Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

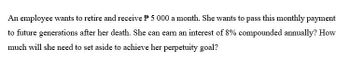

Transcribed Image Text:An employee wants to retire and receive P 5 000 a month. She wants to pass this monthly payment

to future generations after her death. She can earn an interest of 8% compounded annually? How

much will she need to set aside to achieve her perpetuity goal?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- K. Tanja wants to establish an account that will supplement her retirement income beginning 30 years from now. Find the lump sum she must deposit today so that $400,000 will be available at time of retirement, if the interest rate is 10%, compounded quarterly. How much must Tanja invest? P= (Round to the nearest cent as needed.)arrow_forwardEmily is trying to decide between investing $1,000 or $1,500 at the beginning of each year for the next 40 years into a retirement account yielding 10.78%. After 40 years, how much extra money will Emily have in her IRA if she invests $1,500 annually instead of $1,000 annually? $4,016,726.94 B) $4,052,810.53 $273,849.26 $30,020.95arrow_forwardA woman who is now 28 years old invests $40,000 in a retirement account. What interest rate, compounded daily, would she have to earn in order for the account to be worth $600,000 when she retires at age 65? Round your final answer to two decimal places.arrow_forward

- Your friend has just celebrated her 30th birthday and accepted her first job. She must now decide how much money to put into her retirement plan. Assume that every dollar in the plan is expected to earn a return of 8% p.a. and that your friend cannot make any withdrawals until she retires on her 65th birthday. After that point, she can make withdrawals as she wishes. She plans to live to 100 years and she plans to work until she turns 65. She estimates that to live comfortably in retirement, she will need $120,000 every year starting at the end of the first year of retirement and ending on her 100th birthday. Assume that she starts the contribution to her retirement plan on her 31st birthday and that she will contribute the same amount to the plan at the end of every year that she works. The amount of money she would need to contribute every year to fund her retirement is closest to: a. $7,475. b. $8,116. c. $8,207. d. $8,817.arrow_forwardA 40-year-old woman decides to put funds into a retirement plan. She can save $1,000 a year and earn 7 percent on this savings. How much will she have accumulated if she retires at age 65? Use Appendix C to answer the question. Round your answer to the nearest dollar.$ At retirement how much can she withdraw each year for 20 years from the accumulated savings if the savings continue to earn 7 percent? Use Appendix D to answer the question. Round your answer to the nearest dollar.$arrow_forwardSusanna wants to purchase a house costing $212,286. She plans to put $51,874 toward a down payment and finance the rest at 2.9% payable monthly for 30 years. If she stays with this payment schedule for the entire 30 years, how much will she actually pay for the house including down payment and interest?arrow_forward

- Six years ago, Gladys opened a retirement account with an initial deposit of $14,000. Each year since then, she has added $2,000 to the account at the end of each year. She plans on contributing for the next 25 years. How would you determine the future value of her account at retirement? O Future value of a lump sum and future value of an annuity. O Future value of an annuity and the present value of a lump sum. O Future value of a lump sum and present value of an annuity. O Future value of an annuity.arrow_forwardA couple plans to retire in 25 years. At that time, they would like to have enough money in an account so that they can receive a $3,600 every month end for 20 years. The account earns APR 5.8% and will continue to do so until there is a zero balance in the account. To achieve this goal, how much money does the couple need to have in this account by the time they retire? (calculate to cents.)arrow_forwardYou have just made your first $10,000 contribution to your individual retirement account. Assume you earn an annual rate of return of 12 percent compounded quarterly and make no additional contributions. What will your account be worth when you retire in 50 years?Note: Do not round intermediate calculations and round your answer to 2 decimal Blaces, e.g., 32.16. You need $20,000 to go on your dream vacation to South Africa. If you save $5,000 today in an account at 10% interest compounded annually, how long will you have to wait to go on your dream vacation?Note: Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.arrow_forward

- Your friend is celebrating her birthday and wants to start saving for retirement. She has provided you with the following information: Years until retirement: 30 Amount to withdraw each year in retirement: $120,000 Years to withdraw in retirement: 12 Interest rate while saving: 9% Interest rate in retirement: 6% Saved today (nest egg): $25,000 The first deposit will be made one year from today, and the last deposit will be made on the day she retires. Her first withdrawal will not occur until one year after she retires, and she plans to spend her entire nest egg. Calculate the amount she must deposit each year to reach her retirement goal. (Round to 2 decimals)arrow_forwardSharon has worked for a company with a retirement program, and today is retiring from her job with the amount of $157000 in her retirement account. She decides to withdrawal an equal amount from this account, once a year, beginning immediately, and ending 25 years from today (for a total of 26 payments). If the interest rate is 6.75%, solve for the annuity amount such that she uses up her full accumulation. $ Place your answer in dollars and cents. Do not use a dollar sign or comma as part of your answer. For example, an answer of fifty four point three eight would be placed as 54.38.arrow_forwardYou annually invest $2,000 in an individual retirement account (IRA) starting at the age of 30 and make the contributions for 15 years. Your twin sister does the same starting at age 35 and makes the contributions for 25 years. Both of you earn 7 percent annually on your investment. What amounts will you and your sister have at age 60? Use Appendix A and Appendix C to answer the question. Round your answers to the nearest dollar.Amount on your account: $ Amount on your sister's account: $ Who has the larger amount at age 60?-Select-You haveYour sister hasItem 3 the larger amount.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education