Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

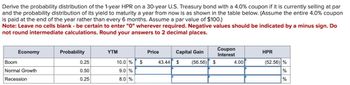

Transcribed Image Text:Derive the probability distribution of the 1-year HPR on a 30-year U.S. Treasury bond with a 4.0% coupon if it is currently selling at par

and the probability distribution of its yield to maturity a year from now is as shown in the table below. (Assume the entire 4.0% coupon

is paid at the end of the year rather than every 6 months. Assume a par value of $100.)

Note: Leave no cells blank - be certain to enter "0" wherever required. Negative values should be indicated by a minus sign. Do

not round intermediate calculations. Round your answers to 2 decimal places.

Economy

Boom

Normal Growth

Recession

Probability

0.25

0.50

0.25

YTM

10.0 % $

9.0 %

8.0 %

Capital Gain

43.44 $ (56.56)

Price

$

Coupon

Interest

4.00

HPR

(52.56) %

%

%

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- You have a 15 year maturity with a yield of 0.06 yield (in decimals), with duration of 11 years and a convexity of 116.7. The bond is currently priced at $805.76. If the interest rate were to increase 92 basis points, compute the predicted new price for the bond, including convexity. (Be mindful of whether the sign is + or -) Note: your answer should be in % this time. If your answer is 5%, please simply input 5 as your answer.arrow_forwardSuppose you are considering two possible investment opportunities: a 12-year Treasury bond and a 7-year, A-rated corporate bond. The current real risk-free rate is 3%, and inflation is expected to be 2% for the next 2 years, 3% for the following 4 years, and 4% thereafter. The maturity risk premium is estimated by this formula: MRP = 0.02(t - 1)%. The liquidity premium (LP) for the corporate bond is estimated to be 0.3%. You may determine the default risk premium (DRP), given the company's bond rating, from the following table. Remember to subtract the bond's LP from the corporate spread given in the table to arrive at the bond's DRP. Corporate Bond Yield Rate Spread = DRP + LP U.S. Treasury 0.83 % — AAA corporate 1.03 0.20 % AA corporate 1.39 0.56 A corporate 1.79 0.96 What yield would you predict for each of these two investments? Round your answers to three decimal places. 12-year Treasury yield: fill in the blank _ % 7-year Corporate yield: fill…arrow_forwardThe real risk-free rate is 2.50%. Inflation is expected to be 1.50% this year and 4.75% during the next 2 years. Assume that the maturity risk premium is zero. What is the yield on 2-year Treasury securities? Do not round intermediate calculations. Round your answer to two decimal places. % What is the yield on 3-year Treasury securities? Do not round intermediate calculations. Round your answer to two decimal places.arrow_forward

- Assume that the real risk-free rate is 2.4% and that the maturity risk premium is zero. If a 1-year Treasury bond yield is 5.6% and a 2-year Treasury bond yields 6.3%. Calculate the yield using a geometric average. What is the 1-year interest rate that is expected for Year 2? Do not round intermediate calculations. Round your answer to two decimal places. % What inflation rate is expected during Year 2? Do not round intermediate calculations. Round your answer to two decimal places. % Comment on why the average interest rate during the 2-year period differs from the 1-year interest rate expected for Year 2. The difference is due to the inflation rate reflected in the two interest rates. The inflation rate reflected in the interest rate on any security is the average rate of inflation expected over the security's life. The difference is due to the real risk-free rate reflected in the two interest rates. The real risk-free rate reflected in the interest rate on any security is the…arrow_forwardConsider two bonds x and y, both with face value 100, coupon rate 10%, and maturity of 1 year. Assume that the interest rate is 10%. Assume that bond y will go into default on both the principal and interest payments with a probability of 50%. Suppose that prices equal the expected discounted payments. What is the difference in the yields to maturity? (a) The yields to maturity are the same. (b) 110. (c) 120. (d) 10. (e) 12.arrow_forwardThe real risk-free rate is 1.95%. Inflation is expected to be 2.95% this year, 4.25% next year, and 2.1% thereafter. The maturity risk premium is estimated to be 0.05 × (t - 1)%, where t = number of years to maturity. What is the yield on a 7-year Treasury note? Do not round intermediate calculations. Round your answer to two decimal places.arrow_forward

- You are given the following information about the yield curve: the 1-, and 2-year yields are yl = 4.5% and y2 = 5.5%, respectively. A 2-year annual 5% coupon bond with a face value of $1,000 is currently selling for $1,000. Assume the first coupon will not be paid until one year from now. Is there an arbitrage opportunity and, if so, how would you exploit it (assume we cannot trade in fractions of a penny)? A. There is no arbitrage opportunity B. Yes: Buy the bond and fund this by shorting a $50 face value 1-year discount bond and a $1,050 face value 2-year discount bond C Yes: Buy the bond and fund this by shorting a $47.85 face value 1-year discount bond and a $943.38 face value 2-year discount bond D. Yes: Short the bond and buy a $50 face value 1-year discount bond and a $1,050 face value 2-year discount bond E. Yes: Short the bond and buy a $47.85 face value 1-vear discount bond and a $943.38 face value 2-year discount bondarrow_forwardInterest rates on 4-year Treasury securities are currently 5.6%, while 6-year Treasury securities yield 7.85%. If the pure expectations theory is correct, what does the market believe that 2-year securities will be yielding 4 years from now? Calculate the yield using a geometric average. Do not round intermediate calculations. Round your answer to two decimal places. %arrow_forwardSolve it correctly please. I will rate accordingly.arrow_forward

- The YTM on a bond is the interest rate you earn on your investment if interest rates don't change. If you actually sell the bond before it matures, your realized return is known as the holding period yield (HPY) a. Suppose that today you buy an annual coupon bond with a coupon rate of 8 3 percent for $785 The bond has 8 years to maturity and a par value of $1,000. What rate of return do you expect to earn on your investment? Note: Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16. b-1. Two years from now, the YTM on your bond has declined by 1 percent, and you decide to sell. What price will your bond sell for? Note: Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16. b-2. What is the HPY on your investment? Note: Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16. a. Rate of return b-1. Price % b-2. Holding period…arrow_forwardConsider a zero coupon bond that promises to pay $100 each year for the next three years. Suppose we observe the set of zero coupon bond prices and its yields as below a) What is the price of this zero coupon bond? What is its yield to maturity? b) If the observe yield on two-year zero coupon bonds falls to 6% per year, but the other rates remain unchanged. What is your estimation of the value of the three-year annuity paying $100 per year? What is its yield to maturity?arrow_forwardYou are a fixed income analyst with an active investment in two bonds. X and Y. Bond X has a coupon rate of 9% and Bond Y has a 10% annual coupon. Both bonds have 5 years to maturity. The yield to maturity for both bonds is now 10%. If the required return rises by 14%, by what percentage will the price of the bond X change? Please provide complete details of the calculations (formula/steps) of the above questionarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education