FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

The Bender Construction Co. is involved in constructing municipal buildings and other structures that are used primarily by city and state municipalities. This requires developing legal documents, drafting feasibility studies, obtaining bond ratings, and so forth. Recently, Bender was given a request to submit a proposal for the construction of a municipal building. The first step is to develop legal documents and to perform all steps necessary before the construction contract is signed. This requires more than 20 separate activities that must be completed. These activities, their immediate predecessors, and time requirements are given in the following table:

Transcribed Image Text:7:37

pucsr.school/mod/as

2

HW-Ch05

The Bender Construction Co. is involved in

constructing municipal buildings and other structures

that are used primarily by city and state municipalities.

This requires developing legal documents, drafting

feasibility studies, obtaining bond ratings, and so forth.

Recently, Bender was given a request to submit a

proposal for the construction of a municipal building.

The first step is to develop legal documents and to

perform all steps necessary before the construction

contract is signed. This requires more than 20 separate

activities that must be completed. These activities,

their immediate predecessors, and time requirements

are given in the following table:

TIME REQUIRED (WEEKS)

АCTIVITY

a

DESCRIPTION OF ACTIVITY

IMMEDIATE PREDECI

1

1

4

5

Draft of legal documents

3

4

Preparation of financial statements

3

3

5

Draft of history

4

7

8

9

Draft demand portion of feasibility study

5

4

4

Review and approval of legal documents

1

6.

1

4

Review and approval of history

3

7

5

6.

Review of feasibility study

4

2

4

Draft final financial portion of feasibility study

7

3

4

Draft facts relevant to the bond transaction

5

10

1

1

Review and approval of financial statements

11

18

20

26

Receive firm price of project

12

3

Review and completion of financial portion of

feasibility study

8

13

1

1

Completion of draft statement

6, 9, 10, 11, 12

14

.10

.14

.16

All material sent to bond rating services

13

Statement printed and distributed to all

interested parties

15

.2

.3

.4

14

16

1

1

2

Presentation to bond rating services

14

17

1

2

3

Bond rating received

16

18

5

7

Marketing of bonds

15, 17

19

.1

.1

.2

Purchase contract executed

18

20

.1

.14

.16

Final statement authorized and completed

19

21

3

6.

Purchase contract

19

22

.1

.1

.2

Bond proceeds available

20

23

.2

.2

Sign construction contract

21, 22

Transcribed Image Text:7:37

6

TIME REQUIRED (WEEKS)

АCTIVITY

a

m

b

DESCRIPTION OF ACTIVITY

IMMEDIATE PREDECESSORS

1

1

4

Draft of legal documents

2

3

Preparation of financial statements

3

5

Draft of history

7

8

Draft demand portion of feasibility study

5

4

5

Review and approval of legal documents

1

6.

1

4

Review and approval of history

3

7

4

5

6.

Review

feasibility study

4

8

1

4

Draft final financial portion of feasibility study

7

3

4

Draft facts relevant to the bond transaction

5

10

1

1

Review and approval of financial statements

11

18

20

26

Receive firm price of project

12

1

3

Review and completion of financial portion of

feasibility study

8

13

1

1

Completion of draft statement

6, 9, 10, 11, 12

14

.10

.14

.16

All material sent to bond rating services

13

Statement printed and distributed to all

interested parties

15

.2

.3

.4

14

16

1

Presentation to bond rating services

14

17

1

Bond rating received

16

18

3

5

7

Marketing of bonds

15, 17

19

.1

.1

.2

Purchase contract executed

18

20

.1

.14

.16

Final statement authorized and completed

19

21

3

6

Purchase contract

19

22

.1

.1

.2

Bond proceeds available

20

23

.2

.2

Sign construction contract

21, 22

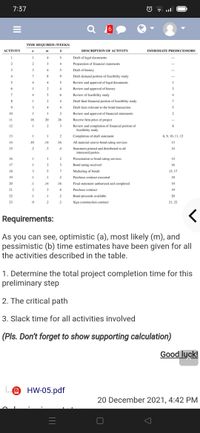

Requirements:

As you can see, optimistic (a), most likely (m), and

pessimistic (b) time estimates have been given for all

the activities described in the table.

1. Determine the total project completion time for this

preliminary step

2. The critical path

3. Slack time for all activities involved

(Pls. Don't forget to show supporting calculation)

Good luck!

