FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

Munabhai

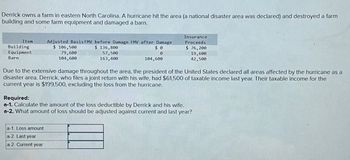

Transcribed Image Text:Derrick owns a farm in eastern North Carolina. A hurricane hit the area (a national disaster area was declared) and destroyed a farm

building and some farm equipment and damaged a barn.

Item

Building

Equipment

Barn

Adjusted Basis FMV before Damage FMV after Damage

$ 106,500

$ 136,800

$0

0

79,600

104,600

57,500

163,400

104,600

a-1. Loss amount

a-2. Last year

a-2. Current year

Insurance

Proceeds

$ 76,200

19,600

42,500

Due to the extensive damage throughout the area, the president of the United States declared all areas affected by the hurricane as a

disaster area. Derrick, who files a joint return with his wife, had $61,500 of taxable income last year. Their taxable income for the

current year is $199,500, excluding the loss from the hurricane.

Required:

a-1. Calculate the amount of the loss deductible by Derrick and his wife.

a-2. What amount of loss should be adjusted against current and last year?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Define Ethics.arrow_forwardIn 2022, Carson is claimed as a dependent on his parents' tax return. His parents report taxable income of $200,000 (married filing jointly). Carson's parents provided most of his support. What is Carson's tax liability for the year in each of the following alternative circumstances? (Use Tax Rate Schedule, Dividends and Capital Gains Tax Rates for reference) Required: Carson is 23 years old at year-end. He is a full-time student and earned $14,000 from his summer internship and part-time job. He also received $5,000 of qualified dividend income.arrow_forwardAn expected social behavior from members of a society is called Oa. Norms O b. Information O C. Attitude O d. Behaviourarrow_forward

- 48:2 Which statement best explains why Mr. Whymper serves as an intermediary for Animal Farm? ad ith O He is motivated by a desire for power. He is motivated by financial success. O He is motivated by a sense of duty. He is motivated by a desire to help others. lier a Save and Exitarrow_forwardWhat is the meaning of Intestate?arrow_forwardmarslow hierarchy of need esteem needsarrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education