Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

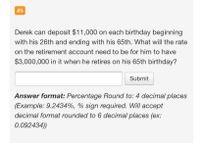

Transcribed Image Text:#5

Derek can deposit $11,000 on each birthday beginning

with his 26th and ending with his 65th. What will the rate

on the retirement account need to be for him to have

$3,000,000 in it when he retires on his 65th birthday?

Submit

Answer format: Percentage Round to: 4 decimal places

(Example: 9.2434%, % sign required. Will accept

decimal format rounded to 6 decimal places (ex:

0.092434))

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- A man intends to save up money for his retirement so that he can withdraw equal sums of P18,000 for his yearly needs from his 60th to 70th birthdays. For his 41st to 59th birthdays, he invests an equivalent amount in a fund that earns 12%. What should the amounts for each of them be?arrow_forwardJohn is currently 25 years old. He has $10,000 saved up and wishes to deposit this into a savings account which pays him J12 = 6% p.a. He also wishes to deposit SX every month into that account so that when he retires at 55, he can withdraw $2000 every month end to support his retirement. He expects to live up till 70 years. How much should he deposit every month into his account?arrow_forwardLeila is saving for her retirement by making deposits of $22,000 on each birthday into a savings account starting on her 51st birthday and ending on her 64th birthday (inclusive). Given an effective annual rate of interest of 3.3%, how much will she accumulate by her 65th birthday?arrow_forward

- Logan starts an IRA (Individual Retirement Account) at the age of 30 to save for retirement. He deposits $400 each month. Upon retirement at the age of 65, his retirement savings is $943,445.01. Determine the amount of money Logan deposited over the length of the investment. Round to the nearest thousand dollars.arrow_forward20.arrow_forwardUna Day is planning to retire in 14 years, at which time she hopes to have accumulated enough money to receive an annuity of $17,000 a year for 19 years of retirement. During her pre-retirement period she expects to earn 8 percent annually, while during retirement she expects to earn 10 percent annually on her money. What annual contributions to this retirement fund are required for Una to achieve her objective and sleep well at night? (Use a Financial calculator to arrive at the answer. Do not round intermediate calculations. Round the final answer to the nearest whole dollar.) Annual contribution $ 7,422 xarrow_forward

- On his 21st birthday, Silver put P300,000 into a retirement fund account that pays 10% interest per year, compounded annually. Now on his 65th birthday he is planning to retire, how much money does he have on his retirement fund?arrow_forwardUna Day is planning to retire in 11 years, at which time she hopes to have accumulated enough money to receive an annuity of $21,000 a year for 16 years of retirement. During her pre-retirement period she expects to earn 12 percent annually, while during retirement she expects to earn 14 percent annually on her money. What annual contributions to this retirement fund are required for Una to achieve her objective and sleep well at night? (Use a Financial calculator to arrive at the answer. Do not round intermediate calculations. Round the final answer to the nearest whole dollar.) Annual contribution $arrow_forwardAji who is now 25 years old, wants to buy a retirement plan starting at the age of 55 year with an income of $3,000,000 per year, where the first payment is made on his 55th birthday. For that he will make annual payments at the beginning of the year starting now and ending on his birthday 54th year. Calculate the amount of the annual payment!Return rate 7%arrow_forward

- Oscar is looking forward to retirement in a few years when he will have completed 20 years of pensionable service. Oscar's pension plan provides an annual pension benefit of 1.5% of average career earnings for each year of pensionable service. Using information from Oscar's pension statements, he estimates his career average annual earnings will be $50,000 when he retires with 20 years of service. Given these assumptions, calculate Oscar's annual pension benefit that he can expect to receive when he retires. $7,500 $10,000 $15,000 $20,000arrow_forwardThe Ali plan to retire and start receiving their Social Security benefits at the same time, when Jimmy is 67 and Lucy is 62 years old. Their monthly Social Security retirement benefits at those ages in today's dollars are estimated to be $3,200 for Jimmy and $2,000 for Lucy. They think their expenses in retirement in today's dollars will be 70% of their total cash outflows now. Other than Social Security, they will rely on their retirement savings in order to meet their retirement expenses. They want to assume they will die in the same year, when Jimmy is 95 and Lucy is 90 years old.Determine what the payments will be in the distribution phase. These will be the withdrawals Jimmy and Lucy will need to take monthly from their accounts, in order to meet their retirement expenses. How much is that monthly amount?Note: this question is asking about the withdrawals they will need, not about the expenses they will be incurring monthly.arrow_forwardAndrea, a self-employed individual, wishes to accumulate a retirement fund of $400,000. How much should she deposit each month into her retirement account, which pays interest at a rate of 5.5%/year compounded monthly, to reach her goal upon retirement 35 yr from now? (Round your answer to the nearest cent.)arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education