock

Common stock (100,000 shares at $4 par)

Paid-in capital in excess of par

Retained earnings

Total stockholders' equity

$ 1,000,000

400,000

1,700,000

10,000,000

$13,100,000

c. What is the maximum cash dividend per share that the firm could pay on common stock before and after the stock split? (Assume that legal capital includes all paid-in capital.)

d. Contrast your answers to parts a through c. with the circumstances surrounding a 50% stock dividend.

a. If the firm declares a 3-for-2 stock split, the new balance in the common stock account after the split is $. (Round to the nearest dollar.)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step 1: a. What effects on Mammoth would result in a stock split?

VIEW Step 2: b. What change in stock price would you expect to result from the stock split?

VIEW Step 3: c. What is the maximum cash dividend per share

VIEW Step 4: d. Contrast your answer in parts a through c with the circumstances surrounding a 50% stock dividend

VIEW Solution

VIEW Step by stepSolved in 5 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- When a company participates in a stock buyback program, it means that the company is buying shares of its own stock and taking them off the market. With this simple definition in mind, how would a company's stock buyback program affect its Earnings per Share?arrow_forwardAccording to the Gordon dividend model, which of the following variables would not affect a stock's price? the firm's expected growth rate in dividends the number of shares outstanding the shareholder's required return next year's expected dividendarrow_forwardThe declaration of a stock dividend will * increase paid-in capital. change the total of stockholders' equity. increase total liabilities. increase total assets.arrow_forward

- Which of the following transactions will increase thereturn on equity?a. Declare and issue a stock dividend.b. Split the stock 2-for-1.c. Repurchase the company’s stock.d. None of the above.arrow_forwardIn calculating earnings per share, a company uses the treasury stock method when a. it recognizes the assumed impact of exercising outstanding warrants. b. it develops a methodology to handle the premium paid on exercised share options. c. it needs to value the cash received for a convertible bond. d. it needs to value treasury stock repurchased during the year.arrow_forwardStock Valuation. Why does the value of a share of stock depend on dividends? Based on the dividend growth model, what are the two components of the total return on a share of stock? A substantial percentage of the companies listed on the NYSE and the NASDAQ don’t pay dividends, but investors are nonetheless willing to buy shares in them. If the value of a share of stock depends on dividends, how is this possible?arrow_forward

- Flexsteel is giving out a large stock dividend. This would: A. Results in a transfer of retained earnings to the common stock account B. Reduces the par value per share by the percentage of the additional shares issued. C. Is accounted for in exactly the same manner as a stock split D. Results in a transfer of retained earnings to common stock and additional paid in capitalarrow_forwardWhich of the following is not a typical question that must be answered with regard to a private company that is owned by a large number of shareholders? Question 46 options: How and when does the company get money from the sale of its stock? What rate of return does the company promise to pay when it sells stock? What is the dividend yield on preferred shares of companies that hold this stock? Who makes decisions in a company owned by a large number of shareholders?arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education