FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

In 2022, Carson is claimed as a dependent on his parents' tax return. His parents report taxable income of $200,000 (married filing jointly). Carson's parents provided most of his support.

What is Carson's tax liability for the year in each of the following alternative circumstances? (Use Tax Rate Schedule, Dividends and

Required:

- Carson is 23 years old at year-end. He is a full-time student and earned $14,000 from his summer internship and part-time job. He also received $5,000 of qualified dividend income.

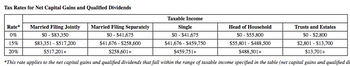

Transcribed Image Text:Tax Rates for Net Capital Gains and Qualified Dividends

Married Filing Jointly

$0-$83,350

Rate*

Trusts and Estates

Single

$0-$41,675

0%

$0-$2,800

$2,801 - $13,700

15%

$41,676 - $459,750

$459,751+

$517,201+

$13,701+

20%

*This rate applies to the net capital gains and qualified dividends that fall within the range of taxable income specified in the table (net capital gains and qualified di

$83,351 $517,200

Married Filing Separately

SO - $41,675

Taxable Income

$41,676-$258,600

$258,601+

Head of Household

$0-$55,800

$55,801 - $488,500

$488,501+

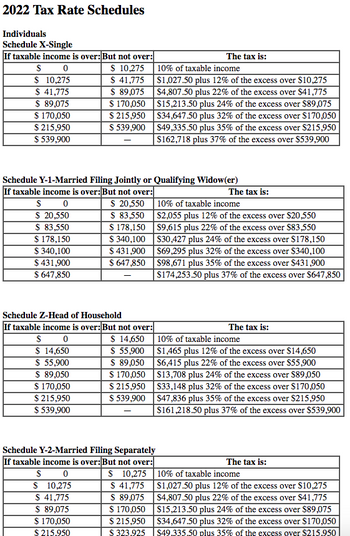

Transcribed Image Text:2022 Tax Rate Schedules

Individuals

Schedule X-Single

If taxable income is over: But not over:

S

0

$ 10,275

$ 41,775

$ 89,075

$ 170,050

$215,950

$ 539,900

$ 0

$ 20,550

$ 83,550

$ 178,150

$ 340,100

$ 431,900

$ 647,850

Schedule Y-1-Married Filing Jointly or Qualifying Widow(er)

If taxable income is over: But not over:

S 0

$ 14,650

$ 55,900

$ 89,050

$ 170,050

$ 215,950

$ 539,900

$ 10,275

$ 41,775

$ 89,075

$ 170,050

$215,950

$539,900

Schedule Z-Head of Household

If taxable income is over: But not over:

-

$ 0

$ 10,275

$ 41,775

$ 89,075

$ 170,050

$ 215.950

$ 20,550

$ 83,550

$ 178,150

$340,100

$431,900

$ 647,850

$ 14,650

$ 55,900

$ 89,050

$ 170,050

$215,950

$539,900

The tax is:

10% of taxable income

$1,027.50 plus 12% of the excess over $10,275

$4,807.50 plus 22% of the excess over $41,775

$15,213.50 plus 24% of the excess over $89,075

$34,647.50 plus 32% of the excess over $170,050

$49,335.50 plus 35% of the excess over $215,950

$162,718 plus 37% of the excess over $539,900

Schedule Y-2-Married Filing Separately

If taxable income is over: But not over:

The tax is:

10% of taxable income

$2,055 plus 12% of the excess over $20,550

$9,615 plus 22% of the excess over $83,550

$30,427 plus 24% of the excess over $178,150

$69,295 plus 32% of the excess over $340,100

$98,671 plus 35% of the excess over $431,900

$174,253.50 plus 37% of the excess over $647,850

The tax is:

10% of taxable income

$1,465 plus 12% of the excess over $14,650

$6,415 plus 22% of the excess over $55,900

$13,708 plus 24% of the excess over $89,050

$33,148 plus 32% of the excess over $170,050

$47,836 plus 35% of the excess over $215,950

$161,218.50 plus 37% of the excess over $539,900

The tax is:

