FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

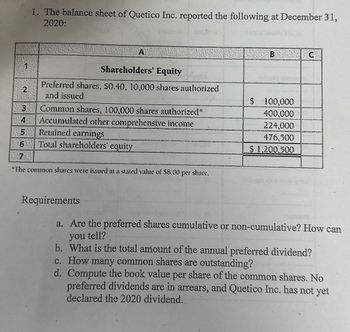

Transcribed Image Text:1. The balance sheet of Quetico Inc. reported the following at December 31,

2020:

A

Shareholders' Equity

B

C

Preferred shares, $0.40, 10,000 shares authorized

2

and issued

$ 100,000

3

Common shares, 100,000 shares authorized*

400,000

45

Accumulated other comprehensive income

Retained earnings

224,000

476,500

6

Total shareholders' equity

7

$ 1,200,500

*The common shares were issued at a stated value of $8.00 per share.

Requirements

a. Are the preferred shares cumulative or non-cumulative? How can

you tell?

b. What is the total amount of the annual preferred dividend?

c. How many common shares are outstanding?

d. Compute the book value per share of the common shares. No

preferred dividends are in arrears, and Quetico Inc. has not yet

declared the 2020 dividend..

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 6 steps with 2 images

Knowledge Booster

Similar questions

- The attached files are the questions.arrow_forwardOn January 1, 2021, Fascom had the following account balances in its shareholders' equity accounts. Common stock, $1 par, 250,000 shares issued $ 250,000 Paid-in capital—excess of par, common 500,000 Paid-in capital—excess of par, preferred 100,000 Preferred stock, $100 par, 10,000 shares outstanding 1,000,000 Retained earnings 2,000,000 Treasury stock, at cost, 5,000 shares 25,000 During 2021, Fascom Inc. had several transactions relating to common stock. January 15: Declared a property dividend of 100,000 shares of Slowdown Company (book value $10 per share, fair value $9 per share). February 17: Distributed the property dividend. April 10: A 2-for-1 stock split was declared and distributed on outstanding common stock and effected in the form of a stock dividend. (Fascom chose to reduce Paid-in capital—excess of par.) The fair value of the stock was $4 on this date. July 18: Declared and distributed a 3%…arrow_forward1. Yellow Corporation had the following stockholders' equity accounts on December 31, 2020. Common Stock ($8 par value, 120,000 shares authorized, $ 320,000 40,000 shares issued and outstanding) Paid-in-Capital in Excess of Par - Common Stock $ 2,900,000 Retained Earnings $ 3,500,000 The following were transactions that occurred during 2021: 20-Feb Declared a $4 cash dividends per share on common stock 3-Mar Record date for cash dividends declared on 20 Feb 19-Mar Paid cash dividends 28-Apr Issued 15,000 shares of common stock for $16 per share 5-May Declared a $3 cash dividends per share on common stock 9-Jun Record date for cash dividends declared on 5 May 17-Jul Paid cash dividends 8-Aug Issued 23,500 shares of common stock for $20 per share 7-Sep Declared a $2 cash dividends per share on common stock 9-Oct Record date for cash dividends declared on 7 September 5-Nov Paid cash dividends 31-Dec Determined that net income for the year was $650,000 Instructions: 1. Journalize the…arrow_forward

- The following partial information is taken from the comparative balance sheet of Levi Corporation: Shareholders’ equity 12/31/2021 12/31/2020 Common stock, $5 par; 36 million shares authorized; 31 million sharesissued and 26 million shares outstanding at 12/31/2021; and ____million sharesissued and ____shares outstanding at 12/31/2020. $ 155 million $ 130 million Additional paid-in capital on common stock 523 million 401 million Retained earnings 192 million 160 million Treasury common stock, at cost, 5 million shares at 12/31/2021 and 2 millionshares at 12/31/2020 (85 million) (48 million) Total shareholders’ equity $ 785 million $ 643 million What was the average price of the additional treasury shares purchased by Levi during 2021? (Round your answer to 2 decimal places.)arrow_forwardOn January 1, 2024, Dolar Incorporated had the following account balances in its shareholders' equity accounts. Common stock, $1 par, 241,000 shares issued $241,000 Paid-in capital-excess of par, common 482,000 Paid-in capital-excess of par, preferred. 195,000 Preferred stock, $100 par, 19,500 shares outstanding 1,950,000 Retained earnings Treasury stock, at cost, 4,100 shares 3,900,000 20,500 During 2024, Dolar Incorporated had several transactions relating to common stock. January 15: February 17: April 10: July 18: December 1: December 28: Required: Declared a property dividend of 100,000 shares of Burak Company (book value $11.9 per share, fair value $9.95 per share). Distributed the property dividend. A 2-for-1 stock split was declared and distributed on outstanding common stock and effected in the form of a stock dividend. (Dolar chose to reduce Paid-in capital-excess of par.) The fair value of the stock was $4 on this date.. Declared and distributed a 4% stock dividend on…arrow_forwardplease help asap pleasearrow_forward

