Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

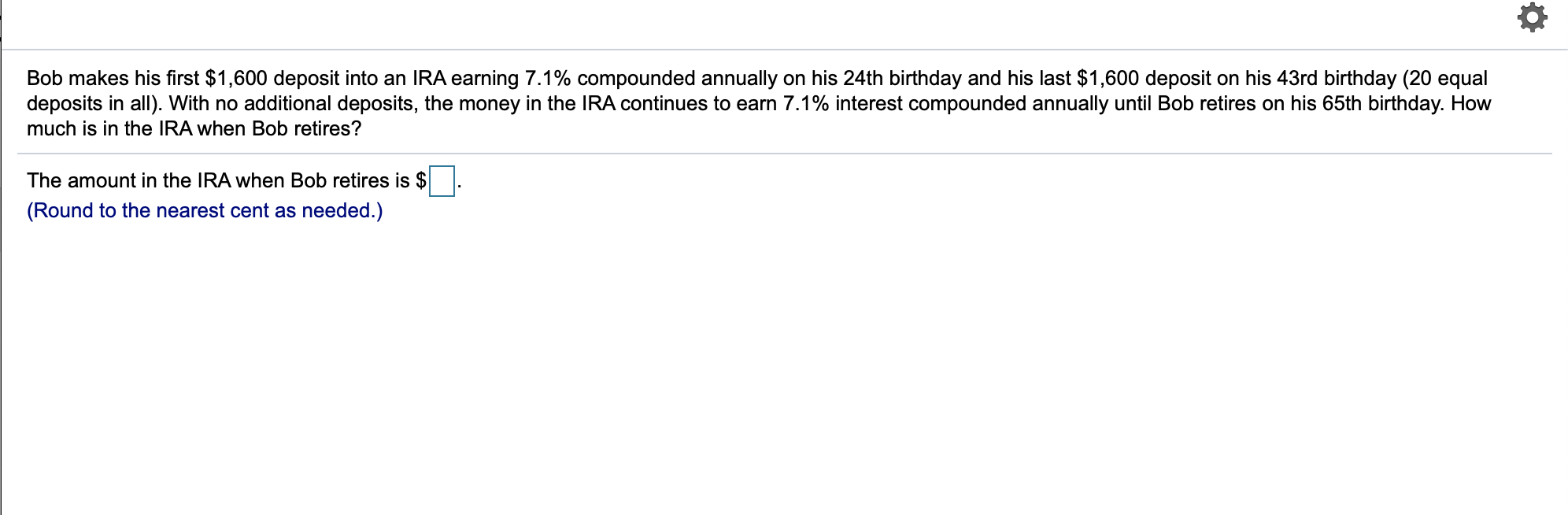

Transcribed Image Text:Bob makes his first $1,600 deposit into an IRA earning 7.1% compounded annually on his 24th birthday and his last $1,600 deposit on his 43rd birthday (20 equal

deposits in all). With no additional deposits, the money in the IRA continues to earn 7.1% interest compounded annually until Bob retires on his 65th birthday. How

much is in the IRA when Bob retires?

The amount in the IRA when Bob retiress is $

(Round to the nearest cent as needed.)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 3 images

Knowledge Booster

Similar questions

- Siegfried Basset is 65 years of age and has a life expectancy of 11 more years. He wishes to invest $20,700 in an annuity that will make a level payment at the end of each year until his death. If the interest rate is 8.0%, what income can Mr. Basset expect to receive each year? Note: Do not round intermediate calculations. Round your answer to 2 decimal places. Annual incomearrow_forwardOn April 1, 1998, Marcus Chapman deposited $4000 into an Individual Retirement Account (IRA) paying interest at the rate of 3% per year compounded continuously. Assume that he deposited $4000 annually thereafter. If the interest is paid at the same initial rate, approximately how much did he have in his IRA at the beginning of 2014? (Round your answer to the nearest whole number.)arrow_forwardBob makes his first $1,400 deposit into an IRA earning 6.8% compounded annually on his 24th birthday and his last $1,400 deposit on his 41st birthday (18 equal deposits in all). With no additional deposits, the money in the IRA continues to earn 6.8% interest compounded annually until Bob retires on his 65th birthday. How much is in the IRA when bob retires?arrow_forward

