ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

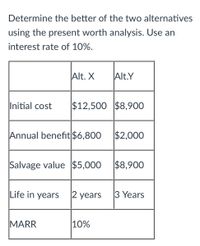

Transcribed Image Text:### Present Worth Analysis for Investment Alternatives

In this exercise, we will determine the preferable alternative between two investment options using a present worth analysis, with an interest rate set at 10%.

#### Data Table:

| Criteria | Alternative X | Alternative Y |

|------------------|---------------|---------------|

| **Initial Cost** | $12,500 | $8,900 |

| **Annual Benefit** | $6,800 | $2,000 |

| **Salvage Value** | $5,000 | $8,900 |

| **Life in Years** | 2 years | 3 years |

| **MARR (Minimum Attractive Rate of Return)** | 10% | 10% |

### Explanation:

- **Initial Cost**: This is the upfront investment required for each alternative.

- **Annual Benefit**: The expected annual profit generated by each alternative.

- **Salvage Value**: The residual value of the investment at the end of its life.

- **Life in Years**: The duration over which the investment will generate returns.

- **MARR**: The minimum rate of return acceptable for the investment, used as the discount rate for present worth analysis.

The goal is to calculate the present worth of each alternative to determine which one offers a higher net present value, making it the preferred option under the given financial conditions.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- ! Required information The annual revenues associated with several large apartment complexes are $225, $225, $275, $375, $75, and $125 for years 0, 1, 2, 3, 4, and 5, respectively. Determine the net cash flow and whether each cash flow series is conventional or nonconventional. The costs for years 0, 1, 2, 3, 4, and 5, respectively, are provided in the problems. When the cash flow is zero, assume it to be negative. Year 0 Cost, $ -1500 1 -450 The cash flow is conventional The Cumulative cash flow is 0 1 Year Cumulative CF, $ 2 -300 2 3 -400 3 4 -125 4 5 -400 5arrow_forwardIf ERR > MARR, then IRR > ERR > MARR. A) True (B) Falsearrow_forwardIf you could write out the equation once for me to see where the values should go, that would be helpful. Thank you!arrow_forward

- If the Savings function is S = -$300 + 0.75Y %3D Then the breakeven level of income is $1200. O True O Falsearrow_forwardNonearrow_forwardCarlisle Company has been cited and must invest in equipment to reduce stack emissions or face EPA fines of $20,500 per year. An emission reduction filter will cost $75,000 and have an expected life of 5 years. Carlisle's MARR is 10%/year. Part a What is the future worth of this investment? $ Carry all interim calculations to 5 decimal places and then round your final answer to the nearest dollar. The tolerance is £10.arrow_forward

- Carlisle Company has been cited and must invest in equipment to reduce stack emissions or face EPA fines of $16,500 per year. An emission reduction filter will cost $75,000 and have an expected life of 5 years. Carlisle's MARR is 10%/year. Part a What is the future worth of this investment? $arrow_forwardGiven cash flows for two alternatives as shown in table below, choose the most attractive alternative if MARR = 8%. Year 0 1 2 3 through ∞ Alt. A -$42K $3.6K $3.6K $3.6K Alt. B -$54K $4.7K $4.7K $4.7K Group of answer choices Alt. A Alt. B Select neither Select eitherarrow_forwardQUESTION 8 For th below two machines and based on AW analysis which machine we should select? MARR=10% Machine A Machine B First cost, $ Annual cost, $/year Salvage value, $ Life, years 3 Answer the below question: B-the AW for machine B= 26,612 12,417 4,135 infinite 140,454 7,170arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education