10% of taxable income

$ 10,275

$ 41,775

$ 89,075

$ 170,050

$215,950

$1,027.50 plus 12% of the excess over $10,275

$4,807.50 plus 22% of the excess over $41,775

$15,213.50 plus 24% of the excess over $89,075

$34,647.50 plus 32% of the excess over $170,050

$ 323.925 $49.335.50 plus 35% of the excess over $215.950

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- In 2023, Sheryl is claimed as a dependent on her parents' tax return. Her parents report taxable income of $600,000 (married filing jointly). Sheryl did not provide more than half her own support. What is Sheryl's tax liability for the year in each of the following alternative circumstances? Use Tax Rate Schedule, Dividends and Capital Gains Tax Rates for reference. c. She received $7,000 of interest income from corporate bonds she received several years ago. This is her only source of income. She is 20 years old at year-end and is a full-time student. What is her tax liabilty?arrow_forwardLacy is a single taxpayer. In 2022, her taxable income is $44,200. What is her tax liability in each of the following alternative situations? Use Tax Rate Schedule, Dividends and Capital Gains Tax Rates for reference. Note: Do not round intermediate calculations. Round your answer to 2 decimal places. Required: All of her income is salary from her employer. Her $44,200 of taxable income includes $1,200 of qualified dividends. Her $44,200 of taxable income includes $5,200 of qualified dividends.arrow_forwardBrian and Kim have a 12-year-old child, Stan. For 2018, Brian and Kim have taxable income of $52,000, and Stan has interest income of $4,500. Click here to access the income tax rate schedules. If Stan’s parents elected to report Stan’s income on his parents’ return, what would the tax on Stan’s income be?$arrow_forward

- In 2023, Jack, age 12, has interest income of $6,540 on funds he inherited from his aunt and no earned income. He has no investment expenses. Christian and Danielle (his parents) have taxable income of $88,150 and file a joint return. Assume that no parental election is made. Click here to access the 2023 tax rate schedule. If required, round the tax computations to the nearest dollar. Jack's net unearned income is Jack's allocable parental tax is Jack's total tax isarrow_forwardDuring 2020, Murray, who is 60 years old and unmarried, provided all of the support of his elderly mother. His mother was a resident of a home for the aged for the entire year and had no income. What is Murray's filing status for 2020, and how many dependents should he report on his tax return? a.Head of household and 1 dependent b.Single and 1 dependent c.Single and 2 dependents d.Head of household and 2 dependents e.None of these choices are correct.arrow_forwardTaylor, a single taxpayer, has $17,400 AGI. Assume the taxable year is 2023. Use Standard Deduction Table. Required: a. Compute taxable income if Taylor's AGI consists entirely of interest income. Taylor is 19 years old and a dependent of his parents for tax purposes. b. Compute taxable income if Taylor's AGI consists entirely of wage income. Taylor is 19 years old and is considered a dependent of his parents for tax purposes. c. Compute taxable income if Taylor's AGI consists entirely of interest income. Taylor is 70 years old and lives with his grown child who provides more than one-half of Taylor's financial support. Complete this question by entering your answers in the tabs below. Required A Required B Required C Compute taxable income if Taylor's AGI consists entirely of interest income. Taylor is 70 years old and lives with his grown child who provides more than one-half of Taylor's financial support. Taxable Income < Required B Required Carrow_forward

- Sharon Jones is single. During 2022, she had gross income of $159,800, deductions for AGI of $5,500, itemized deductions of $14,000 and tax credits of $2,000. Sharon had $22,000 withheld by their employer for federal income tax. She has a tax (due/refund) rounded to the nearest whole dollar of $.arrow_forwardIn 2020, Ashley earns a salary of $ 55,000, has capital gains of $ 3,000, and receives interest income of $ 5,000. Her husband died in 2018. Ashley has a dependent son, Tyrone, who is age eight. Her itemized deductions are $ 9,000. What is her filing status? Calculate Ashley’s taxable income for 2020.arrow_forwardSarah is completing her tax return for the year 2021 and calculating her personal exemption. I'm 25 years old, single, and have no children. What is her personal exemtion for 2021?arrow_forward

- John Leslie lives with his wife and 21 year old blind son, Keith, who qualifies for the disability tax credit. Keith has no income of his own. During 2020, John paid medical expenses of $16,240 for Keith. None of these expenses involve attendant care. John’s Taxable Income for 2020 was $100,000. Determine the total amount of tax credits related to Keith that will be available to John.arrow_forwardPlease help me.....arrow_forwardChris and Heather are engaged and plan to get married. During 2023, Chris is a full-time student and earns $9,400 from a part-time job. With this income, student loans, savings, and nontaxable scholarships, he is self-supporting. For the year, Heather is employed and has wages of $72,600. Click here to access the standard deduction table to use. Click here to access the Tax Rate Schedules. If an amount is zero, enter, "0". Do not round your intermediate computations. Round your final answer to the nearest whole dollar. a. Compute the following: Gross income and AGI Standard deduction (single) Taxable income Income tax Chris Filing Single Heather Filing Singlearrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education