FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

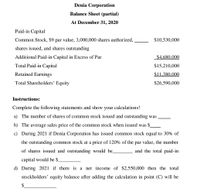

Transcribed Image Text:Denia Corporation

Balance Sheet (partial)

At December 31, 2020

Paid-in Capital

Common Stock, $9 par value, 3,000,000 shares authorized,

$10,530,000

shares issued, and shares outstanding

Additional Paid-in Capital in Excess of Par

$4.680,000

Total Paid-in Capital

$15,210,000

Retained Earnings

$11,380.000

Total Shareholders’ Equity

$26,590,000

Instructions:

Complete the following statements and show your calculations!

a) The number of shares of common stock issued and outstanding was

b) The average sales price of the common stock when issued was $

c) During 2021 if Denia Corporation has issued common stock equal to 30% of

the outstanding common stock at a price of 120% of the par value, the number

of shares issued and outstanding would be

and the total paid-in

capital would be $

d) During 2021 if there is a net income of $2,550,000 then the total

stockholders' equity balance after adding the calculation in point (C) will be

$.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- 1. The balance sheet of Quetico Inc. reported the following at December 31, 2020: A Shareholders' Equity B C Preferred shares, $0.40, 10,000 shares authorized 2 and issued $ 100,000 3 Common shares, 100,000 shares authorized* 400,000 45 Accumulated other comprehensive income Retained earnings 224,000 476,500 6 Total shareholders' equity 7 $ 1,200,500 *The common shares were issued at a stated value of $8.00 per share. Requirements a. Are the preferred shares cumulative or non-cumulative? How can you tell? b. What is the total amount of the annual preferred dividend? c. How many common shares are outstanding? d. Compute the book value per share of the common shares. No preferred dividends are in arrears, and Quetico Inc. has not yet declared the 2020 dividend..arrow_forwardIdentifying and Analyzing Financial Statement Effects of DividendsThe stockholders' equity of DiFrancesco Company at March 31, 2019 is shown below. 4% preferred stock, $1,000 par value, 25,000 shares authorized; 10,000 shares issued and outstanding $10,000,000 Common stock, $1 par value, 3,000,000 shares authorized; 700,000 shares issued and outstanding 700,000 Additional paid-in capital—preferred stock 60,000 Additional paid-in capital—common stock 17,150,000 Retained earnings 49,005,689 Total stockholders' equity $76,915,689 The following transactions, among others, occurred during the fiscal year ended March 31, 2020.April 15, 2019 Declare and pay preferred dividends of $400,000April 15, 2019 Declare and pay common dividends of $1.30 per share October 1, 2019 Execute a 3-for-1 stock split of the common stock when the stock price was $140 per share.March 1, 2020 Declare and pay common dividends of $0.50 per share (a) Use the financial statement effects template…arrow_forwardThe following is the Stockholders' Equity section of the balance for Spencer Corporation as of December 31, 2019. Stockholders' Equity Common stock, $1 par value; authorized, 10,000,000 shares. Issued and outstanding, 500,000 shares Additional paid-in capital, common stock Retained earnings Total Stockholders' Equity $500,000 3,500,000 6,750,000 $10.750.000 Spencer Corporation declared a 10% stock dividend on January 1, 2020, at which date the fair value of Spencer Corporation common stock was trading at $35 per share. Prepare the January 1, 2020, journal entry to record the declaration of the stock dividend. Date Account Debit Creditarrow_forward

- subject ; accountarrow_forwardSubject : Accountingarrow_forwardRunning Corporation reports the following components of stockholders’ equity at December 31, 2019 Common stock - $20 par value, 250,000 shares authorized, $ 2,000,000 80,000 shares issued and outstanding Paid-in capital in excess of par value, common stock 235,000 Retained earnings 890,000 Total stockholders' equity $ 3,125,000 During 2021, the following transactions affected its stockholders’ equity accounts. Jan. 2 Purchased 6,300 shares of its own stock at $35 cash per share. Jan. 5 Directors declared a $2.00 per share cash dividend payable on February 28 to the February 5 stockholders of record. Feb. 28 Paid the dividend declared on January 5. May 5 Sold 3,982 of its treasury shares at $42 cash per share. Sept. 5 Directors declared a $2.00 per share cash dividend payable on October 28…arrow_forward

- Denia Corporation Balance Sheet (partial) At December 31, 2020 Paid-in Capital Common Stock, $9 par value, 3,000,000 shares authorized, $10,530,000 shares issued, and shares outstanding Additional Paid-in Capital in Excess of Par $4,680,000 Total Paid-in Capital $15,210,000 Retained Earnings $11,380,000 Total Shareholders’ Equity $26,590,000 Instructions: Complete the following statements and show your calculations! a) The number of shares of common stock issued and outstanding was b) The average sales price of the common stock when issued was $arrow_forwardThe December 31, 2023, equity section of ZoomZoom inc's balance sheet appears below ZooZoon Inc. Equity Section of the Balance Sheet December 31, 2023 Contributed capital: Preferred shares, $3.75 cumulative, 33,000 shares authorized and issued Preferred shares, $10 non-cumulative, 8,700 shares authorized and issued Common shares, 330,000 shares authorized and issued Total contributed capital Retained earnings Total equity Required: All the shares were issued on January 1, 2021 (when the corporation began operations) No dividends had been declared during the first two years of operations (2021 and 2022) During 2023, the cash dividends declared and paid totalled $578,300. 1. Calculate the amount of cash dividends paid during 2023 to each of the three classes of shares Show Transcribed Text Cumulative preferred shares Noncumulative preferred shares Common shares Required: All the shares were issued on January 1, 2021 (when the corporation began operations). No dividends had been de first…arrow_forwardThe stockholders' equity section of Waterway Corporation appears below as of December 31, 2025. 8% preferred stock, $50 par value, authorized 114,400 shares, outstanding 104,400 shares Common stock, $1.00 par, authorized and issued 10,000,000 shares Additional paid-in capital Retained earnings (includes 2025 net income of $38.280,000) Total stockholders' equity $5,220,000 10,000,000 23,780,000 193,720,000 232.720,000 Earnings per share. Net income for 2025 reflects a total effective tax rate of 20%. Included in the net income figure is a loss of $20,880,000 (before tax) as a result of a non-recurring major casualty. Preferred stock dividends of $417,600 were declared and paid in 2025. Dividends of $1,160,000 were declared and paid to common stockholders in 2025, Compute earnings per share data as it should appear on the income statement of Waterway Corporation. (Round answers to 2 decimal places, e.g. 1.48.) ...arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education