Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

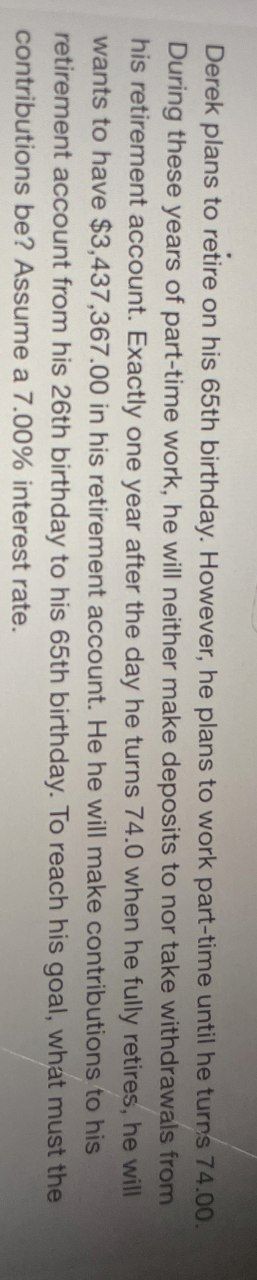

Transcribed Image Text:Derek plans to retire on his 65th birthday. However, he plans to work part-time until he turns 74.00.

During these years of part-time work, he will neither make deposits to nor take withdrawals from

his retirement account. Exactly one year after the day he turns 74.0 when he fully retires, he will

wants to have $3,437,367.00 in his retirement account. He he will make contributions to his

retirement account from his 26th birthday to his 65th birthday. To reach his goal, what must the

contributions be? Assume a 7.00% interest rate.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Haresharrow_forwardDenise has $180,983 saved for her upcoming retirement and will make no further contributions. She wants to allow these funds to accumulate additional interest until her savings are sufficient to allow her to purchase an annuity that will pay $5,000 at the start of every quarter for 20 years. If her funds earn 5% compounded semiannually during both the period of deferral and the annuity period, how long will it be before Denise’s first $5,000 payment can be received?arrow_forwardEugene began to save for his retirement at age 27, and for 14 years he put $ 275 per month into an ordinary annuity at an annual interest rate of 5% compounded monthly. After the 14 years, Eugene was unable to make the monthly contribution of $ 275, so he moved the money from the annuity into another account that earned 5% interest compounded monthly. He left the money in this account for 24 years until he was ready to retire. How much money did he have for retirement? Retirement amount = If Eugene had waited until he was 42 years old to start saving for retirement and then decided to put money into an ordinary annuity for 23 years earning 5% interest compounded monthly, what monthly payment would he have to make to accumulate the same amount for retirement as you found in the first part of the question? Retirement amount =arrow_forward

- Anderson just landed his first job and is scheduled to start work on his 20th birthday. His parents have advised him that even though retirement seems like a long way off, it is important to start planning early. He has decided to deposit $4,500 into a retirement fund at the end of his first working year and hopes to increase this amount by 5% each year thereafter. The retirement fund is projected to pay an average rate of interest of 4%. If Danny plans to retire at age 65, and will therefore make 45 payments into the fund, how much is the retirement fund worth to him today?arrow_forwardH. Today is Amy's 24th birthday. Starting today, Any plans to begin saving for her retirement, which she expects to be at age 68. Her plan is to contribute $6,000 to a brokerage account each year on her birthday. Her first contribution will take place today. Her final contribution will take place on her 67th birthday. Her grandpa has decided to help Amy with her savings, which is why he gave Amy $2,000 today as a birthday present to help get her account started. Assume that the account has an expected annual return of 8.6 percent. How much will Any expect to have in her account at retirement (on her 68th birthday)? Hint: think of the cash flow type, annuity DUE.arrow_forwardSix years ago, Gladys opened a retirement account with an initial deposit of $14,000. Each year since then, she has added $2,000 to the account at the end of each year. She plans on contributing for the next 25 years. How would you determine the future value of her account at retirement? O Future value of a lump sum and future value of an annuity. O Future value of an annuity and the present value of a lump sum. O Future value of a lump sum and present value of an annuity. O Future value of an annuity.arrow_forward

- In 2020, Jack and Eri are married. Jack earns $150,000 from his job as a finance executive. Eri earns $25,000 per year as a part-time florist. They have two children, Harry and Gon, ages 2 and 5. Jack's great aunt Jean gave him a check for $17,000 during the year because he is her favorite nephew. Also, Jack's job reimbursed him $5,000 for childcare for his two sons. Eri owns a 20% interest in Flowers to Go (a partnership). The partnership earned $75,000 in operating income during the year, it also paid a cash distribution of $15,000 to Eri during the year. Jack and Eri have a joint checking account that earned interest of $165 for the year. Jack also own City of Mexico bonds which paid interest of $1,000. They also have the following expenses during the year: · Medical Expenses: $22,000 · State & Local Taxes: $11,500 · Federal Income Tax Payments: $10,000 · Cash Charitable Contributions: $3,000 The standard deduction amounts for 2021 are listed below: · Single: $12,550 · Head…arrow_forwardBob makes his first $1,600 deposit into an IRA earning 7.1% compounded annually on his 24th birthday and his last $1,600 deposit on his 43rd birthday (20 equal deposits in all). With no additional deposits, the money in the IRA continues to earn 7.1% interest compounded annually until Bob retires on his 65th birthday. How much is in the IRA when Bob retires? The amount in the IRA when Bob retiress is $ (Round to the nearest cent as needed.)arrow_forwardBob makes his first $1,400 deposit into an IRA earning 6.8% compounded annually on his 24th birthday and his last $1,400 deposit on his 41st birthday (18 equal deposits in all). With no additional deposits, the money in the IRA continues to earn 6.8% interest compounded annually until Bob retires on his 65th birthday. How much is in the IRA when bob retires?arrow_forward

- After retiring, Valeria wants to be able to withdraw $36,500.00 every year from her account for 27 years. Her account earns 6% interest compounded annually.How much does Valeria need in her account when she retires? Valeria needs$_________ to have in her account when she retires.arrow_forwardMr. X to retire at age 65 and believes that he can live comfortably with an annual pension of $76,000, to be withdrawn at the beginning of each year in his retirement. Suppose his pension account will generate 9% of annual interest rate, and suppose Mr.X believes tgat he will live to 100. In order to have sufficient money for his retirement , what is the minimum amount that Mr. X must have saved up in his pension account at the time of his retirement at of 65?arrow_forwardJ'Mal wishes to retire at age 65. At the age of 21, he begins depositing $35 per month into an account earning 8.5% AAPR. How much money will he have when he turns 65?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education