- Chase starts an IRA (Individual Retirement Account) at the age of 30 to save for retirement. He deposits $400 each month. Upon retirement at the age of 65 , his retirement savings is $558,638.87 . Determine the amount of money Chase deposited over the length of the investment and how much he made in interest upon retirement.arrow_forwardAt age 24, someone sets up an IRA (individual retirement account) with an APR of 5%. At the end of each month he deposits $30 in the account. How much will the IRA contain when he retires at age 65? Compare that amount to the total deposits made over the time period. After retirement the IRA will contain $ (Do not round until the final answer. Then round to the nearest cent as needed.)arrow_forwardYou annually invest $2,000 in an individual retirement account (IRA) starting at the age of 30 and make the contributions for 15 years. Your twin sister does the same starting at age 35 and makes the contributions for 25 years. Both of you earn 7 percent annually on your investment. What amounts will you and your sister have at age 60? Use Appendix A and Appendix C to answer the question. Round your answers to the nearest dollar.Amount on your account: $ Amount on your sister's account: $ Who has the larger amount at age 60?-Select-You haveYour sister hasItem 3 the larger amount.arrow_forward

- 1.I plan to deposit $376 into my retirement every year for the next 25 years. The first deposit will be made today (that is, at t = 0) and the last deposit will be made at the end of year 24 (that is, at t = 24). I plan to make no other deposits. Assuming that I will earn 12.13% p.a. on my retirement funds, how much money will I have accumulated 36 years from today (that is, at t = 36)? Round your answer to 2 decimal places; record your answer without commas and without a dollar sign. 2. Assume that you deposit $ 1,038 each year for the next 15 years into an account that pays 11 percent per annum. The first deposit will occur one year from today (that is, at t = 1) and the last deposit will occur 15 years from today (that is, at t = 15). How much money will be in the account 15 years from today? Round your answer to 2 decimal places; record your answer without commas and without a dollar sign.arrow_forwardDerek plans to retire on his 65th birthday. However, he plans to work part-time until he turns 74.00. During these years of part-time work, he will neither make deposits to nor take withdrawals from his retirement account. Exactly one year after the day he turns 74.0 when he fully retires, he will wants to have $2,565,252.00 in his retirement account. He he will make contributions to his retirement account from his 26th birthday to his 65th birthday. To reach his goal, what must the contributions be? Assume a 9.00% interest rate.arrow_forwardAt age 21, someone sets up an IRA (individual retirement account) with an APR of 8%. At the end of each month he deposits $50 in the account. How much will the IRA contain when he retires at age 65? Compare that amount to the total deposits made over the time period. After retirement the IRA will contain $nothing. (Do not round until the final answer. Then round to the nearest cent as needed.)arrow_forward

- At age 24, someone sets up an IRA (individual retirement account) with an APR of 4%. At the end of each month he deposits $100 in the account. How much will the IRA contain when he retires at age 65? Compare that amount to the total deposits made over the time period. After retirement the IRA will contain $ ??arrow_forwardJohn recently set up a TDA to save for his retirement. He arranged to have $150 taken out of each of his monthly checks; it will earn 8% interest. He just had his 45 birthday, and his ordinary annuity comes to term when he is 65. Find the future value of the account.arrow_forwardAt age 19, someone sets up an IRA (individual retirement account) with an APR of 8%. At the end of each month he deposits $95 in the account. How much will the IRA contain when he retires at age 65? Compare that amount to the total deposits made over the time period. After retirement the IRA will contain $ (Do not round until the final answer. Then round to the nearest cent as needed.)arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education