LO HW-05.pdf

20 December 2021, 4:42 PM

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Geneva County authorized the issuance of bonds and contracted with the Chessie Construction Company (CCC) to build a new convention center. During 2016, 2017, and 2018, the county engaged in the transactions that follow. All were recorded in the county’s capital projects fund. a. In 2016, the county issued $350 million in bonds (and recorded them as bond proceeds, an account comparable to revenues.) b. The county approved the contract proposal from CCC for $350 million and encumbered the entire amount. c. CCC billed the county for $115 for construction to date. d. The county paid CCC the amount due in full. e. In 2017, CCC billed the county for additional construction to date of $190 million. f. The county paid the amount due in full. g. In 2018, CCC completed construction of the convention center and billed the county an additional $50 million. The county approved the additional costs, even though the total cost of the center was now $355 million, $5 million more than the contract…arrow_forwardThe county of Santa Clara is building a new park. The main financing source will be $1,000,000 bond issue. In addition, the general fund will transfer $100,000 transfer to fund the capital project. Please record the journal entries for the Capital Project Fund & the Government-Wide financial statements. 1. The county has signed a contract with Spectacular Construction to construct the park $1,000,000 2.The $1,000,000 bonds were issued at par 3. Spectacular Construction billed the county of Santa Clara $1,000,000 upon completion of the project 4. The park is completedarrow_forwardThe City of Chessie received two contributions during its current fiscal year: A developer contributed 10 acres of land as part of an agreement with the city to allow more houses to be built per acre than current zoning laws permit. The city will use the land to build a park. The developer purchased the land for $1.5 million. The fair value of the land at the time of the contribution was $1.9 million. · A local resident contributed 30 acres of land to the city. The city agreed that it would sell the land and use the proceeds to add a new wing to the city’s senior center. The resident paid $500,000 for the land. When it was contributed, it had a fair value of $1.5 million. The city sold the land to several developers a month after its fiscal year-end for $1.7 million. a. Prepare journal entries to record each of these contributions in the city’s general fund. b. Comment on and justify any differences in the way you recognized each of these transactions. c. Would your answer on the…arrow_forward

- Topic Please research an annual comprehensive financial report of any local municipality of your choice that had a general government capital construction project that was financed. Discuss the project and type of financing that the local government used, and opine on the other various financing options that the government could have used. In your opinion, did the local government use the most effective financing option? Why or why not? Note: Please provide a link to the referenced material used. This can be attached as a website link or a document (PDF/Word). Make sure to reference your source (using APA 7th edition).arrow_forwardThe Government has decided to offer a grant to all small hotels that have a 100 room capacity or less. The Hotel Mingle's audit programme is currently being prepared by the audit senior.While reviewing the notes from the Finance Director the following issue was noted: Major renovation work was carried out on one section of the building and the company purchased major leisure equipment. The Finance Director has proposed that the new leisure equipment be depreciated over ten years using the straight-line method. Required: Concerning the issue raised, describe substantive procedures to obtain sufficient and appropriate audit evidence.arrow_forwardProject: The streets and roads maintained by the government have not had an adequate maintenance program. The Public Works Department’s Civil Engineers have recommended the establishment of a dedicated team for the rapid and efficient accomplishment of the repair of potholes and other paving failures. The accomplishment of this recommendation is expected to require the services of a full-time, dedicated crew of four (4) field personnel: one (1) Crew Foreman and three (3) Maintenance Workers. The efforts of this group will be the constant execution of a job-order report from the Public Works Department’s current Road Inventory computer software’s Repair Report List. They will accomplish their scheduled work using an automated asphalt patching system for the repair of potholes in major roadways that will be purchased for this purpose. Purchase price estimated @ $175,000. The purchase price includes training of three (3) individuals in the operation and maintenance of the equipment. The…arrow_forward

- A city builds sidewalks throughout its various neighborhoods at a cost of $2.1 million. Which of the following is not true? Because the sidewalks qualify as infrastructure, the asset is viewed in the same way as land so that no depreciation is recorded. Depreciation is required unless the modified approach is utilized. The modified approach recognizes maintenance expense in lieu of depreciation expense for qualifying infrastructure assets. The modified approach is allowed only if the city maintains the network of sidewalks at least at a predetermined condition.arrow_forwardFreitas Corporation was organized early in 2024. The following expenditures were made during the first few months of the year: Attorneys’ fees in connection with the organization of the corporation $ 12,200 State filing fees and other incorporation costs 3,200 Purchase of a patent 20,100 Legal and other fees for transfer of the patent 2,200 Purchase of equipment 30,100 Preopening salaries and employee training 40,100 Total $ 107,900 Required: Prepare a summary journal entry to record the $107,900 in cash expenditures. Note: If no entry is required for a transaction/event, select "No journal entry required" in the first account field.arrow_forwardAltona City opened a landfill that it elects to account for in an enterprise fund. At the time the landfill was opened the government estimated total capacity of the landfill to be 5 million cubic feet, useful life to be 20 years, and total closure and postclosure costs to be $18 million. At the end of Year 1, the government reestimated total closure costs to be $18.3 million and estimated capacity to be same as the original estimate. At the end of Year 2, the government reestimated total capacity to be 4.8 million cubic feet and total closure costs to be $18.5 million. At the end of Year 3, the government reestimated useful life to be 17 years but capacity remained unchanged from the preceding year and closure and postclosure costs were estimated to be $18.4 million. REQUIRED: Prepare journal entries in the enterprise fund to record the following events. a)During Year 1, the city estimates that 300,000 cubic feet of capacity were used. Record the landfill expense. b)During…arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education