FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

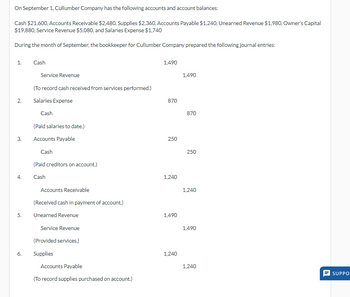

Transcribed Image Text:On September 1, Cullumber Company has the following accounts and account balances:

Cash $21,600, Accounts Receivable $2,480, Supplies $2,360, Accounts Payable $1,240, Unearned Revenue $1,980, Owner's Capital

$19,880, Service Revenue $5,080, and Salaries Expense $1,740

During the month of September, the bookkeeper for Cullumber Company prepared the following journal entries:

1.

2.

3.

4.

5.

Cash

Service Revenue

(To record cash received from services performed.)

Salaries Expense

Cash

(Paid salaries to date.)

Accounts Payable

Cash

(Paid creditors on account.)

Cash

Accounts Receivable

(Received cash in payment of account.)

Unearned Revenue

Service Revenue

(Provided services.)

6. Supplies

Accounts Payable

(To record supplies purchased on account.)

1,490

870

250

1,240

1,490

1.240

1,490

870

250

1,240

1,490

1,240

SUPPO

Transcribed Image Text:Post the September transactions and determine the ending balance in each account. (Post entries in the order as displayed in the

problem statement.)

SAVE

AI-Generated Solution

info

AI-generated content may present inaccurate or offensive content that does not represent bartleby’s views.

Unlock instant AI solutions

Tap the button

to generate a solution

to generate a solution

Click the button to generate

a solution

a solution

Knowledge Booster

Similar questions

- Brangelina Adoption Agency's general ledger shows a cash balance of $4,586. The balance of cash in the March-end bank statement is $7,331. A review of the bank statement reveals the following information: checks outstanding of $2,796, bank service fees of $78, and interest earned of $27. Calculate the correct balance of cash at the end of March. (Amounts to be deducted should be indicated with a minus sign.)arrow_forwardCompute the balance in the subsidiary accounts at the end of the month!arrow_forwardThe actual cash received during the week ended June 7 for cash sales was $18,921, and the amount indicated by the cash register total was $18,903. Journalize the entry for cash receipts and cash sales for the week. If an amount box does not require an entry, leave it blank. June 7arrow_forward

- T. L. Jones Trucking Services establishes a petty cash fund on April 3 for $200. By the end of April, the fund has a cash balance of $97. The company has also issued a credit card and authorized its office manager to make purchases. Expenditures for the month include the following items: Utilities (credit card) Entertainment (petty cash) Stamps (petty cash) Plumbing repair services (credit card) $ 435 44 59 630 Required: Record the establishment of the petty cash fund on April 3, all expenditures made during the month, and the replenishment of the petty cash fund on April 30. The credit card balance is paid in full on April 30. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field.)arrow_forwardThe accounting records and bank statement of Orison Supply Store provide the following information at the end of April. The closing 'Cash' account balance was $28,560, and the bank statement shows a closing balance of $32,000. On reviewing the bank statement it is found an account customer has deposited $2,000 into the bank account for a March sale and the monthly insurance premium of $4,500 was automatically charged to the account. Interest of $5,10 was paid by the bank and a bank fee of $50 was charged to the account. A payment of $1,500 to a supplier has been recorded twice in the accounts. After the ,calculation of the "ending reconciled cash balance", what is the balance of the 'cash' account?arrow_forwardOn September 29, the company determined that the petty cash fund needed to be increased to $1,000. What is the correct journal entry?arrow_forward

- Journalize the entries to record the following (refer to the Chart of Accounts for exact wording of account titles): Instructions A. On March 1, Check is issued to establish a petty cash fund of $1,175. B. On April 1, the amount of cash in the petty cash fund is now $110. Check is issued to replenish the fund, based on the following summary of petty cash receipts: office supplies, $665; miscellaneous selling expense, $211; miscellaneous administrative expense, $178. (Because the amount of the check to replenish the fund plus the balance in the fund do not equal $1,175, record the discrepancy in the cash short and over account.)arrow_forwardOn April 3, Erin Gardner received her bank statement showing a balance of $2,086.93. Her checkbook showed a balance of $1,912.47. Outstanding checks were $234.15, $317.80, $78.10, $132.42, and $212.67. The account earned $20.43. Deposits in transit amount to $814.11, and there is a service charge of $7.00. Use the form below to calculate the reconciled balance. CHECKBOOK BALANCE Add: Interest Earned & Other Credits SUBTOTAL Deduct: Service Charges & Other Debits ADJUSTED CHECKBOOK BALANCE tA ta ta ta tA STATEMENT BALANCE Add: Deposits in Transit SUBTOTAL Deduct: Outstanding Checks LA tA ·SA $ LA ADJUSTED STATEMENT BALANCE $ LA Earrow_forwardA company's Cash account shows a balance of $3,460 at the end of the month. Comparing the company's Cash account with the monthly bank statement reveals several additional cash transactions such as bank service fees ($50), an NSF check from a customer ($370), a customer's note receivable collected by the bank ($1,600), and interest earned ($130). Required: Record the necessary entry(ies) to adjust the company's balance for cash. (If no entry is required for a transaction/event, select "No Journal Entry Required" in the first account field.) View transaction list Journal entry worksheet Record the items that increase cash. 2 Note: Enter debits before credits. Transaction Record entry General Journal Clear entry Debit Credit View general Journalarrow_forward

- Your company paid rent of $1,000 for the month with check number 1245. Which journal would the company use to record this?arrow_forwardprepare journa entries and bank rencoliationarrow_forwardThe month-end journal entry to adjust its cash balance to agree to the adjusted book balance should include a: a) debit to interest revenue for $125 b) credit to service revenue for $4000 c) credit to bank service charge expense for $35 d) credit to note receivable for $2500arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education