- The following information is available for Barone Corporation: January 1, 2022 Shares outstanding 1,250,000April 1, 2022 Shares issued 200,000July 1, 2022 Treasury shares purchased 75,000October 1, 2022 Shares issued in a 100% stock dividend 1,375,000 The number of shares to be used in computing earnings per ordinary share for 2022 isarrow_forwardShown below is information relating to the stockholders' equity of Robertson Corporation at December 31, 2022: 12% cumulative preferred stock, $150 par Common stock, $1.50 par Additional paid-in capital: preferred stock Additional paid-in capital: common stock Treasury stock (at cost: 6,000 common shares) Retained earnings Refer to the above data. How many shares of common stock are outstanding? O a. 600,000 O b. 406,000 O c. 594,000 O d. 394,000 $1,500,000 600,000 300,000 900,000 180,000 1,350,000arrow_forwardsarrow_forward

- The equity section of the December 31", 2025, balance sheet for BOOYA Inc. showed the following: BOOYA Inc. Equity Section of the Balance Sheet December 31, 2025 Contributed Capital: Preferred shares, $0.25 non-cumulative, 80,000 shares authorized, 60,000 shares issued and outstanding Common shares, 250,000 shares authorized, 120,000 shares issued and outstanding Total contributed capital Retained earnings Total equity $150,000 120.000 $270,000 92.500 $362,500 During the year 2026, BOOYA Inc had the following transactions affecting equity accounts: Sold 20,000 common shares for a total of $21,500 cash Sold 5,000 preferred shares for $3.00 each, cash. Issued and exchanged 7,000 common shares for equipment with a list price of $10,000 (fair value unknown). Common shares were trading at $1.42 on June 15th. Jan. 3 Mar. 1 June 15. Closed the Income Summary account, which showed a credit balance of $175,000. Dec. 31 The board of directors had not declared a dividend for the past two years…arrow_forwardPrepare the Statement of Shareholders’ Equity for ABC CORPORATION for the year ended December 31, 2020, using the following information: January 1, 2020 balances § 15% Preference Share Capital, P100 par value, authorized 25,000 shares, 6,000 shares issued, of which 250 shares are in treasury P600,000 § Ordinary Share Capital, P50 par value, authorized 40,000 shares, 9,000 shares issued 450,000 § Reserves 45,000 § Accumulated profits (includes appropriation for cost treasury shares, P25,500) 400,000 Summary of transactions during the year: § Appropriated for Plant Expansion P 90,000 § Appropriated for Treasury Shares 56,680 § Cash Dividend Declared 200,000 § Issued 15% Preference Share Capital 280,000 § Issued Ordinary Share Capital 230,000 § Net Income for the period 450,000 § Share premium-Donated Shares 5,250 § Share premium – Ordinary 7,000 §…arrow_forward1. An abstract of the shareholders’ equity of the Camia Co. on December 31,200A appears as follows:Preference Share, Php35 par value, 150,000 shares issued and outstanding Php5,250,000Ordinary Shares, Php25 par value, 300,000 shares issued and Outstanding 7,500,000Premium on Preference Share 450,000Premium on Ordinary Share 600,000Retained Earnings 1,200,000Treasury Share – Ordinary 60,000 The Board of Directors decided to establish a reserve of Php230,000 for contingencies and Php380,000 for plant expansion. Required:1. Record…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education